ANZ executes seamless BPO using STP & electronic Bill of Lading

by Kylene Casanova

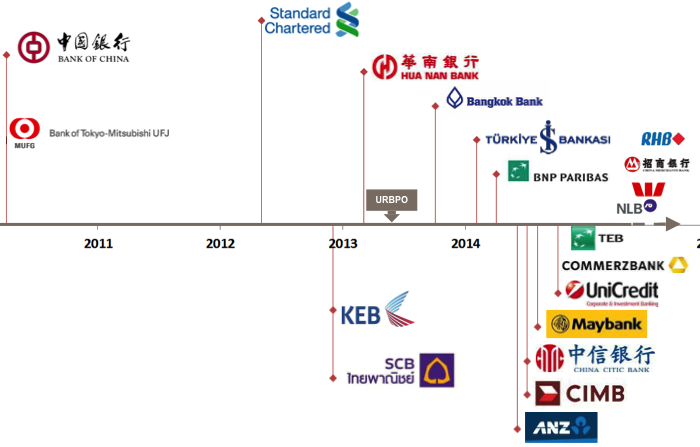

In their latest report on Bank Payment Obligation instrument, SWIFT claim that ‘Live use of BPO is accelerating’:

Source & Copyright©2015 - SWIFT

In reality, the global roll-out has been steady though, but definitely making progress.

The development of the vital ICC Uniform Rules for BPO - URBPO has progressed much faster, with the rules developed in 18 months from the initial ICC/SWIFT agreement.

Overall BPO adoption has grown steadily, current figures are:

Source & Copyright©2015 - SWIFT

We are starting to see important firsts in using BPO.

First BPO with eB/L allows seamless BPO execution

ANZ has completed a four-cornered Bank Payment Obligation (BPO) transaction for an iron ore shipment from Australia to China. The transaction involved Cargill and BHP Billiton as buyer and seller respectively, with ANZ as obligor bank. It marks the first use of BPO coupled with an electronic Bill of Lading and commercial invoices, where data flowed through all participants’ corners with zero data re-entry.

Document flow (including Bills of Lading) is normally separated from BPO transactions, requiring data re-entry and reconciliation. In this solution, title documents and related commercial invoices are electronically transmitted through the essDOCS Platform.

By combining Electronic Bills of Lading with the BPO transaction, ANZ and its clients were able not only to submit original data and supporting documents as trade data to be matched against the BPO payment terms on SWIFT TSU, but also to automate the release of original documents to the buyer upon data match.

Impact:

- integration of this functionality with the SWIFT network allows seamless BPO execution by providing straight through processing of key data

- reduction of transaction risk and acceleration of trade finance processes for all four corners of a BPO transaction.

Vivek Gupta, ANZ Global Head of Trade and Supply Chain Product, said: “This groundbreaking solution reflects ANZ’s ambition to be a leading innovator in Asia-Pacific trade finance and bank of choice for companies active in the Australia-China trade corridor.”

CTMfile take: Achieving seamless four-corner BPO execution is an important step in the maturing of the BPO instrument, but there is still a long way to go to convince the corporates and banks world-wide. Not only this, the comprehensive supply chain services providers such as GT Nexus with their integrated payment services - see, could take much of the growth that SWIFT/BPO are hoping to attract.

Like this item? Get our Weekly Update newsletter. Subscribe today

Dear Mr/Ms

You said “In their latest report on Bank Payment Obligation instrument, SWIFT claim that ‘Live use of BPO is accelerating’”. where can i find this statement of SWIFT? could you please send me the link of this statement?

Best Regards

Omid