Liquidity planning and cash flow forecasting the Reval way

by Kylene Casanova

The first step in liquidity management is determining cash availability- visibility of ALL cash balances world-wide + the inflows and the outgoings: the cash flow forecast. Liquidity planning is all about process and best practice, particularly in cash flow forecasting.

Typical problems in companies' cash flow forecasting include overcoming large deviations between actual cash flow and forecasts, unreliable and inaccurate Excel forecasts; inefficient processes in which chasing missing data and errors leave little time for analysis. Most companies want to centralise cash optimisation combined with a decentralised forecasting process covering the whole enterprise. Other requirements include using a 12-18 month rolling forecast with at least monthly intervals, and currency specific forecasts that are aligned to the company's management and legal structure.

Cash flow forecasting process

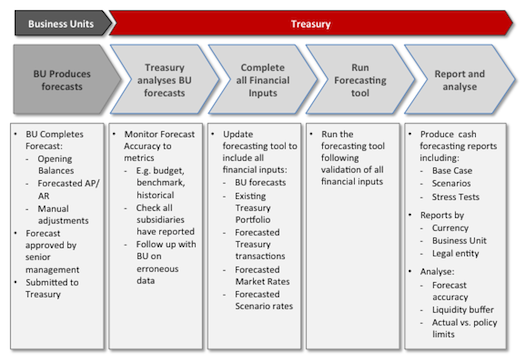

The objective is to provide both ease of forecast collection and ease evaluation that is better than the main competitor, the Excel spreadsheet. Reval's cash flow forecasting process covers all the processes in the business units and in treasury, see figure.

Cash flow forecasting processes

Source & Copyright©2013 - Reval

Set up, data consolidation and aggregation

Setting up a company on the Reval cash forecasting module takes 1-3 months depending upon the scale and complexity of the company. This includes specifying the forecasting template set up, identifying the business units/subsidiaries to be included, the appropriate individuals to generate the forecasts and what they have to do, and how the system will broadcast the cash flow forecast variance/performance results. Some companies also review how they will reward staff for making accurate cash flow forecasts.

Reval's Treasury and Risk Management Liquidity and Cash Flow Forecasting module consolidates and aggregates:

- plan data from across the group

- market data - FX rates, etc.

- manual forecasts data from head office and business units

- bank statement data from all the group's banks world-wide.

Managing the forecasting process and simulations

The Reval cash flow forecasting module provides: company wide cut-offs for locking the forecast so it cannot be changed; the ability to drill down into all data behind the forecast; automated comparison of forecasts and actuals in absolute or % terms.

There is also the functionality to carryout 'what-if' simulations of the impact on the forecast, e.g. delay in accounts receivables, impact of a specific project, changes to FX rates, the increase the rate of insolvency/counter-party risk, and the impact of changes in credit ratings. Reval has found that their simulation functionality is not widely employed, use varies by industry, and most simulation modelling is carried out in the USA.

Benefits

Reval has found that the main benefits of their cash flow forecasting module is an improvement in the whole Cash Flow Forecasting process - the standardising of systems and procedures world-wide makes data collection and aggregation much easier, more accurate forecasts, and freeing up time to carryout cash flow analysis (often for the first time). Corporates also like how the process is auditable (the system records the source of the data and when input). It enables companies to manage exposures against policy, improves investing/borrowing decisions, easier subsidiary facility monitoring, and better FX exposure management.

The enterprise wide and increasingly effective comprehensive cash flow forecasting solutions from the Treasury Management System suppliers seem to be taking over cash flow forecasting in corporations. Does your TMS and its cash flow forecasting module give you more control of the financial flows within the company. If not, why not? Accurate cash flow forecasting is critical for effective liquidity management and investing/borrowing decisions.

Like this item? Get our Weekly Update newsletter. Subscribe today