Best e-FX platform for corporates

by Jack Large

Kantox was voted the Best e-FX Platform for Corporates at the 2019 FX Week e-FX Awards earlier this month and is the first fintech to receive the award instead of a bank. Kantox was founded in 2011 providing a FX peer hedging service, see, which used a computer algorithm to match counterparties with receivables or payables in currencies they want to exchange - in USD, GBP and EUR. In the Kantox netting marketplace, there is no principal risk as the cash flows are netted at due date, not before, and so reducing bank FX hedging fees.

Kantox eco-system

Since then Kantox have expanded their range of services and now provide an e-FX platform for corporates comprising:

- Currency Accounts with IBANs that appear in your company’s name to make your collection and reconciliation processes smoother for 29 different currencies for collection and over 130 currencies for payments which Kantox claim “save between 1-3% on conversion fees”

- FX Data solution, Dynamic Pricing, providing all the rate information businesses need with real-time rules-based rates and data

- FX Risk Management solutions: Automate your hedging. Execute spots and forwards in over 40 currencies using Dynamic Hedging module which allows micro-hedging of foreign currency transactions and Hedge Accounting module which integrates with Dynamic Hedging to minimise P&L volatility.

- International Payments:

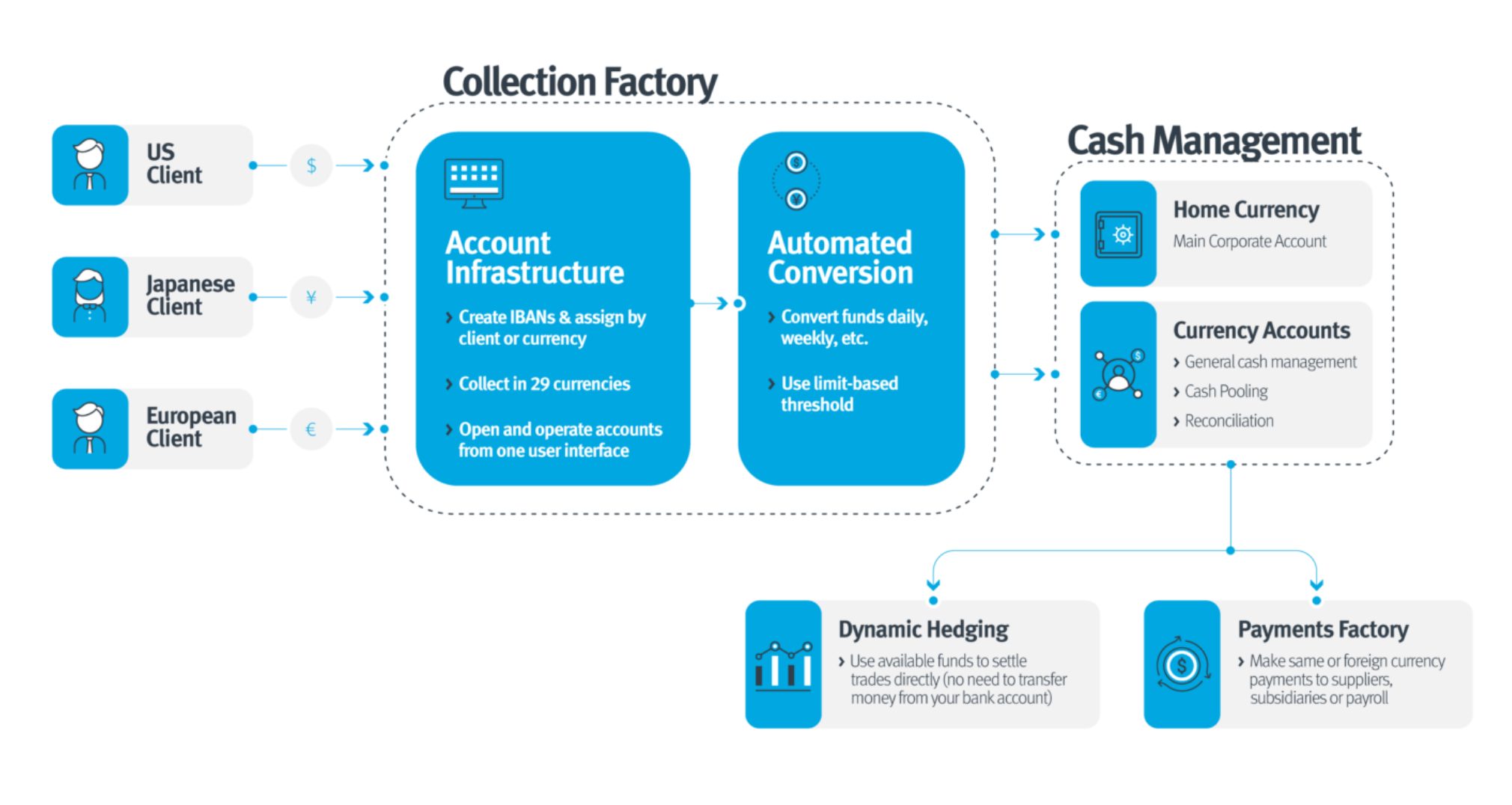

- Collection Factory: for international businesses looking to centralise their multi-currency collection and accounts receivable processes: open accounts in 29 different currencies within the Kantox eco-system

