New payments tech on track to surpass cash usage globally

by Bija Knowles

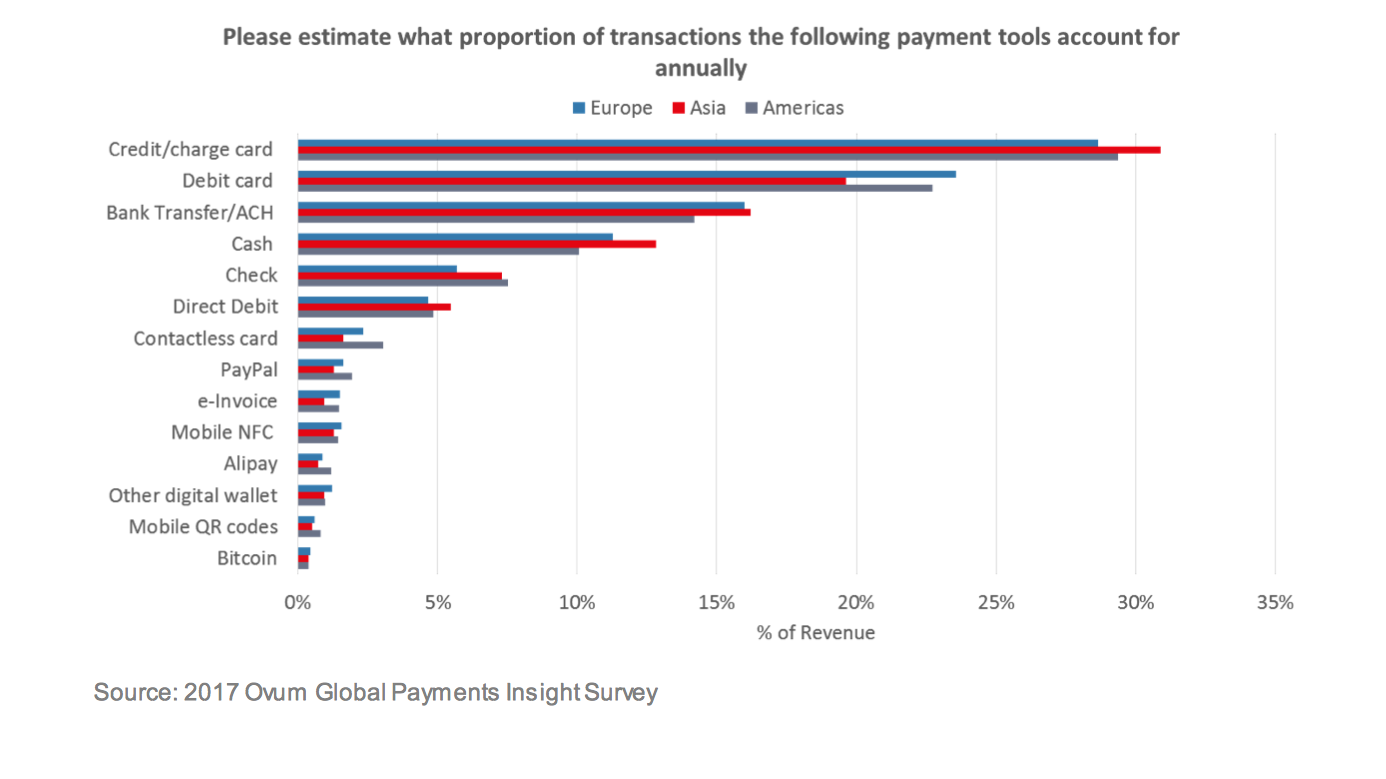

Traditional methods still dominate payments received by merchants and retailers but new payment technologies are gaining popularity, according to the 2017 Global Payments Insight Survey: Merchants and Retailers, by Ovum and ACT Worldwide. Debit and credit cards remain the most widely used payment instruments for retail/merchant transactions (along with other traditional methods including bank transfer, cash and cheque). Debit and credit cards alone account for roughly half of all merchant and retail transactions.

Interestingly, the survey shows that new and alternative payment methods account for 10 per cent of transactions globally – see Ovum's graph below. These methods include PayPal, e-invoicing, NFC or QR codes on mobile devices, Alipay, digital wallets and bitcoin. Together, these new payment technologies are almost as popular as cash – and in the Americas, new payment tech has actually surpassed cash usage (new payments methods account for 11 per cent of retail/merchant payments, compared to cash usage at 10 per cent).

Ovum's survey report says: “It is unlikely that any single tool will supplant cards anytime soon, but the payments mix is becoming more complicated. Merchants and retailers require traditional payments tools, however they also increasingly need the flexibility and capability to accept a growing variety of new payment methods.”

Some of the key findings from the survey include:

Some of the key findings from the survey include:

- new and alternative payment tools now account for 10 per cent of global merchant transactions;

- 83 per cent of merchants say they need help in reducing the cost of processing payments;

- and 82 per cent say that new payment technologies will bring business benefits;

- 89 per cent of merchants expect an enhanced customer experience when they invest in their payments capabilities;

- despite the focus on the customer experience, 82 per cent of merchants hold back on investment due to security concerns;

- 84 per cent of US merchants report EMV has lowered their fraud costs; and

- while 52 per cent of merchants say their CNP losses are growing, 70 per cent say they are satisfied with their CNP fraud prevention tools.

4 strategies for modern payments infrastructure

The survey report also made the following recommendations for merchants and retailers to prepare and respond to the changes in payments technology and usage:

- Don't rely on legacy infrastructure – payments technology is developing too quickly and updating your payments infrastructure is an ongoing process.

- Use payment partners to develop payments capabilities.

- Having an omni-channel offering is key to remaining competitive and improving the customer experience.

- CNP (card not present) fraud is still a major problem so focus on your security strategy is paramount.

Like this item? Get our Weekly Update newsletter. Subscribe today