Payables automation drivers

by Jack Large

Tipalti have been providing payables automation services since 2010 and have focused on enabling companies to scale their payment remittance operations globally and at the same time use best practices and improve compliance with local taxes and requirements.

The Tipalti platform automates 26,000 rules across the payment remittance processes of hundreds of thousands of payees. It is no good sending a supplier a payment if they have not correctly completed the tax identification form. Tipalti collects these when on-boarding new suppliers, i.e. making the payment is only part of automating the “partner payment process.”

Tipalti services

Tipalti offers a full automated payment process from:

- streamlined invoice management and bill processing

- PO matching service

- early payment is integrated into Tipalti’s accounts payable process, the effort to set up supply-chain finance is eliminated

- global mass payment capability for paying thousands of suppliers in a matter of clicks

- supplier management with a best-in-class, web-based onboarding experience

- FATCA and VAT compliance: solve the complex, highly-manual process of collecting tax information for accounts payable

- instant payment reconciliation

- Detect™ Risk module to proactively prevent fraud with detailed payee monitoring.

No wonder that Tipalti claim to cut payables costs by 80% with their fully automated payables process.

Recent payables automation research

Earlier this year, Tipalti commissioned Gatepoint Research to carryout a survey into Strategies in Accounts Payable with 100 USA based finance and accounts payable executives. The main findings were:

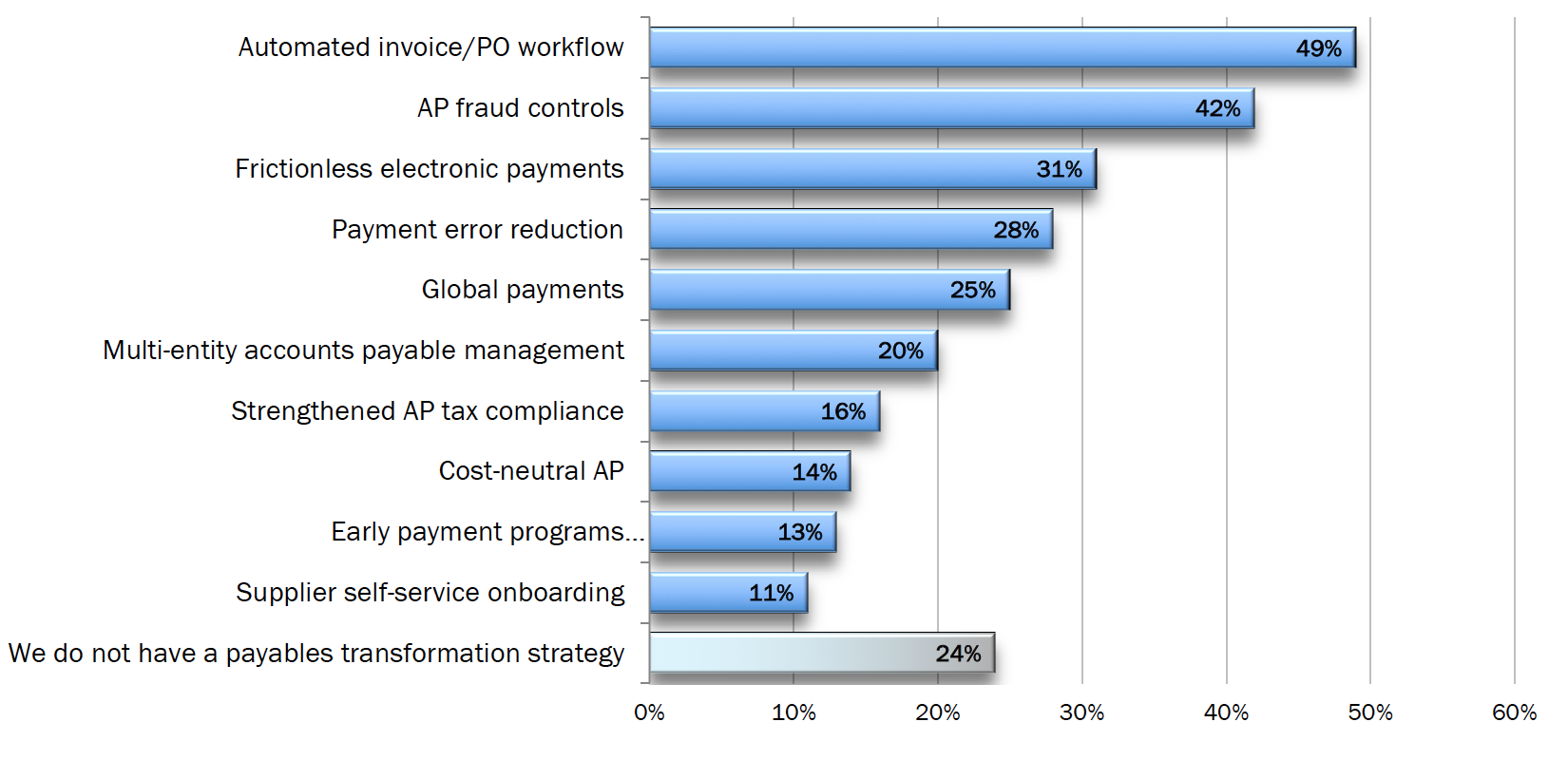

- Which of these initiatives is part of your organization's payables transformation strategy?

