How to develop the ultimate cash flow forecast

by Nicolas Christiaen, CEO & Founder, Cashforce

Cash flow forecasting has been called many things in literature. Ranging from the cornerstone of a finance & treasury department to the lifeblood of any organization; it’s fair to say cash forecasting is vital to get an accurate prediction of an organization’s health.

Cash forecasting, at its core, is simply identifying all the various in & outflows over a given period in order to analyze and compare those estimations with your actuals. However, in reality, it’s not that simple and a lot of challenges arise in getting an acceptable end result, especially when complexity increases i.e. multiple systems, entities, currencies, etc.

Additionally, it doesn’t stop at regularly getting the right information in a timely and efficient matter. Setting sensible assumptions and providing contingencies that offer flexibility in case of unexpected events are a few quintessential things to consider. Improving your forecasting results is more than relying on hard data, but bears fruit in the synergy of art and science. Don’t know where to start, or how to fill in the blanks on further optimizing your current process? Then follow this Checklist.

1. Set your goals & requirements – getting to the why - decide:

- Why are you creating a cash forecast?

- Do you want to perform an indirect or a direct cash forecast e.g. focus on short term (direct) or longer-term (indirect), or a combination of both

- What does successful (output look like? (formats, visuals…)

- If you would like to combine both, choose how the reconciliation would work?

- What level of granularity do you need?

- What KPI’s will you be measuring?

A possible output – reporting on Cash position & Cash forecast

2. Audience – define your stakeholders and what they need:

- Who will be the main users of the reports and analyses? (operational vs strategic or both)

- Who will be contributing to generate the forecast?

- How will the different contributors and users consume the outputs?

- What other stakeholders will use the forecast? (e.g. shareholders)

- Will you recognize forecasting performance? (e.g. remuneration)

3. Process – Getting to a well-oiled machine - choose:

- What are your main cash flow drivers? (how do you define your business model?)

- What will be the main process-steps?

- To what extent your staff will be involved in the process? (vs. technology doing the work)

- In case of exceptions, can the process be sidestepped? If so, what happens then?

- What controls will be put in place?

- Who will be in charge of setting up the process? (internal/external)

- Who will be the main owner of the process?

4. Data quality – tidy up the house – by deciding:

- How often does the data need to be updated?

- How will data quality be ensured for new inputs?

- What process will be put in place to clean the current data?

- How will you flag and treat misallocated cash flows?

- What will you use as a reporting currency?

- How do you treat currency differences?

5. Input data – bring it all together – by determining:

- What data sources are most relevant for the forecast and what data you want to take into account:

- Systems holding your (actual & future) payables and receivables?

- What formats are your bank statements in? (MT940, BAI, EBICS, CODA…)?

- Financial planning data. e.g. FP&A / budget / planning tools?

- Do you have any Treasury & financing data, e.g. interest & FX payments on ongoing deals, residing in, e.g. a Treasury Management System or spreadsheets?

- Do you need to take any other data into account, e.g. in data warehouses, other specialized systems for leasing, salaries, projects, etc.?

- What manual input do you require? To what level?

- How will you get the above data into the forecast? Is it possible to automate these processes?

