FX Settlement

A corporate FX transaction involves a bank, on behalf of their corporate client, paying for the currency it sold at an agreed rate to another bank and receiving a different currency in return for the funds being cleared and settled in the local clearings. For a corporate treasury department, carrying out and settling many FX deals a day involves three things:

- intra-day liquidity to fund each deal separately because they do not know when it will settle;

- administration; and

- FX settlement risk - the risk of their bank in the foreign exchange transaction paying the currency without receiving the currency in return.

FX settlement risk is one of the biggest concerns in today's international banking community. After the credit/liquidity crunch, there is even more risk of the bank defaulting on a deal in the US$5+ trillion/day FX market. For many banks, FX transaction settlement risk is typically higher than credit risk, often three times as high. No wonder the central banks continue to be concerned about FX settlement risk. Companies have very different levels of settlement risk. However, those with large volumes of commodity trading have significant levels of settlement risk, although many have much less.

Corporate treasury departments have four options for managing FX settlement:

- ignore it;

- settle most of their trades with their principal cash management bank where there is no settlement risk;

- use the Continuous Linked Settlement (CLS) System; or

- use bilateral settlement.

About a third of all corporate FX trades are settled with the principal cash management banks.

The Continuous Linked Settlement Solution

The Continuous Linked Settlement (CLS) Bank operates the largest multi-currency cash settlement system which eliminates settlement risk caused by FX transactions occurring across time zones for over half the world’s foreign exchange payment instructions. CLS settles matched FX trades on a gross payment versus payment (PvP) basis in 17 currencies that account for 95% of daily traded value. The funding for settlement is required on a multi-laterally netted basis per value date. CLS settles payment instructions related to trades executed in six main instruments: FX spot, FX forwards, FX options, FX swaps, non-deliverable forwards and cash settlements from credit derivatives.

CLS went live in September 2002 and by September 2015 has an input volume of 1.08 million instructions per day with an average daily value of $4.81 trillion across 17 currencies, a higher total value than any other cash settlement system. At the start of 2014 there were 346 bank participants including one reserve bank, 50+ corporate users, 66 non-bank financial institutions and 16,531 individual pension and investment funds participating in the system.

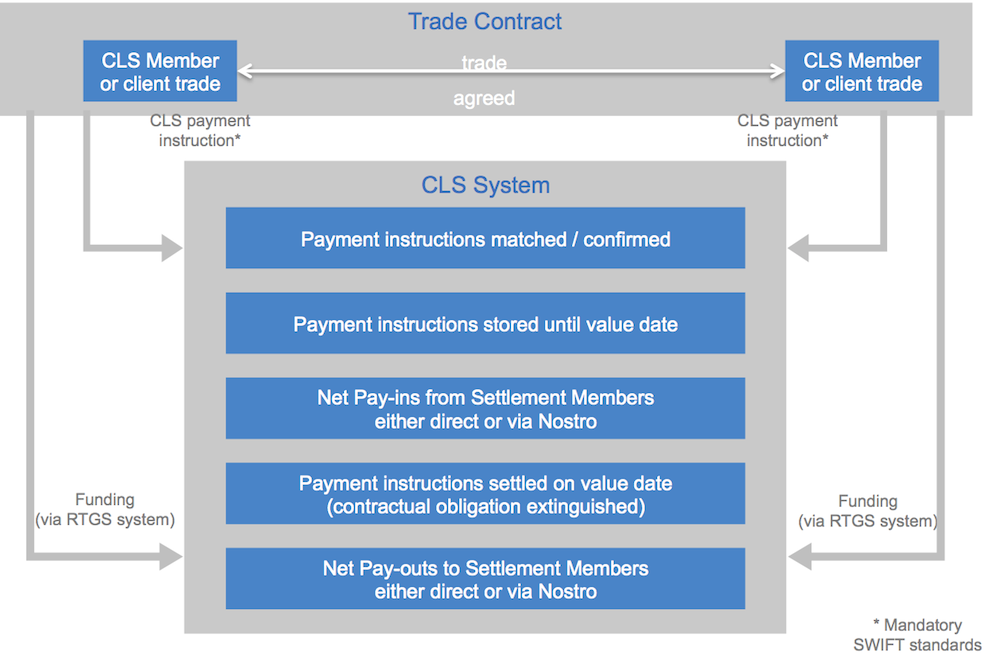

How CLS works within the trade lifecycle

Source & Copyright©2014 - CLS

Member benefits

One of the main benefits from using CLS for members is the reduction in the cash needed to settle FX transactions and the intra-day overdrafts required because settlement in CLS occurs on a gross, individual payment versus payment (PvP) basis, whilst funding required for settlement is calculated on a multilateral netted basis which reduces the number of payments needed to settle a day's trades, see figure below.

CLS Member Benefits: Settlement Risk + Liquidity

Source & Copyright©2014 - CLS

CLS also protects participants against loss of principal associated with FX trades because in the event of a settlement failure, neither of the two payments for an FX trade will be settled, and the related funding is immediately returned to the CLS Settlement Member, so there were no failed FX trades when Lehman failed.

The CLS settlement process, shown in figure above, is fully automated and transparent, participants have a global view of their FX positions in real time, so they know exactly what their FX and same day funding requirements will be. Also CLS is easier to use because it provides post trade and pre-settlement matching, generally within 30 minutes of trading, i.e. once the trade is matched the corporate treasury department can be sure the trade will settle. Compliance with Sarbanes Oxley and other process regulations are also improved as the whole settlement process is fully automated and transparent.

Corporate users are reporting a 50% drop in settlement transactions and 90% reduction in settlement values required. Another benefit for the corporate treasury department from using CLS is that it can be part of the disaster recovery plan. As one corporate treasurer put it "As all settlements are automated after matching, CLS forms an integral part of the corporate treasury department Business Continuity plan. In event that our Business Continuity Plan has to be invoked, we can rest assured that all our matched CLS trades will settle without the need for our interaction, freeing up essential resources which we can focus elsewhere."

Corporate treasury departments need to have centralised all FX trading for CLS to be appropriate. When evaluating possible use of CLS corporate treasury departments need to ask:

- do our clearing banks offer CLS settlement?

- does the volume of CLS compliant trades warrant the cost of implementing and operating a CLS link?

- do they want to centralise all their FX settlement just through a single bank?

- what operational administration and resources will be saved?

The Bilateral Netting Settlement Alternative

The use of bilateral netting between banks and counter-parties not participating in CLS for settlement is still around and is used for many $millions trades/day. Although nobody is quite sure what the actual volumes are for bilateral netting. This helps to reduce settlement and clearing costs and is an alternative to CLS settlement.