Instant Payments de-mystified – part 1

by Christof Hofmann, Global Head of Payments and Collections, Deutsche Bank

A revolution in the global payments landscape is underway – spearheaded by Instant Payments. This immediate and transparent means of exchanging cash has the potential to replace all legacy payments methods currently used for domestic payments – such as domestic wires, debit and credit cards, and automated clearing house (ACH) payments (including direct debits).

Described by the European Central Bank (ECB) as “the new normal” in payments, Instant Payments could soon become one of the most important payment types in the world. For corporate treasurers, it has the potential to completely reform the way daily operations are conducted.

The development of payment systems

In order to fully appreciate the impact of Instant Payments, we need to first understand the limitations of traditional payment mechanisms when applied to modern use-cases.

Domestic wire payments

Introduced in the early 1870s, domestic wire payments were able to transfer money over the local telegraph network, facilitating safer and faster non-cash payments between distant transacting parties.

Today, domestic wire payments are typically settled using Real Time Gross Settlement (RTGS) systems and can be executed within minutes if the transaction is made during working hours. This payment method is chosen when same day execution and absolute settlement certainty is essential.

Due to the higher transaction fees associated with domestic wire payments, they are predominantly used for higher amounts in a business to business (B2B) environment.

ACH payments

By the 1960s, ACH payments had arrived. Designed to offer automated and straight-through processing (STP) cashless payments at a larger scale, ACH promised to supersede cheque payments.

Generally, ACH payment schemes work in so-called “clearing cycles” – transactions and the subsequent claims are aggregated and netted by the clearing, and settled at certain times during the working day. After, settlement banks make the money available to their clients.

However, the speed at which settlement occurs can vary. In some countries, settlement takes place throughout the day; in others, it can take up to three working days. As such, transferring small amounts of cash at short notice is not possible – at least not after working hours, on weekends or bank holidays.

Of course, this process is too slow for the modern customer, who demands the immediate delivery of goods and services. Before the introduction of Instant Payments, merchants would look to meet this demand by offering payment via direct debits or credit cards – a less-than-ideal solution, putting the merchant at risk of rejection and non-delivery of payment.

Credit card transactions

Widely accepted as a means of payment since the 1950s, credit card transactions seek to avoid this risk – providing merchants with immediate confirmation that they will receive the funds due. What’s more, credit card transactions give the customer a near real-time experience.

However, for the merchant, guarantee of payment can only be secured with a fee – one that is often associated with a delayed receipt of funds.

Instant Payments

By offering lower costs for merchants and consumers, and delivering funds between currents accounts in seconds, Instant Payments are the next step in the evolution of cashless, domestic payments.