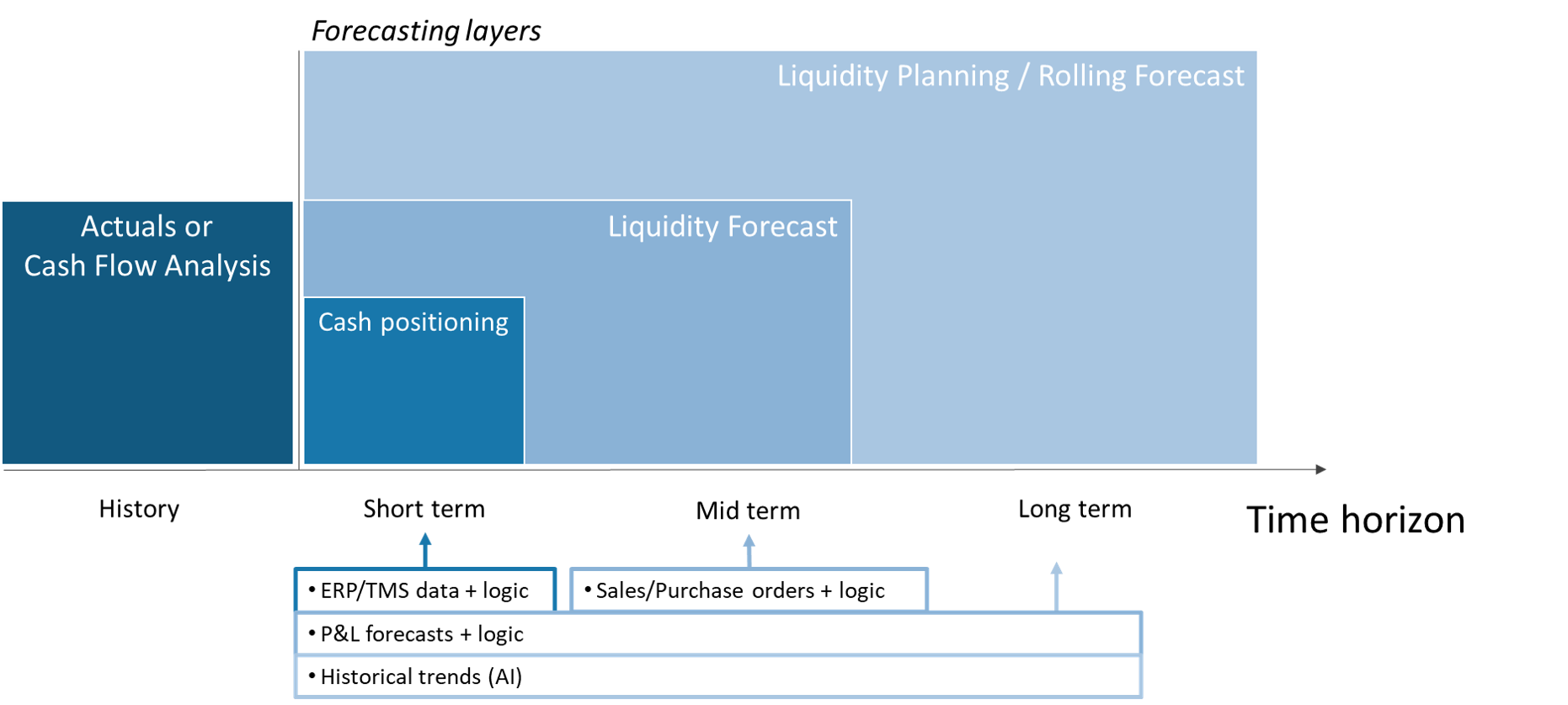

6. Horizons – To infinity & beyond – choose:

- How many forecast horizons do you want to define?

- What cutoffs would you put in place to split the horizons?

How would you divide the short-mid- & long-term components of the forecast, see (e.g. different per data source below:

An example of Cash forecasting horizons & their sources

7. Data segmentation – Sorting out the sheep from the goats – decide:

- What cash flow categories do you want to use?

- Is there a template you can use as a basis of cash allocation categories, e.g. your current ERP, etc.?

- How will you treat the unallocated transactions/cash flows, as shown below?

Commonly used Cash categories

8. Ensure continuous improvement – Climbing to the summit – by:

- Setting up accuracy feedback loops, e.g. regularly comparing actuals vs forecast & reviewing for improvement

- Choosing which algorithms / logic – based on business drivers - can be integrated into your model to improve the forecast

- Decide which contingencies to build in, e.g. revenue/cost/currency/… assumptions

Evaluate how you will you compare with and integrate industry best practices, e.g. staying up to date with the latest technology/peers/…

Possible logic to take into account

While creating an accurate cash forecast is not rocket science, getting an effective reporting process in place certainly requires a well thought out and reproduceable plan. Defining the who, the what, the when and the how is both a quantitative and qualitative exercise in building out a forecast. This checklist shows you how to combine the art and science of cash flow forecasting to get it done.

Like this item? Get our Weekly Update newsletter. Subscribe today