- Source & Copyright©2019 - Kantox

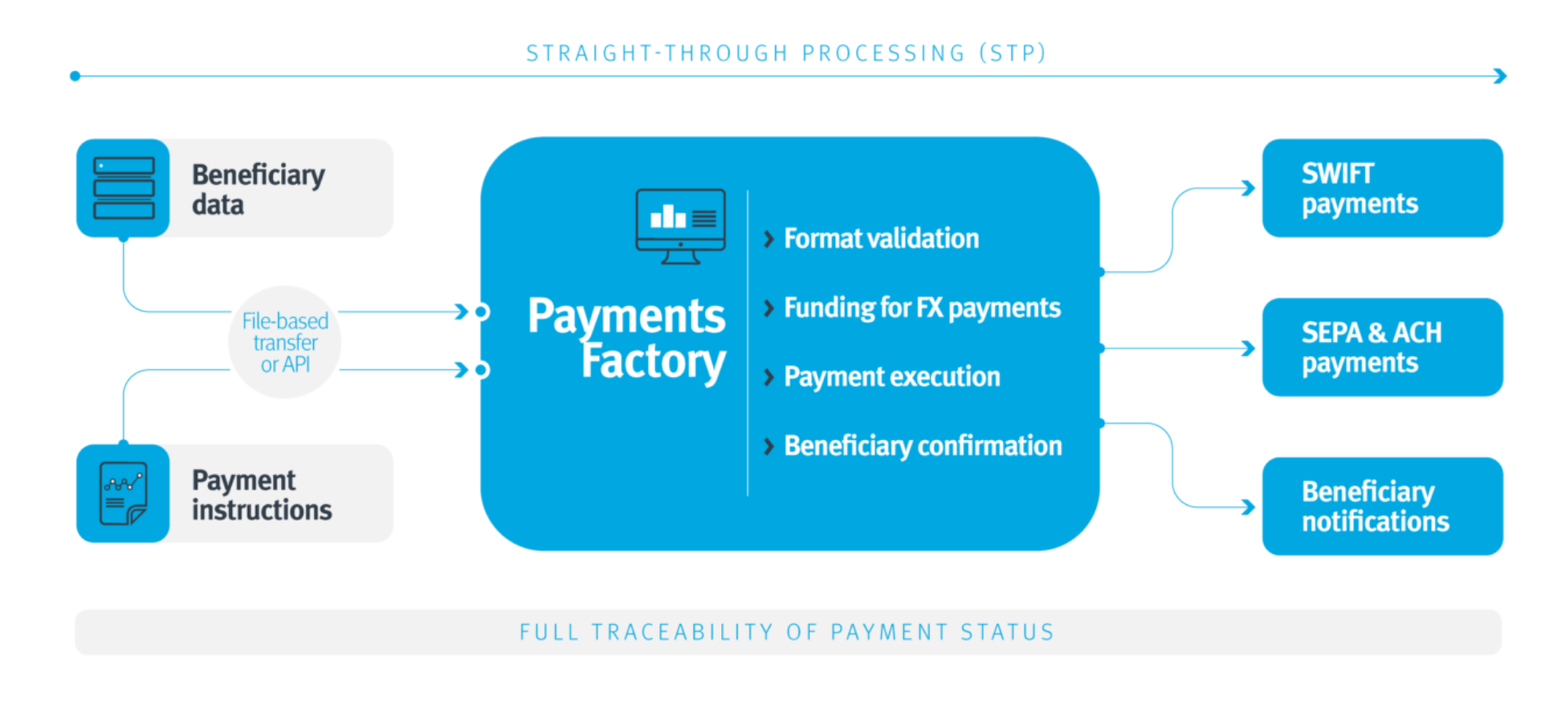

- Payments Factory: for companies to centralise all their local or international payments. Company simply makes one same currency transfer to Kantox (e.g. in EUR or GBP) and Payments Factory dispatches the funds to the beneficiaries in the chosen currency.

- Source & Copyright©2019 - Kantox

- Collection Factory: for international businesses looking to centralise their multi-currency collection and accounts receivable processes: open accounts in 29 different currencies within the Kantox eco-system

Use of APIs and partners

Kantox use API for direct connection to corporate’s ERP and TMS throughout their ecosystem:

- FX Data API which provides access to Kantox’s real-time and daily exchange rate data

- FX API automatically executes several types of FX transactions (spots, forwards, and conditional orders), as well as executing foreign and same currency payments

- Payments API for companies that need to manage and automate a large volume of payments allowing multiple cross- or same-currency payments in a single request.

Kantox has developed a number of key partnerships with TMS providers, e.g. BELLIN and ‘neobanks’, e.g. FINAVI, and also with trading platforms such as FXall and 360T.

But Kantox are very clear about what sort of partnering they want. Philippe Gelis, wrote in an article on LinkedIn that, “At Kantox we have always been very clear that we do not want to be a white label, nor a vendor to banks. Our partnerships are based on co-branding.”

CTMfile take: Kantox is a real success story, and no wonder, the clarity of thinking about what corporates want in their FX processing and technological innovation are superb. It will be interesting to see how they tackle the North American market.

Like this item? Get our Weekly Update newsletter. Subscribe today