Does supply chain finance work for international supply chains?

by Tim Nicolle, Founder & CEO, PrimaDollar

Cross-border global trade in goods and services is largely unsupported by working capital solutions, see the chart below.

Source & Copyright © 2021 – ICC trade register and PrimaDollar estimates.

Our last article focussed on the issues surrounding the traditional trade finance product – like the letter of credit, see https://bit.ly/3jKAQEh. We explained why trade finance is no longer a popular product amongst importers and exporters and how the solution most likely requires a fundamental re-think on how trade finance is conducted across borders.

This article explains the difference between invoice finance and trade finance – and why supply chain finance is limited in its effectiveness for international supply chains. And why this has led to the development of a new category of trade finance –“Supply Chain Trade Finance”.

Supply chain trade finance is a hybrid new product built on a supply chain finance approach BUT with all the features of traditional trade finance.

What is supply chain finance?

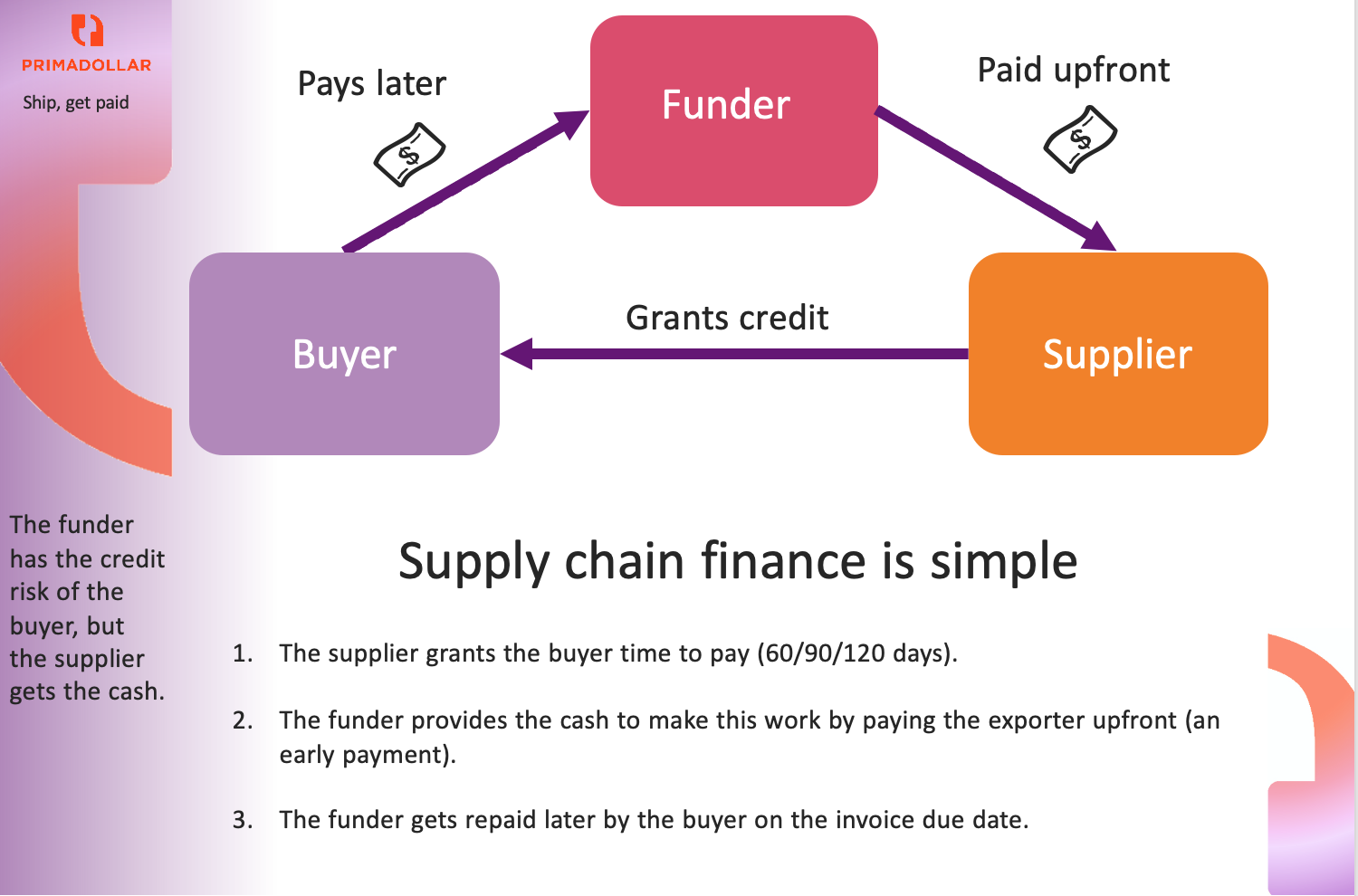

Supply chain finance is a simple product, although it has limitations when used cross-border:

- Suppliers can get paid early

- Buyers can pay later

- A financier (e.g. a bank) bridges the gap

How supply chain finance works

Source & Copyright ©2021 – PrimaDollar

This early payment option has been a lifeline for suppliers, especially during this current pandemic era. Liquidity has drained from supply chains rapidly as a result of interruptions in supply and production – and many buyers have sought to extend payment terms for their suppliers in order to manage their own stresses.

But supply chain finance has always had limited reach and it has hardly penetrated international supply chains. As the PwC supply chain finance surveys have shown, typical SCF programs only support 16% of suppliers and 25% of spend. It is usually the international suppliers that are left out.

This is because SCF is an “invoice finance” product and not a trade finance product.

Invoice finance vs trade finance – what’s different?

Bizarrely, this is a question that requires some thought – since both products are based upon a receivable from a buyer; that is a commitment the buyer makes to make a payment in the future that can be discounted to generate an early payment (i.e. finance). And, in both cases, that commitment is anchored by the same thing – a commercial invoice.