- Source & Copyright©2018 - Gatepoint Research

- Companies were really keen to retain their payees by providing first class payables services

- 31% of organizations surveyed make less than 1% of their payments to international payees. 20% make over 10% of their payments internationally

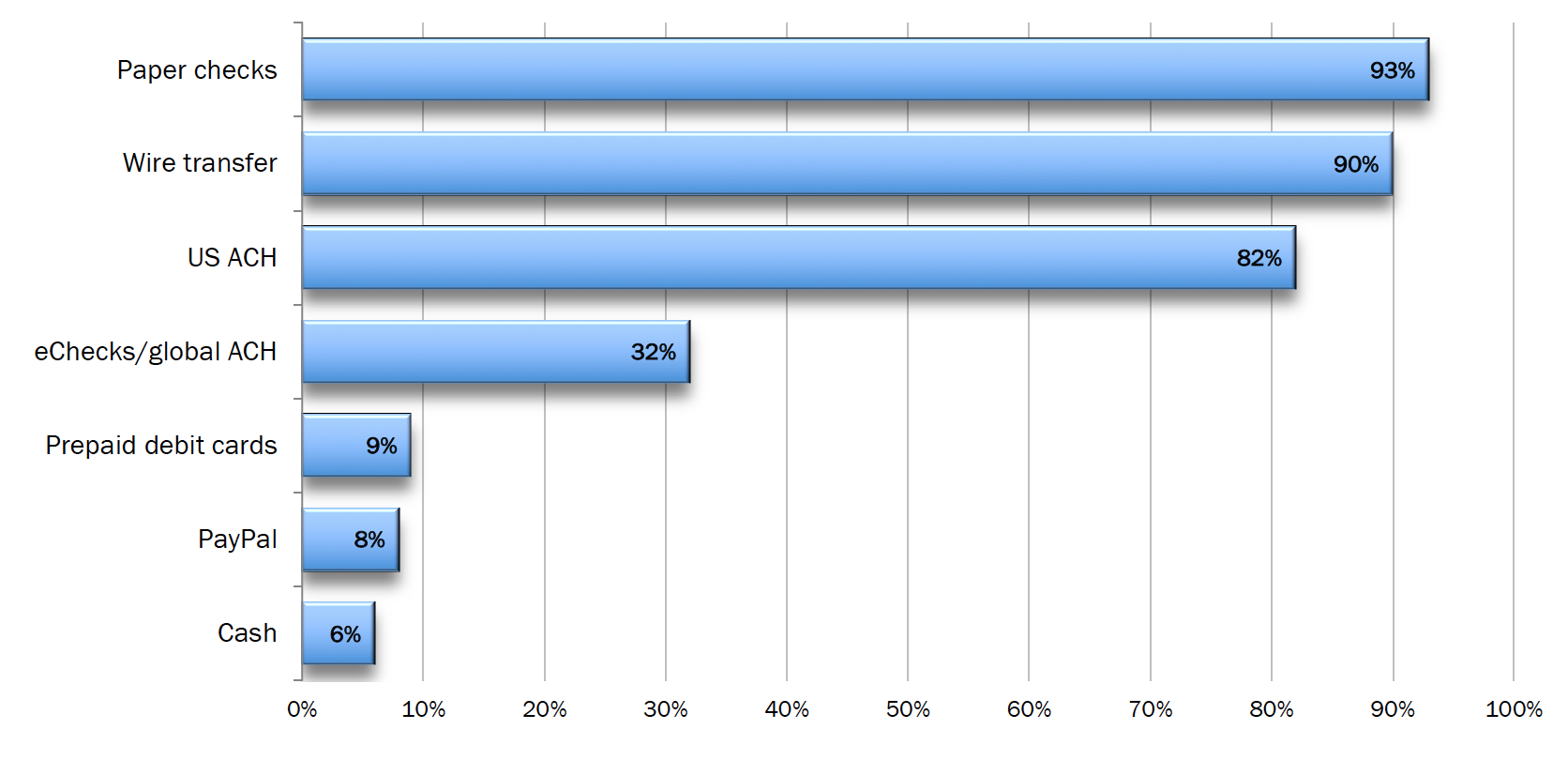

- Forms of payment used

- Source & Copyright©2018 - Gatepoint Research

- Only 10% of those surveyed can automatically validate whether suppliers have submitted error-free tax forms. 30% do not even bother to validate forms

- Despite the risk of possibly paying recognized (and blocked) individuals or organizations, 60% of respondents admit they do not check OFAC/SDN lists before making supplier payments.

CTMfile take: No wonder use of Tipalti’s payables automation services is growing so fast.

Like this item? Get our Weekly Update newsletter. Subscribe today