Downward insolvency trend coming to end, predict Euler Hermes trade credit insurer

by Kylene Casanova

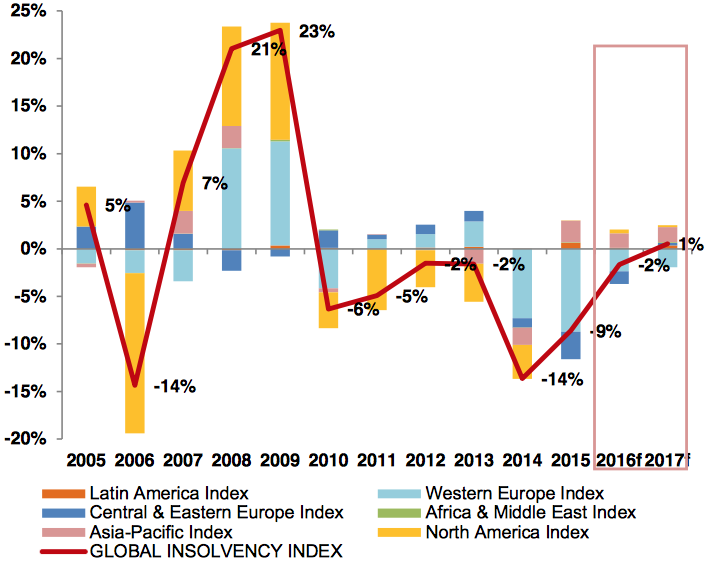

In 2016, companies struggled to stay resilient despite robust support from policymakers, according to Euler Hermes, a leader in trade credit insurance. Strong deflationary pressure and subdued global demand made life harder for businesses. After two years of substantial declines in insolvencies, the Euler Hermes 2016 Global Insolvency Index - which weighs countries based on their GDP and represents 84% of world GDP - is expected to record a limited decrease of -2%. ( See full 2017 report, here.)

Euler Hermes believe that at a global level, the contained return of inflation should provide only limited relief to corporate revenues, while companies will face higher input costs, upward wage pressure and tighter financing conditions. Businesses absorbed the 2008-2009 shock, but remain vulnerable to the lack of a solid macroeconomic and financial environment.

2016 commentary

In 2016 companies faced major global headwinds:

- A sluggish global economy (real GDP growth +2.5% in 2016 vs. +2.7% in 2015)

- A sharp slowdown in global trade (+1.9%)

- Fierce price competition

- Volatile exchange rates and international financial flows.

This produced, Ludovic Subran, chief economist at Euler Hermes: “Bankruptcies on the rise in Asia Pacific and the Americas, and Europe’s improvement is fading. We expect global insolvencies to rise by +1% in 2017.”

Europe appeared immune to the gloom in the rest of the world in 2016, with insolvencies decreasing by -5%. Meanwhile, Latin America should post its fifth consecutive increase in insolvencies (+18%), impacted by recession in Argentina, Brazil and Venezuela, low commodity prices and currency depreciations. In Asia Pacific, the Chinese slowdown and a rebound in insolvencies and protectionism will impact companies. In North America, the steady decline in insolvencies came to an end, as figure below shows.

2017 forecast

EH predict that in 2017:

- Companies will more vulnerable to external shocks.

- Bankruptcies will rise in Asia Pacific and the Americas

- Europe’s improvement will fade

- Worldwide insolvencies are expected to rise by +1% (see graph)

- The contained return of inflation should provide only limited relief to corporate revenues, however companies will face higher input costs, upward wage pressure, and tighter financing conditions

- The recent surge in the number of major bankruptcies will be a source of second-round turbulence. Large bankruptcies will have a domino effect, with adverse implications for fragile suppliers.

EH Global Insolvency Index and Regional Indices 2005-2107

Sources: National statistics, Euler Hermes forecasts

CTMfile take: 2017 is not going to be good and the combination of Brexit and Trump economics will definitely make it worse.

Like this item? Get our Weekly Update newsletter. Subscribe today