But, in many banks, invoice finance people and trade finance people are in different buildings, use different words, work with different legal instruments and have separate career paths. It is also not as simple as a separation between domestic business and international business either. It is feasible to apply the principles of invoice finance to cross-border invoices, albeit for the reasons explained in this article, there are significant limitations.

Differences between invoice finance and trade finance

Source & Copyright ©2021 – PrimaDollar

There are some overlaps between invoice finance and trade finance, but there are two vital differences:

- the timing of the early payment or when finance is provided to the supplier

- the restrictions on the eligibility of suppliers when banks are asked to finance suppliers outside their own country.

1) When finance is provided to the supplier

Trade finance generates cash for the supplier earlier than invoice finance:

- typically trade finance is used to deliver cash to suppliers at or shortly after shipment

- whereas invoice finance is used to deliver cash after delivery.

This difference arises because the trade finance solution includes support for the buyer “early approval process” which is against the shipping documents. This is out of scope for invoice finance which only starts once approval for early payment has already been given by the buyer. This is why invoice finance typically is only available after delivery as buyers do not give approvals for early payment before then.

There are four reasons why payment timing is very important for international suppliers – and why payment at shipment is so much better than payment after delivery:

- Elapsed shipping time for Asian suppliers to the US or Europe can be 30 days or more.

- Suppliers have little confidence that they can enforce a claim for payment in a distant foreign jurisdiction – so find that local banks give little or no value to the invoice.

- The goods that are being shipped often form part of the collateral for pre-shipment loans. Once the goods are handed over, the collateral has gone leaving the supplier with a gap.

- Many emerging market jurisdictions have tough foreign exchange regimes that mean local banks are very exposed when goods are shipped without a hard currency payment upfront.

