Five trends and pain points in global FX and payments

by Kylene Casanova

Accessing global transaction banking is at the heart of the challenges facing businesses trading internationally, with some of the problems including cost and speed of transaction, according to a white paper by Saxo Payments, Missing the Opportunity. It highlights some of the FX and payments 'pain points', based on responses from a variety of entities around the world, including FX businesses, banks and corporates.

In terms of FX, companies continue to rely on their banking relationships but there has been a move towards alternative providers, such as fintech companies. The report found that two-thirds (64 per cent) of companies still use a bank to manage FX payments, while more than a quarter (27 per cent) use a specialist FX provider and 13 per cent use a financial technology company.

The report also found that cost is the primary concern when it comes to cross-border transfers, for 50 per cent of respondents. Speed of transaction was the second biggest concern, with 32 per cent, while manual processing came third with 31.5 per cent.

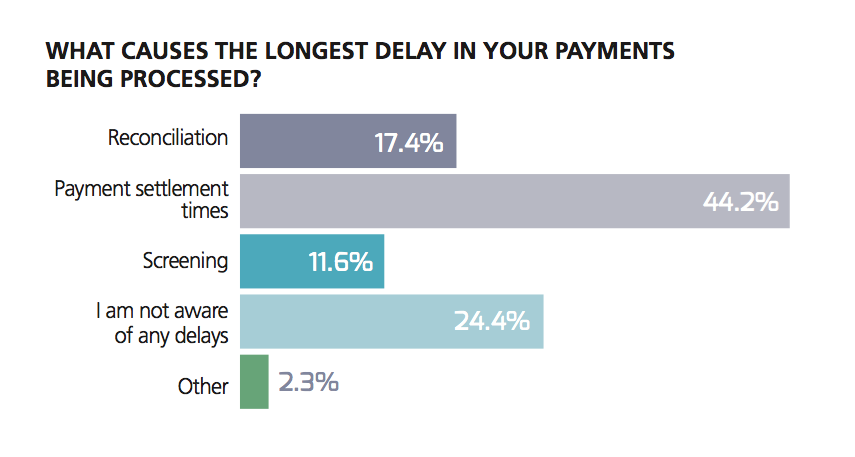

Payment settlement times are the main cause of long delays in FX payments processing, according to 44 per cent of respondents. This was followed by reconciliation (17 per cent) and screening (12 per cent). And nearly a third of companies surveyed said they did not think they are offered competitive rates by their current FX provider.

Five trends in global payments

The white paper also included an overview of five trends in global payments:

- New market opportunities driven by globalisation. The report says that Europe is still the largest ‘inbound’ transaction banking market, but rapidly developing economies will grow significantly faster during the next decade.

- Digitisation and the focus on the customer. Banks will improve their digital capabilities in line with customer expectations in coming years but the report said that many incumbents are not as operationally efficient as newer market entrants, with incumbent bank STP rates as low as 60 per cent.

- New regulation – driving banks to retrench. These include Basel III, the revised Payment Services Directive and tighter requirements around KYC and anti-money laundering legislation.

- Entry of third party payment providers. New entrants are threatening to disintermediate banks by address existing pain points by providing, for example, real-time, rich remittance information or lower fees.

- The evolution of the 'utility'. This means that banks could become more digitised, relationship-driven and focused on the customer relationship by outsourcing non-core functions to third parties.

Like this item? Get our Weekly Update newsletter. Subscribe today