CLS minimises FX settlement risk and improves corporates’ FX processing efficiency

by Kylene Casanova

Since 2002 the Continuous Linked Settlement system has been one of the cornerstones of the global FX system by helping to mitigate settlement risk - the single biggest risk to the world’s largest and most liquid market, e.g. in 2008 when Lehman failed and in 2012 when Hurricane Sandy hit the USA the global FX market was not affected. CLS now has 62 settlement banks, including all the major banks world-wide and one reserve bank in New Zealand. CLS enhances financial stability by providing risk mitigation services to the global FX market. It operates the world’s largest multicurrency cash settlement service to mitigate FX settlement risk for its 62 settlement members and their clients globally.

CLS settles payment instructions in 17 main currencies, which account for an estimated 94% of average daily FX turnover according to the BIS. It has reduced the global daily gross FX settlement required in these currencies from a total of USD 4.8 trillion to USD 41 billion as well as bringing stability to the global FX system. CLS offers similar benefits to corporates, yet there are only 50+ corporates - global MNCs - using CLS, which mystifies many banks and suppliers. A business development director in a leading TMS supplier, commented, “Every mid-to-large MNC should be aware of CLS and should be using it as a third party connection through their banking relationship.”

How CLS works and timings

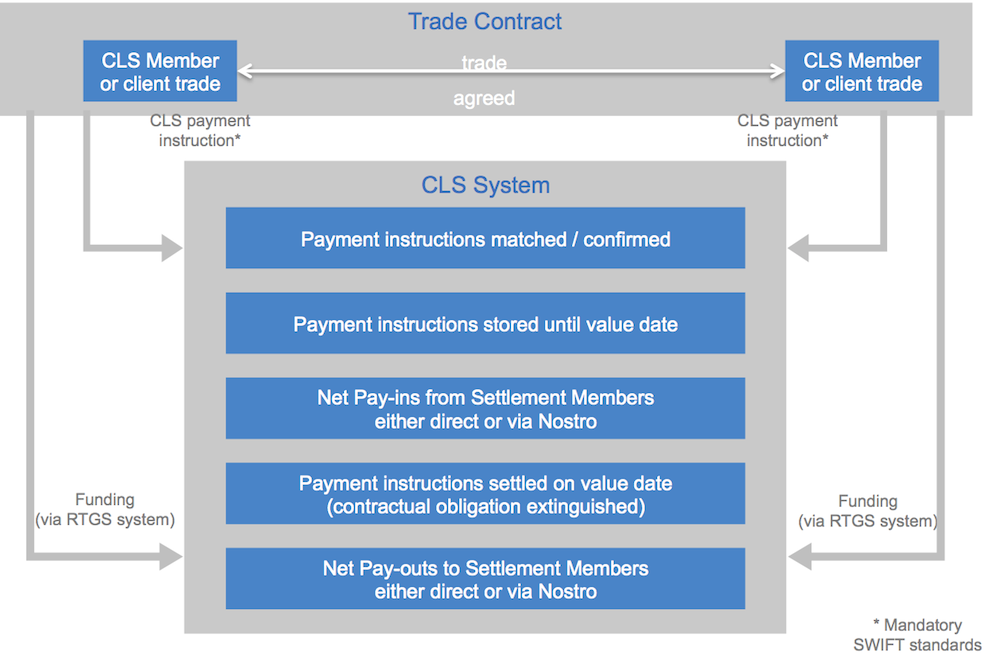

The role of CLS works within the trade life cycle is shown in figure below.

How CLS works within the Trade Lifecycle

Source & Copyright©2014 - CLS UK Intermediate Holdings Ltd

CLS uses the payment versus payment operating model, and, because of the global nature of the service employs overlapping RTGS systems, as shown below, to ensure that all currencies settle from 07.00-09.00 CET.

CLS payment v. payment operation uses overlapping RTGS systems

Source & Copyright©2014 - CLS UK Intermediate Holdings Ltd

The operational deadlines in the main CLS session are shown below.

CLS main session operational timeline

Source & Copyright©2014 - CLS UK Intermediate Holdings Ltd

CTMfile take: CLS is critical for the stability of the global FX system. It is a great example of how the financial system has worked together to mitigate a genuine risk to the market and its counterparties in FX. (But there is now a huge concentration risk for the FX market, so CLS has the most incredibly resilient and robust systems, and process tested set-up imaginable.) CLS has definitely achieved its mission “To enhance financial stability by providing risk mitigation services to the global FX market.” The issue for corporates is whether, when and how to use CLS which is covered in Part II of this progress report.

Like this item? Get our Weekly Update newsletter. Subscribe today