Emerging technologies that matter for corporate treasury and their impact on TMSs

by Pushpendra Mehta, Executive Writer, CTMfile

“Whether to their chagrin or to their delight, treasurers are increasingly finding that they must have a fairly high level of familiarity and capacity with technology. While there is an abundance of information available about technology online, it is typically too deeply technical, too broad, too out of date, or too lacking in relevance to treasury to suitably fit the need”, stated Strategic Treasurer’s 2023 Treasury Technology Analyst Report, which can help fill this gap, while also helping corporate treasury stay up-to-date in the current context.*

With global economic uncertainty and geopolitical risks likely to remain elevated, corporate treasury is expected to accelerate their digital transformation by embracing emerging technologies to improve cash flow visibility and liquidity forecasting for greater efficiency, risk mitigation and cyber security.

But what types of technology are available that could help your organization? How might they assist? What’s on the horizon? How to proceed, and more are collated in this report that can act as a definitive guide to treasury practitioners exploring how treasury technology meets treasury needs.

Here are the main emerging technologies currently in use in treasury, or are expected to be adopted within the next two to five years, including how these technologies are specifically impacting treasury management systems (TMSs):

Emerging technologies that matter and their growing use in treasury management systems (TMSs)

Breakthrough technologies such as application programming interfaces (APIs), artificial intelligence (AI) and machine learning (ML) are expected to exert a significant impact on the treasury function in the upcoming two to five years.

APIs are a set of defined rules and protocols that enable different software applications to talk to or communicate with each other to access and exchange information or data.

According to Strategic Treasurer’s latest Treasury Technology Analyst Report, “In the corporate treasury space, APIs allow treasury technology users to access bank data at the click of a button and power more efficient integration between internal systems.”

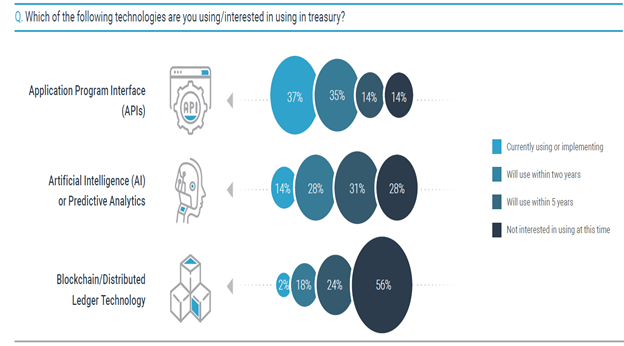

Over one-third (37%) of the respondents in the analyst report are currently using APIs in treasury, with an additional 35% of the survey report participants interested in adopting APIs over the next two years.

Source: Strategic Treasurer’s 2023 Treasury Technology Analyst Report

This increasing API adoption is not only because APIs ensure that treasurers can access high quality and reliable financial data consistently, but also because APIs facilitate instant and secure flows of banking transaction and account data, allowing corporate treasurers to have complete visibility of the global cash position that enhances their ability to forecast and manage cash flows with greater accuracy and speed.

In this connection, treasurers are adopting API technology to facilitate integration between internal systems such as TMSs, ERP systems and more. Additionally, through their TMS and treasury and risk management system (TRMS) vendor or provider, treasury respondents are using APIs primarily for connecting to banks for information reporting (56%) and payments (37%), Strategic Treasurer’s report noted.

Of all the emerging technologies, “AI and ML have been making headlines in 2023, and for good reason, as they are expanding the list of tasks computers can adequately perform”, observed the report.

Despite the fact that AI is constantly in the news, it wasn’t widely used by treasury professionals this year with only 14% of respondents adopting AI in treasury.

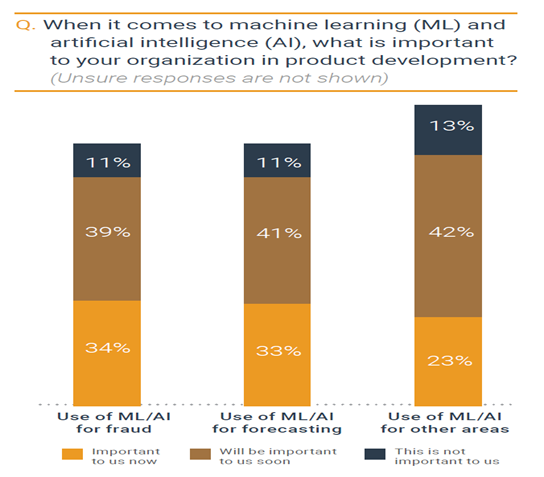

The two most notable use cases where AI and ML impacted the treasury management systems (TMS) were cash forecasting and anomaly detection, as per the analyst report.

Source: Strategic Treasurer’s 2023 Treasury Technology Analyst Report

“Cash forecasting is an area that treasury professionals consistently report spending much of their time on, and yet many also report that the time they do spend on it is insufficient. Once made, the forecasts are also often inaccurate. Some vendors have been finding good success in applying machine learning to the task of forecasting. With adequate historical data, these applications are proving accurate and efficient at predicting cashflow. While ML-powered forecasting is fairly new and not built into all TMSs, it is likely to become more widespread”, the Strategic Treasurer report mentioned.

Another area where AI and ML have demonstrated significant value within the TMS is anomaly detection.

“Fraudulent activity tends to break the normal pattern of system usage, such as an unusually large transaction being initiated after normal working hours, or an unusual number of files being accessed in a short amount of time. AI and ML excel at pattern recognition and, therefore, recognizing when activities fall outside the normal range. The TMS can then flag the suspicious activity and, in some cases, hold payments until they are released by an analyst”, the report suggested.

With fraud detection being a pivotal application of AI and ML technologies, and cyber criminals also utilising their advanced capabilities for malicious purposes, corporate treasury must consider how else can these innovative technologies be used to help them and what they need to be watchful of to avoid detrimental consequences.

To conclude, it is imperative for treasurers to remain mindful of the shifts taking place in treasury technology so they can harness the power of emerging technologies to drive business growth and informed decision-making, thereby gaining a competitive edge.

To help treasurers keep their ears to the ground, and discover how they can make treasury technology work for them, we recommend treasury executives download, review and benefit from Strategic Treasurer’s 2023 Treasury Technology Analyst Report.

⃰ Disclosure: Strategic Treasurer owns CTMfile.

Like this item? Get our Weekly Update newsletter. Subscribe today