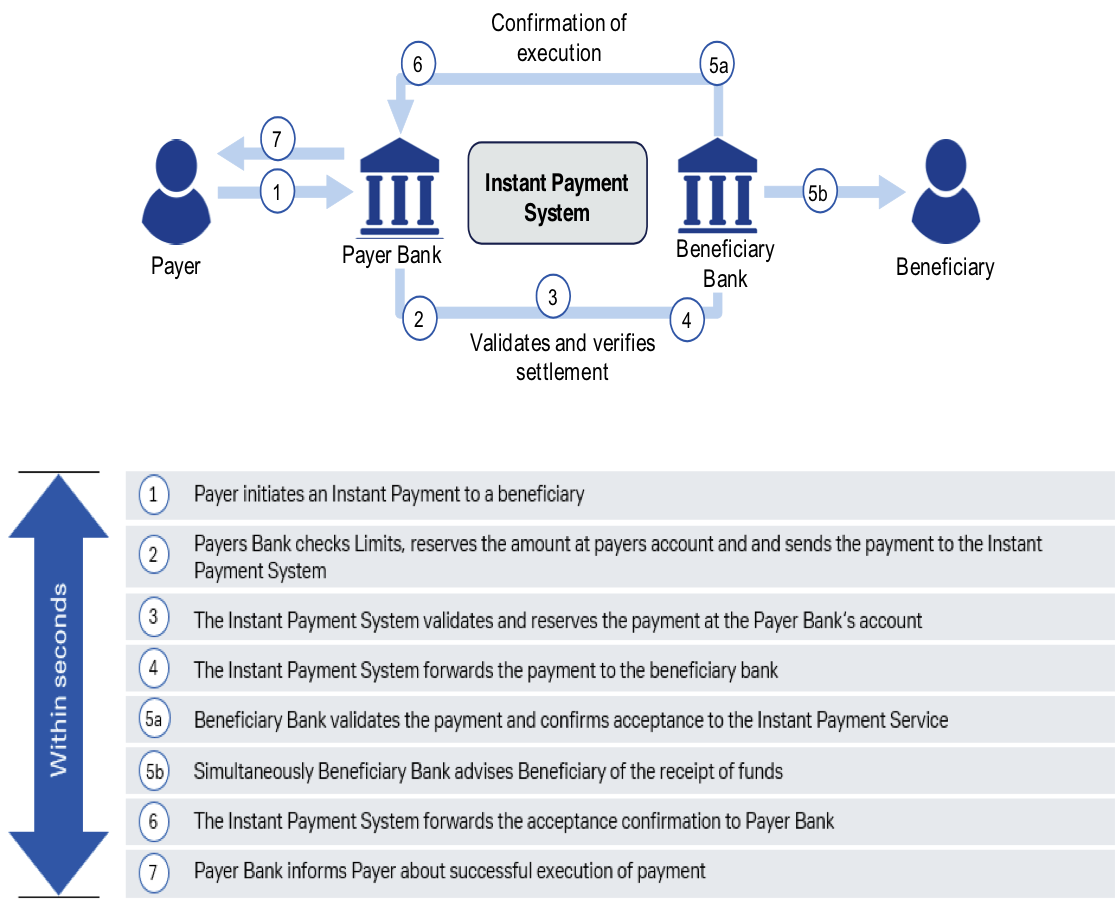

So, how do Instant Payments do this? First, in order to exchange payments in near real-time, 24/7, 365 days a year, dedicated market infrastructures have to be in place. Since transactions are executed within seconds – and made immediately available to the beneficiary – banks need to ensure all required process steps, such as fraud-checks, sanction-screenings and bookings, are done instantly. Finally, to be able to initiate or receive an Instant Payment, the account maintaining banks need to be a participant in the same Instant Payment clearing system. Typically, every participant bank is required to have balances on their account (pre-funding). For more on the Instant Payment clearing mechanism, see the diagram below:

Source & Copyright©2019 - Deutsche Bank

Meeting the needs of individuals and corporates

Instant Payments have the potential to revolutionise the payments world by successfully meeting the demands of both private consumers and corporates.

Addressing the “always on” demand, Instant Payments can be executed by individuals with ease, and around the clock, via online banking applications. Moreover, by providing merchants with information on incoming payments in real-time, they can in turn release ordered goods or services instantly – decreasing the time between an order and its delivery.

With the integration of payments initiation and APIs, Instant Payments systems could become invaluable to numerous Internet of Things (IoT) scenarios – for example, executing: toll payments, parking fees, car insurance instalments, and so on.

For corporates, Instant Payments similarly meet the need for speed, allowing payments to be integrated deeper into their processing and value chains and enabling corporates to instantly react to client behaviour.

Naturally, Instant Payment systems can also improve treasury processes. By sending payments in near real-time, treasurers can enhance working capital – allowing for cost reductions and precise funding allocations.

What does the future hold?

While many end-users are already reaping the benefits of Instant Payment systems, further promising developments are on the horizon.

Brand new schemes and clearing mechanisms are being launched in a number of countries and are starting to gain traction. With further advances – such as request to pay, push payments, instant direct debits and point of sale solutions – Instant Payments may well revolutionise business processes as we know them today and become the most favoured payments method for both corporates and private consumers.

Covering all of this potential in just one article is simply not possible. So, in further articles in this series, we will look at different features of Instant Payments, the role of APIs in ERP/TMS systems and the readiness for broad corporate usage in the SEPA area. Stay tuned!

Like this item? Get our Weekly Update newsletter. Subscribe today

Wonder if there is a distinction in their use of the term “Instant Payments” rather than Real Time Payments ?