How to manage working capital through an economic downturn

by Giles Newell, Treasury Advisory Executive, Bank of America / Bruce Meuli, Treasury Advisory Executive, Bank of America

It is widely recognised that Treasury “owns” cash and liquidity as part of their core cash management function; but, Treasury is rarely directly responsible for AP, AR and Inventory.

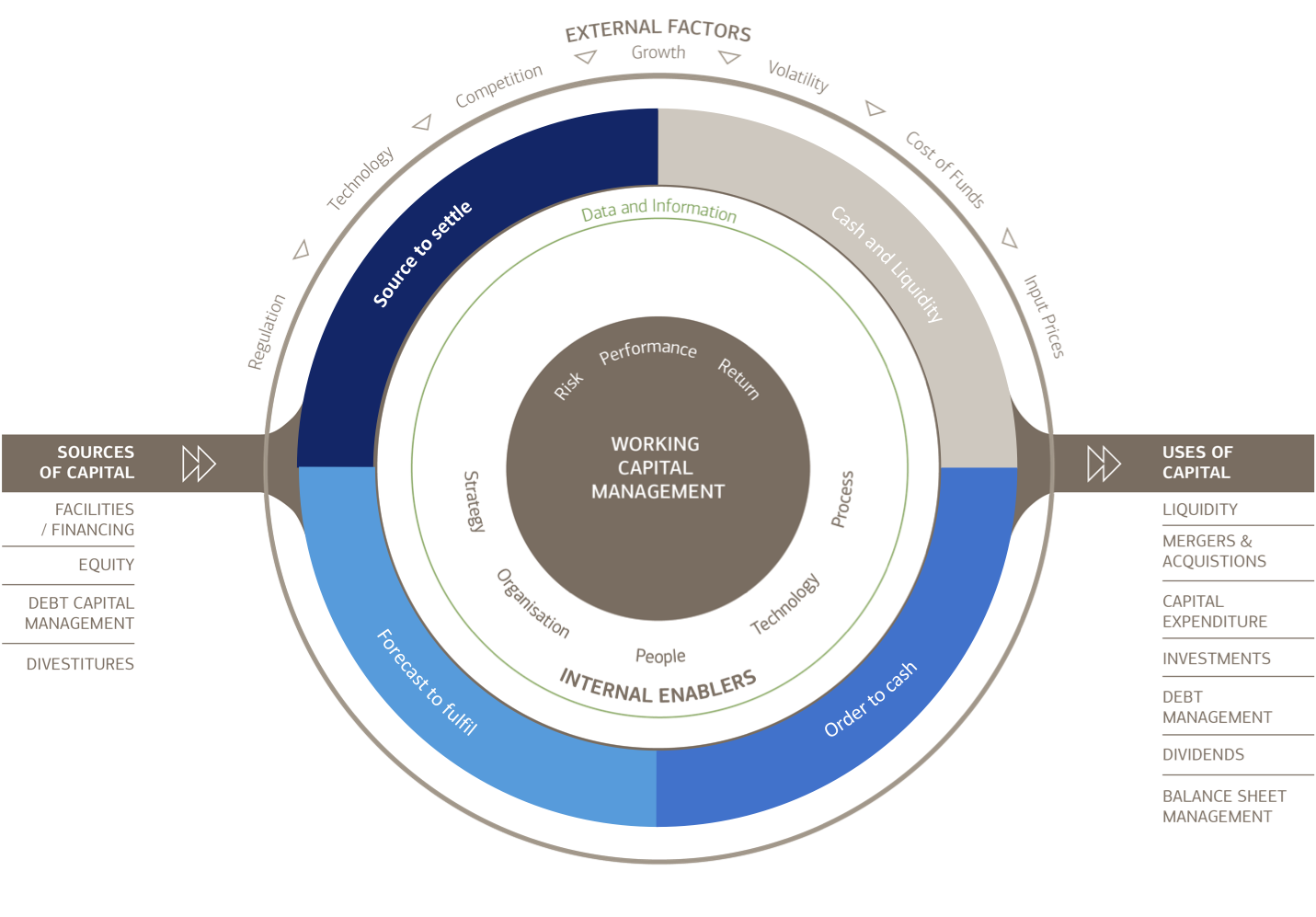

However, Treasurers can play a vital role in helping businesses bolster working capital during times of economic stress by taking a more strategic cross-functional role in optimizing working capital. Treasury is increasingly having an oversight role over working capital with the treasurer’s often reporting KPIs and chairing working capital committees, and by taking a Holistic View of Working Capital:

Learn how to optimise your Total Working Capital management by following these six steps:

1. Agree clear working capital definitions

Key considerations here are:

- Ensure that working capital benefits are permanent and not achieved solely as a year-end window-dressing exercise. As a result, internal working capital definitions and KPIs should be based on long term working capital improvements. To achieve this, many companies use a 12-month moving average (12MMA) as the numerator when calculating DIO, DSO and DPO

- Define the meaning of working capital. There is often a disconnect between the treasurer and the finance controller/supply chain manager as to the meaning of working capital - this is driven by a narrow functional definition and the assignment of accountability

- Take a holistic or enterprise view – it requires a cross-functional team with shared goals. An example would be increasing inventory prior to a marketing /sales initiative. Focussing just on stock levels could result in stock-outs during the marketing initiative and compromise sales. As a result, many organisations have established working capital committees at operating business unit level comprised of senior representatives from across the business to optimise (rather than minimise) working capital without having an adverse impact on sales. These working capital committees are often chaired by treasury

- Choose your KPIs carefully – be careful of driving unsustainable outcomes, non-value-adding behaviours or unintended consequences.