2) Restrictions on the eligibility of suppliers

In the invoice finance world, there is only one bank involved, and it is the bank that makes the early payment to the supplier by discounting the invoice. Since banks find it difficult to onboard suppliers that are not in their country of operation, this limits the scope of operation when international trades are involved – since international suppliers are, by definition, in other countries. In traditional trade finance, the use of two banks solves this limitation – since the exporter bank takes care of the exporter and the importer bank takes care of the importer.

This is why trade finance is cross-border whilst invoice finance is usually domestic. And it also explains why supply chain finance, an invoice finance product, starts to struggle when suppliers are international.

***

In the next section, the two models, “SCF” and “SC-TF” are compared below to show the important differences.

Supply chain finance - limited reach, invoice approach

In the case of supply chain finance – it is the invoice that entirely drives the financial service provided. The invoice is a commitment from a buyer to make a payment in the future that can be discounted to deliver cash early – i.e. finance.

Information flow in supply chain finance

Source & Copyright ©2021 – PrimaDollar

Since invoice obligations are subject to the terms and conditions of sale and purchase between the buyer and the supplier, in supply chain finance the invoice obligation is also reinforced by an additional commitment from the buyer confirming that the invoice will be paid without reduction – often called an “IPU” or irrevocable payment undertaking. This is the concept of “approved invoice” that makes supply chain finance work.

Funding comes from relationship lenders to the buyer, or from the capital markets, for example, as in programmes that are arranged by Greensill.

Even if the supplier(s) involved are eligible for the SCF program, there are further limitations because the only information circulating in the platform is the already-approved invoice. This means that the buyer has had no assistance with the early approval process (the giving of the IPU); this has to be happening elsewhere. It also means that funders (typically the buyer’s banks) have difficulties with KYC and compliance for financing before delivery because there is not enough information to support the typical AML and compliance requirements. When goods are funded on the water, vessels and routings have to be checked for sanctions, and underlying commercial transactions have been tested for reasonableness. These compliance requirements are standard in trade finance, but not available in the invoice finance model.

In the end, supply chain finance, as an invoice finance product, has limited scope to support international supply chains. This is due to limitations on supplier eligibility, lack of assistance to buyers in giving early payment approvals and lack of trade data to carry out the compliance checks that are typically needed..

Supply chain trade finance – designed for international supply chains

The SCF limitations are addressed in the new hybrid product: supply chain trade finance (SC-TF).

SC-TF uses a hybrid approach:

- All the features of a documentary credit

Plus

- All the ease and simplicity of supply chain finance.

Illustration of the hybrid features of SC-TF

Source & Copyright ©2021 – PrimaDollar

The hybrid product has the same starting point as supply chain finance, but has much wider capabilities:

- Funding still comes from the buyer’s own banks, or from the capital markets using programs like the ones that are arranged by Greensill;

- Funding is still based upon an early approval by the buyer (the “IPU” described above);

- But supply chain trade finance additional brings the shipping documents directly into the process, enabling international suppliers to be brought easily into the program and paid at shipment.

Shipping documents deal with three main risks that apply when early payment is sought before delivery:

- Early Approval: When the buyer gives an early approval, he is committing to pay the invoice later. Giving early approval can be risky, especially if it is before delivery. What if the suppliers have not done his job? In trade finance, the shipping documents are used to mitigate this risk. The package of documents typically demanded by buyers includes the bill of lading (evidence of shipment), packing list (what has been shipped), inspection reports (quality of what has been shipped), certificate of origin and other forms (ensuring that goods can be landed). Taken as a package, these documents show that the supplier has fully performed his tasks – and so his invoice is safe for early approval. In supply chain trade finance, this is an integral part of the system and the process.

- Compliance: Regulators recognise that, when finance is provided before delivery, additional checks should be carried out. Trade-based money laundering is a big area of focus – as B2B transactions provide easy routes for illegal funds to be layered into the system. Most regulators place explicit obligations on trade finance banks to carry out a wide range of checks, including on the ships involved, the route taken, and to ensure that the container does contain what it should, and is, indeed, on the vessel it is supposed to be. All of these checks require information that is only available from the shipping documents. Supply chain trade finance adds these documents into the data flow and makes all these compliance checks easily possible and, indeed, allows them to be automated.

