Debt crisis on the horizon: US national debt surpasses $33 trillion

by Pushpendra Mehta, Executive Writer, CTMfile

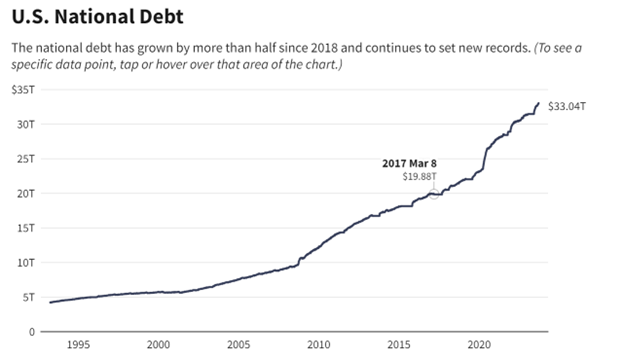

America has the highest level of government debt in the world. Last month the national debt of the US exceeded US$33 trillion for the first time in history.

National debit is defined as “The total amount of outstanding borrowing by the U.S. Federal Government accumulated over the nation’s history”, according to the US department of the Treasury. In essence, this debt is the amount of money borrowed by the US federal government to pay for or cover its operating expenses.

Chart: Investopedia Source: The US department of the Treasury

As per the US Treasury Department, the national debt has experienced significant surges in recent years, primarily driven by notable events such as the Afghanistan and Iraq wars, the 2008 Great Recession, and the COVID-19 pandemic.

“From FY 2019 to FY 2021, spending increased by about 50% largely due to the COVID-19 pandemic. Tax cuts, stimulus programs, increased government spending, and decreased tax revenue caused by widespread unemployment generally account for sharp rises in the national debt”, the US Treasury Department added.

The ballooning US national debt is a stark reminder of the country’s precarious financial path, and is likely to spark a debt crisis, warned billionaire investor Ray Dalio last week in an interview with CNBC.

“We’re going to have a debt crisis in this country,” the founder of the world’s largest hedge fund Bridgewater Associates said during the interview expressing concern about it leading to a “meaningful slowing of the economy,” which according to him could mean the country’s growth is at risk of falling to zero, give or take 1% or 2%.

Dalio believes the speed at which the crisis transpires is going to be a function of supply and demand.

Dalio also cautioned that high debt levels could spark a "balance sheet recession”, where growth stops because companies and people prioritise debt repayment over investing in expansion.

For years, the US borrowed cheaply as interest rates remained historically low. However, with the Fed raising interest rates 11 times since March 2022 as a part of its ongoing drive to combat inflation, borrowing became more expensive for corporations, households, and the US government.

As per data from the US Treasury Department, the interest cost jumped by 25% reaching $652 billion in the nine months leading up to June 2023. The surge in interest payments also contributed to the government hitting the debt ceiling that much faster.

With the Fed likely to hike interest rates one more time this year, an increase in government borrowing costs is also likely. And even if the Fed lowers interest rates in 2024, the interest rates are likely to remain on the higher side for longer, which means that the debt interest payments will continue to be a heavy burden on the US government in the coming years.

Furthermore, considering that the US national debt is expected to rise and reach $52 trillion by 2033, and with interest costs likely to triple to more than $3 billion per day from today’s $2 billion per day in debt interest payments, as per Peter G. Peterson Foundation’s (an organization that seeks to increase awareness of America’s key fiscal challenges) research estimates, America’s unsustainable fiscal outlook marked by its exponential rise in debt will likely hinder its long-term economic growth.

High and rising debt is also likely to leave the US more exposed to instability in international credit markets, and erosion of confidence in the US dollar as the world’s principal reserve currency.

For the US, excessive borrowing amplifies vulnerabilities and propels the inevitability of an advancing debt crisis that may constrain domestic and international economic growth, lead to reduced business investments, spikes in inflation, and cause global financial markets to plunge.

With the threat of the US government shutdown averted late Saturday night after Congress passed a 45-day stopgap funding bill to keep the federal government running until mid-November, one thing is clear that this temporary fix still leaves a lot of uncertainty, potentially making the path back to fiscal prudence even more challenging.

Data from the Peter G. Peterson Foundation reveals that the US national debt now more than $33 trillion is roughly equivalent to the combined value of the economies of China, Japan, Germany, India, and the UK, and amounts to $252,000 per US household or $99,000 per person in America.

That means that if every household in America contributed $1,000 per month towards paying down the national debt it would take over 21 years to do so. But this is unlikely to happen because the US national debt that is at a historic high is expected to keep growing over the next decade.

The United States federal debt is the subject of ongoing concern, but this time around it may become a dire problem for the country, especially in the context of the Fed signalling higher-for-longer interest rates and less easing next year than anticipated.

Moreover, the United States debt-to-GDP ratio is 120%, according to Federal Reserve Data. This was 97% at the end of fiscal year 2022 and is also projected to continue growing.

As US national debt keeps piling up and rising debt imposes higher interest costs, spending on debt may eat up a broad portion of the national budget, crowd out private investment, and drag down the economy.

Time may be running out and before that happens, policymakers will need to restrain spending, raise revenues, and stabilize debt as a percentage of GDP before it turns into a fiscal crisis and poses other risks to the US economy.

Like this item? Get our Weekly Update newsletter. Subscribe today