Instant Payments demystified - part 2: What can we learn from UPI in India?

by Hartmut Bremer, Global Head, Instant Payments, Deutsche Bank

When people think of instant payments, they think of immediate credit transfers – typically focused on consumer-to-consumer (C2C) payments. But the implementation of these schemes is just the beginning. Going forward, instant payments are set to expand to incorporate business-to-consumer (B2C) and business-to-business (B2B) transactions, as well as incorporating API connectivity – creating a much more sophisticated ecosystem.

A prime example of this is India’s Unified Payments Interface (UPI), which has taken a previously cash-dominated economy rapidly into the embrace of instant payments. This kind of leading example can act as a guide – even a provisional roadmap – for further development in other markets while stimulating the appetite for further innovation.

Insights from India

India has historically been a cash-intensive economy – with a cash-to-GDP ratio of over 12%. Various estimates indicate that even until 2015 95% of consumer transactions and 65% of the total payment value in India were carried out in cash. This compares with 40-50% of consumer transactions and 10-20% of the total payment value for advanced economies. However, with rising mobile and internet penetration, evolving technology, the entry of new players in the payments ecosystem, and initiatives taken by the Government of India and the Reserve Bank of India (RBI), India’s payments landscape is undergoing a revolutionary transformation.

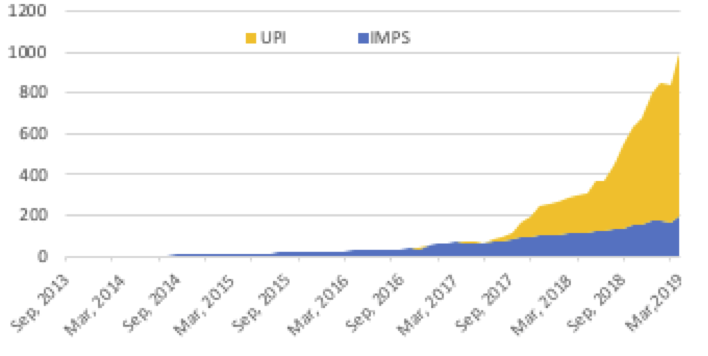

In 2010, following the launch of IMPS (Immediate Payments Service), India embarked on its innovative payments journey. The IMPS provides an instant, 24/7, interbank electronic fund transfer service that can be accessed through multiple channels – including mobile, internet, ATM, SMS, branch and Unstructured Supplementary Service Data (USSD). As of March 2019, 498 banks have gone live on IMPS, processing approximately 190 million transactions each month (totalling €22bn).

A further boost to India’s payments ecosystem came in April 2016. RBI, the Indian banking regulator, and the National Payments Corporation of India (NPCI) launched the Unified Payments Interface (UPI), a platform that facilitates instant 24/7 low-value payments and collections through a standard set of application programming interfaces (APIs). UPI has several advanced capabilities over IMPS, including the architecture to operate multiple bank accounts through a third-party Payment Service Provider (PSP) mobile application, support for virtual payment addresses, instant collection requests, biometric authentication, and extensive merchant payment options including QR and NFC intent-based mechanisms. Since 2017, the platform has grown by 10,000% – with 142 banks now live on UPI (as of March 2019), processing approximately 800 million transactions each month (totalling €17bn).

The uptake extends beyond simple C2C payments. An instant 24x7 payment service would significantly augment their services and product offerings to provide them with a high level of competitive advantage in terms of customer experience and efficiencies.

What we can learn from UPI?

UPI’s rapid rise is a testament to the fact that initiating instant credit transfers is just the beginning. Assuming that credit transfers will prove a stimulus for more innovation in other domestic instant payment services, India’s example can provide an insight into where less mature instant payment schemes are headed.

The following features are currently available in India, and could anticipate the “next steps” for other markets:

- Instant collections offerings, in various forms and shapes. For example “Request to Pay” or “Instant Direct Debit”

- Payment initiation to a beneficiary identified by

- Account + IFSC, which would be equivalent to the account number and sort code or IBAN

- Virtual payment address (e.g. – joe.bloggs@upi)

- Standard set of APIs across various Payment Service Providers (PSPs), allowing for interoperability of bank accounts through any of the UPI-enabled PSPs

- Support for UPI mandates to allow one-time direct-debit transactions with funds block. This will be comparable with an instant version of German point of sale (PoS) card transactions

- Support of Foreign Inward Remittance (domestic settlement leg) – inbound transactions from outside the country (also known as “one leg out” transactions)

- Merchant refund payments.

Mobile devices as the key catalyst

As smartphone penetration increases, we can expect that it will increasingly become the standard for doing business and performing financial transactions.

With this in mind, UPI has put a number of value propositions on its agenda:

- Simplifying authentication: UPI can ride on the biometric authentication of UIDAI (trusted third-party biometric authentication as a utility service)

- Simplifying issuance infrastructure: the virtual addresses in conjunction with your mobile device can be used as a "what you have" trust factor, which helps payment providers to create virtual token-less infrastructure

- Mobile as acquiring infrastructure: using a mobile phone as the primary device for payment authorisation completely transforms the acquiring infrastructure – making it simple, low-cost and universal

- Enabling one-click Two-Factor Authentication (2FA): UPI allows all transactions to be at least 2FA by using the mobile and a second factor (PIN or Biometrics) to make all transactions compliant with the existing regulatory guidelines

- End-user friendly: customers can make or receive payments with ease and security without sharing their banking credentials. The solution’s alerts and reminders, consolidation of multiple banking relationships via a single mobile app, and use of special purpose virtual addresses, all simplify the end-user experience, too.

- Flexibility for Payment Service Providers (PSPs): PSPs can build mobile apps with rich functionality using UPI

- Exponential innovation: UPI offers APIs that are minimalistic, fully functional, and allow innovations in the user interface, convenience features, authentication schemes and mobile devices to be brought in without having to change the core API structure.

For the Indian market, these steps will likely comprise the foundation of an unprecedented increase in real-time payments. For instance, if UPI functionality can combine with a high transaction limit, such as the UK’s £250,000 cap (soon to be raised to £1m), instant payments could usurp traditional payment instruments. But there is still a long way to go. In the meantime, banks must continue to increase their capabilities to serve their customers.

In the next article, we will provide more information on what functionality corporate clients should expect from their banks on their migration journey from traditional payment instruments to more interactive payment processing using instant payments. Stay tuned!

(For the first article in this series, click here.)

Like this item? Get our Weekly Update newsletter. Subscribe today