- Landing: As pointed out above, early approval of an invoice is a risk for the buyer. It is important that the buyer only gives early approval before delivery if he is also 100% confident that all the paperwork needed to bring the goods into his country has been provided. This is highlighted for us in the UK right now as a result of Brexit. This is called “trade compliance” – making sure that the goods have a correct and appropriate certificate of origin, and that it is clear which HS code should apply – since the HS code drives the duty classification. Moreover, many goods require additional certifications – for example, fumigation certificates on wooden pallets and storage and processing certifications for food products. Supply chain trade finance enables the buyer to specify the documents required given the product and the supplier – and then helps the supplier to provide the correct paperwork via its process. As highlighted above, systems that only track invoices do not have the capabilities to store, manage and process these additional and essential documents.

***

This is why trade finance requires a wide range of documents to be available in order for it to work effectively – and why it is so different to invoice finance. The outcomes are different, the work involved is different, and the process is different as shown in the figure below.

Information flow in supply chain trade finance platforms

Source & Copyright ©2021 – PrimaDollar

From a technological point of view, the challenge has been to build a platform to manage all the documents on top of the much simpler tasks involved in managing the invoice and its approval. This has required a complete rebuild of the concept, and, in supply chain trade finance the data flow is backwards:

- Supply chain finance needs information about invoices and approvals. These are obtained from the buyer’s accounting system or “ERP”.

- Supply chain trade finance needs a full set of documents to manage the buyer’s decision for early payment, to ensure that mandatory compliance checks can be done and that all the documents needed to land the goods are being provided. These are obtained, just like in trade finance, from the exporting suppliers themselves – and, just as in trade finance, the decision as to what documents are needed is driven by the buyer.

The beauty of the new supply chain trade finance platforms is that there is no mandatory IT project for the buyer as a result. It is simply a matter of plugging in the suppliers and standardising the payment terms.

What next for supply chain finance?

Supply chain finance is a powerful product, but it has inherent limitations which mean it works very poorly, if at all, cross-border. As PwC surveys have pointed out, most SCF programs support only 16% of suppliers and 25% of spend. Moreover, over 80% of corporate treasurers wanted to expand their SCF programs.

But SCF programs run directly into limits because of how they work. Without the shipping documents available inside the programme, it is difficult and risky for buyers to give early approvals before delivery, and funders cannot perform mandatory compliance checks on trades. In both cases, this means the funding arrives too late to be useful, and most suppliers are ineligible.

Recent estimates for the liquidity gap in international supply chains range from $1.5trn (ADB) to $3trn (ICC) to $5.2trn (IFC). Whatever the right number, the gap is real and it is holding back efficient international trade.

Adding the features of trade finance to the SCF platform is not straightforward – but that is achieved through the new proven hybrid approach. Our platform alone has already processed approaching $0.5bn in payments involving clients in 40 countries. Supply chain trade finance is here now, enabling early payments processes to work fully across international borders.

Expanding early payment programs so that they work efficiently for the international supply chain is the next milestone for this industry. Supply chain trade finance is the way to do this. There are significant cost savings available from taking control over how international suppliers are funded and paid. This is the new direction for the industry – and where early payment technologies can deliver huge value to corporate clients.

Like this item? Get our Weekly Update newsletter. Subscribe today

May I ask a question about Supply Chain Finance?

When supplier and buyer are in different countries, how does buyer’s banker give finance to supplier in other country? by remittance? if yes, what are the elements that buyer’s banker need to pay attention? compliance, money laundering rules in supplier’s country? and how to put supplier and buyer in the same SCF agreement that may involve different country laws.

Thanks,

Edmen