Is maintaining working capital efficiency impossible?

by Jack Large

Informita have just published the results of their latest analysis of working capital management in the pharmaceutical industry which showed that excess working capital has risen 33% to €68 Billion since 2015. There has been steady increase since 2012 when it was ‘only’ €51 billion. Again the study showed that there is a large difference in performance across the sector which is shown by the difference in working capital to sales performance:

- 27% lower quartile

- 22% median

- 19% upper quartile.

Of the 32 corporations surveyed only two have made an improvement in all three areas - receivables, payables and inventories - of working capital management.

Receivables

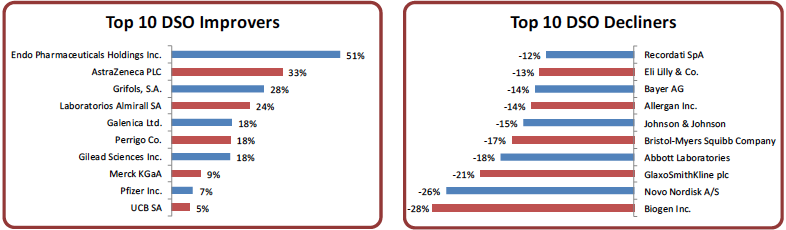

The performance was very varied with the DSO ranging from 73 days in the lower quartile to 54 days in the upper quartile. Of the 32 companies in the survey there were 14 improvers and 18 decliners:

Source & Copyright©2018 - Informita

Payables

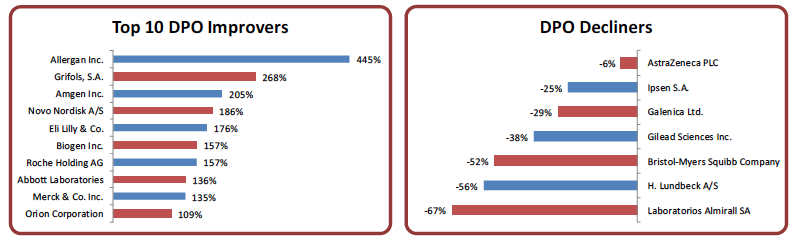

Informita found that payables has been the one area of working capital where there have been continued and steady improvements up to our last survey in 2016. In the last 2 years there has been a dramatic 78% improvement in payables balances with upper quartile DPO jumped 88 days, the lower quartile has increased by 48 days and median DPO has risen by 64 days.

Of the 32 companies in the survey there were 26 improvers and only 7 decliners. Of those 7, 3 were also decliners in the last survey in 2016:

Source & Copyright©2018 - Informita

Inventories - supply chain success

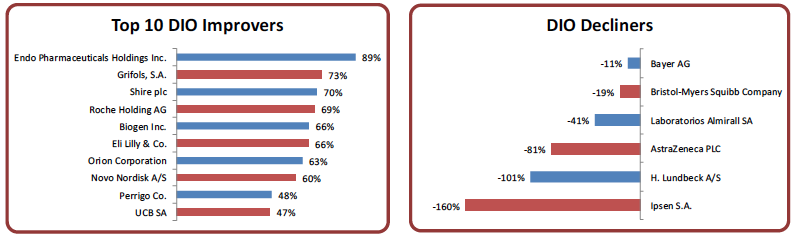

Inventory levels have dropped by a massive 24%. Upper quartile DIO (Days Inventory Outstanding) has dropped by 58 days, lower quartile DIO by 69 days and the median DIO by 61 days. Informita comment, “It looks as if supply chain professionals across the industry have been working hard to introduce supply chain efficiencies that have resulted in reduced levels of inventory.”

Of the 32 corporations in the peer group, 26 were improvers and only 6 were decliners. Of the 6 decliners, 2 were also decliners in the last survey:

Source & Copyright©2018 - Informita

Conclusions

Informita report finishes with, “What is deeply troubling is that many of those companies that have spent large amounts on external help tend to see improvement for a couple of years and then it all slips back to where it was before any change effort was made.” The other major concern raised by this report is that bad working capital performance seems to be endemic in some pharma companies.

CTMfile take: In WCM: truly changing poor working capital management practices is difficult, and then keeping up these best practices is even more difficult.

Like this item? Get our Weekly Update newsletter. Subscribe today