Blockchain platforms to dominate international trade?

by Kylene Casanova

Blockchain, the Distributed Ledger Technology, is become the underlying technology in global trade platforms. Already McKinsey&Company are predicting $400 million trade spending on block chain patforms in 2019.

Last week four banks went live on we.trade blockchain platform across 11 European countries. We.trade is powered by HyperLedger Fabric - is a blockchain framework implementation and hosted by The Linux Foundation. Last month Natexis went live on the Marco Polo Trade Finance Network platform which uses the TradeIX platform and open APIs and R’3s Corda blockchain technology.

Blockchain trade platforms

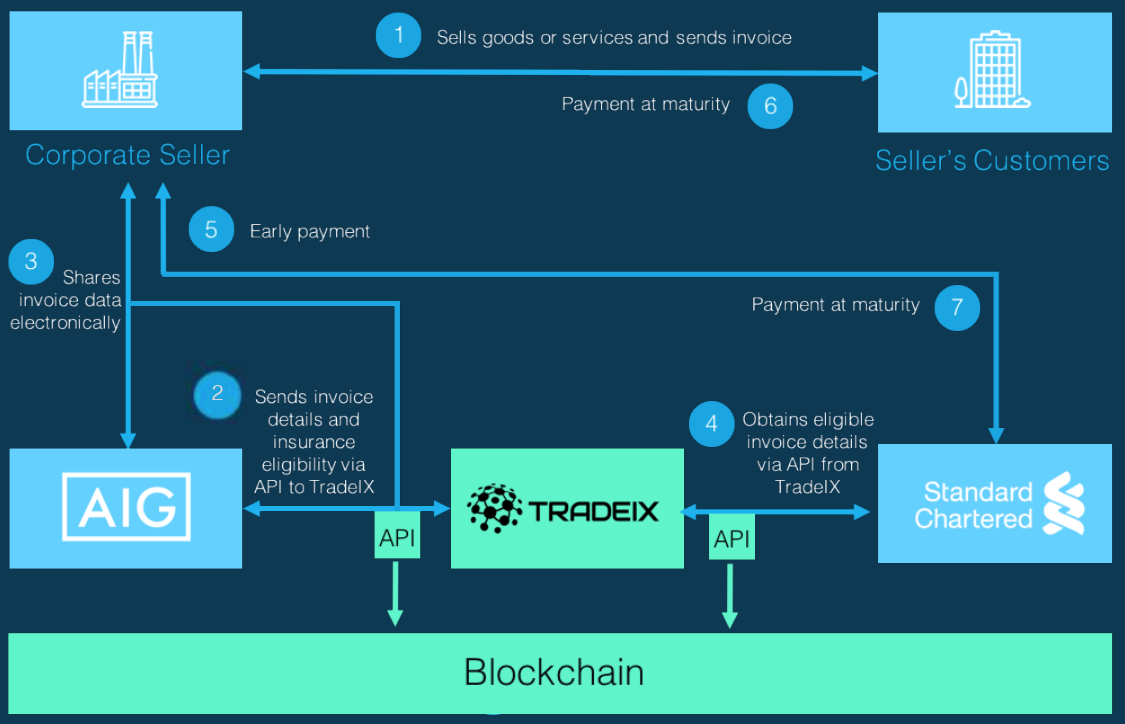

Blockchain trade patforms use the Distributed Ledger Technology which allows, see Marco Polo figure below, banks to offer trade guaranteed transaction on a multi-party blockchain.

Source & Copyright©2018 - TradeIX

It solves the problem, “Do I ship products before I receive payment or do I as buyer pay before I receive the shipment?” It is now fully secure and all parties know what is happening.

Which platform to join?

Natexis have already joined both the Marco Polo trade finance and the we.trade platforms. Others are bound to follow their example.

CTMfile take: These platforms will have to Interact with each other. At least they use the same basic technologies.

Like this item? Get our Weekly Update newsletter. Subscribe today