2. Establish a working capital framework approach

Key considerations:

- Define responsibility over working capital processes. Where AP and AR have been outsourced to a SSC, responsibilities often takes a matrix approach with process experts being responsible for AP and AR.

- Establish a cross-functional team – create a “cash task force” or “war room” – a working capital committee. This is often chaired by the Treasurer

- Develop regular short/medium and long term forecasts for Supply/Production and Demand/Sales – these will support long term working capital improvements. In this way the company can accurately identify working capital issues well in advance and take necessary action to mitigate. This process is often called Strategic Operational Planning and forms a key input into the working capital committee

- Establish a working capital framework – the template above is designed to establish and develop a working capital management capability over time. It emphasises the multi-faceted approach – policy + process + systems + people. The requirement for automation of internal and external processes

- Jump in at any point of the framework to progress “tactical” more focussed interventions e.g. identify 10 key areas where you could release cash. You don’t have to start at the beginning

- Focus initially on internal process interventions – that is – improve what you currently do. Look to simplify and improve execution of internal processes

- In times of stress focus on key issues – 80/20 rule applies

- Take stock as to the current position of the company and “baseline” current working capital operations. This will identify pinch points and the “low hanging fruit”

- Ensure that Short Term Incentives (STIs) of local management are aligned to working capital improvements – STIs often focus on Sales or profitability margin and ignore working capital.

3. Identify your working capital drivers

Key considerations are:

- The usual working capital drivers are Accounts Receivable (AR), Accounts Payable (AP) and Inventory.

- DSO +DIO - DPO = Cash Conversion Cycle (CCC). Note that cash and liquidity are not included in this definition

- Companies should also consider Revenue Enhancement, Cost Efficiency and Cost Reduction as the other value drivers that can have a dramatic impact on working capital.

4. Drive DIO improvements

Actions required here include:

- Segment inventory in order to understand what inventory is required for core sales lines and their critical suppliers. During a crisis period, contingency plans should be developed and alternative suppliers on-boarded

- Undertake stock segmentation and assess the risk of supply. Consider:

- Suppliers and geographies and build contingency – identify alternative suppliers and on-board

- Possible changes in supplier lead-times - a slowdown

- Reduced order quantities resulting from lower sales

- Increased orders to guarantee the inventory

- Recalculate minimum stock levels

- Review write-off processes

- Review frequency of Supply & Demand planning – shift to weekly and adopt a more short term forecasting horizon

- Review stock lines – consider stopping production of slow-moving lines

- Focus sales on core lines

- Transition to a more centralized procurement model

- Cut costs – either input costs, specification or quality.

5. Drive DPO improvements

Key actions include:

- Undertake Supplier segmentation. Identify critical suppliers

- Develop contingency plans

- Actively collaborate to ensure supply of goods

- Update supplier risk assessment

- Benchmark payment terms

- By country – take into account regulatory restrictions in terms of treating all suppliers fairly

- By category

- By market location

- As a rough estimate, review your supplier DSOs to assess their average payment terms

- Extend payables where possible

- Revisit SCF and Discounting solutions

- Eliminate early payments where no discounts received

- Pay early to secure critical suppliers

- Reduce frequency of payments

- Only pay what is due rather than what is due and what becomes due before the next payment run

- Review and re-document AP processes from start to finish focussing on :

- Master data – streamline payment options and duplicate suppliers

- Ordering and approval processes

- Timing of receipt of invoice to upload on AP system

- Approval of payment on the AP system

- 3-way match processes

- Payment approval and escalation processes

- Implement “Payment Hub” technology to ensure standardized approval mechanisms throughout the organization

- Implement cyber fraud technology to identify unusual amounts and beneficiaries.

6. Drive DSO improvements

Key actions here include:

- Review the liquidity of customers from their most recent financial statements and rating agency reviews

- Segment customers based on credit risk. During a period of crisis, greater weighting should be placed on the short term credit risk

- Update customer risk assessment focussing on short term measures – use data analytics tool to identify changes in customer payment patterns such as late payments or short payments

- Reduce limits for at-risk customers. In extreme cases consider cash on delivery

- Focus management time on overdue receivables taking into account the general rule that 20% of customers generate 80% of revenues

- Develop tailored contact strategies

- Revisit receivables discounting solutions

- Revue end to end AR processes and re-document – focus in particular on:

- Escalation procedures to senior management

- Write-off timing and processes

- Frequency of invoicing

- Contact strategies

- Ensure that Sales and AR teams work together to maximise collections

- Implement automated cash allocation tools to focus on high risk customers.

This Checklist shows that Total WCM spans the enterprise. Optimising and balancing the demands on cash as a scarce enterprise resource and applied at a local level, is what really produces savings.

Like this item? Get our Weekly Update newsletter. Subscribe today