Seven key insights into growth corporates and their working capital needs

by Pushpendra Mehta, Executive Writer, CTMfile

Most banks tend to classify growth corporates or middle market companies as businesses generating between US $50 million and $1 billion in annual revenue, as per the 2023-2024 edition of the Growth Corporates Working Capital Index, a Visa report done in collaboration with PYMNTS Intelligence.

The report offers insights into the business conditions and working capital solutions of 873 chief financial officers (CFOs) and treasurers of fast-scaling companies across five industry segments and five global regions (North America, Europe, the Asia Pacific, Latin America and the Caribbean, and Central Europe, the Middle East and Africa).

The working capital solutions comprise eight financing options that growth corporates use to access external capital. These options encompass working capital loan, corporate overdraft, bank line of credit, corporate/virtual credit card, third-party revolving credit facility, letter of credit and bank guarantee, draw against unused corporate credit line, and invoice financing and factoring.

The report delves deeper to offer seven crucial observations about growth corporations and their working capital requirements. Here are the seven insights:

Top performing growth companies are supplier-centric

According to the report, “The most efficient Growth Corporates have annual sales between $50 million and $250 million, are more prevalent in the marketplace sector, Latin America, the Caribbean (LAC region) and utilize virtual credit cards and working capital loans to support strategic business needs.”

For top performing growth corporates, operational efficiency is paramount. This enables them to save, on average, $3.3 million annually by leveraging working capital solutions in strategic and supplier-centric ways. These savings cover reduced interest and late fees, lower internal processing costs, and increased discounts from suppliers for early payments.

Growth corporates use working capital solutions to fund strategic growth

Growth corporates utilised working capital solutions for strategic and tactical reasons.

“Two-thirds of Growth Corporate CFOs who accessed external working capital in the last 12 months did so for strategic purposes: to cover planned cash flow gaps related to predictable business cycles or to invest in business growth, including funding systems upgrades, buying inventory at discounted prices and making investments”, the Visa report noted.

By adopting this approach, these companies achieved a higher level of operational efficiency compared to those firms that used working capital as a tactical solution to address emergencies and unexpected opportunities. On average, this translated to a 33% higher probability of improving days payable outstanding (DPO).

Strikingly, strategic users of external working capital were predominantly found in Europe and the agriculture sector, demonstrating a preference for tapping into unused corporate credit lines and securing working capital loans as required.

Access and availability influence working capital selection

CFOs and treasurers in growth corporations often employ working capital solutions that are readily available, rather than opting for what’s truly optimal.

The gap between the relevance and utilization of working capital solutions underscores the need for a more diverse and accessible portfolio of financing options that align with the capital needs of growth corporates.

Source: PYMNTS Intelligence Growth Corporates Working Capital Index, September 2023

Finance chiefs at such companies rely on working capital loans, bank lines of credit, and corporate overdrafts, even as top index performers indicate a reduced reliance on these financing options in the coming year, with a mere 14% of those inclined towards working capital loans and 15% of those leaning towards overdrafts as their preferred solutions falling into the category of top performers.

Furthermore, marketplace firms set themselves apart through their adoption of third-party revolving credit facility solutions, a trend primarily observed in North America, driven by their specific business requirements. Additionally, CFOs in both the marketplace and agriculture sectors are planning to triple their usage of virtual cards next year.

Mindsets and market readiness impede use of working capital solutions

“Perceptions of working capital use, emerging markets and sector-specific conditions impede working capital access for 30% of growth corporates”, the report added.

Out of the firms included in the study, three in ten chose not to make use of any external working capital resources over the past 12 months. These companies were predominantly located in Central Europe, the Middle East and Africa (CEMEA) and North American regions, with a notable presence in the healthcare/medical industry.

Interestingly, 70% percent of the finance leaders in these companies refrained from seeking external capital, citing a lack of necessity and viewing the use of working capital as a sign of an inefficiently run business. It is also possible that this reluctance to tap into external funding was influenced by the volatile global macroeconomic environment over the last year, as well as pressure from CEO and boards to manage their organization’s finances without outside capital assistance.

Economic optimism prompt CFOs to increase usage of working capital solutions in 2024

In the forthcoming year, an overwhelming 92% of growth corporate CFOs intend to increase their utilisation of working capital solutions, representing a significant 30% increase in the usage of these solutions, as per the report.

Growth corporate CFOs are shrugging off recession fears and appear less concerned about supply chain disruptions than in years past. They also foresee credit easing and improved business conditions, including improvements to both their days sales outstanding (DSO) and DPO for next year.

With economic optimism on the rise, finance chiefs are planning to double the number of working capital solutions they intend to employ. The most substantial growth is projected to occur in sectors and regions that had limited or no prior utilisation of such solutions in the previous year, particularly expected with companies in CEMEA and the healthcare/medical sector.

Growth corporates turn to bankers and fintechs for working capital advice

When seeking advice on working capital solutions, the average growth corporate firm selects such advisors based on accessibility. This is likely why the average growth corporate CFO turns to bankers in developed economies and fintechs in emerging markets for their working capital solutions and advisory needs.

Source: PYMNTS Intelligence Growth Corporates Working Capital Index, September 2023

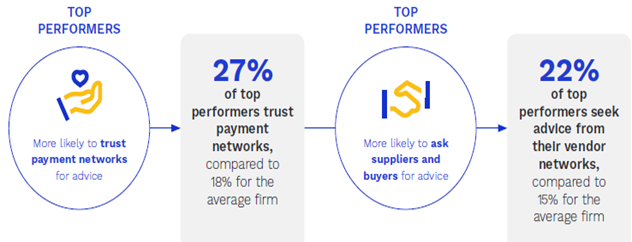

In contrast, the top performing growth corporates seek advice from “A diverse group of advisers, including payment networks, their supplier networks and FinTechs. The operational efficiencies gained from using a mix of working capital solutions also gives them more of an ability to explore nontraditional sources of advice and relevant options”, the report stated.

Virtual cards emerging as the all-purpose working capital solution for growth corporates

Virtual cards are regarded as the most versatile working capital option by over two-thirds of growth corporate CFOs.

Despite nearly half of the growth corporates refraining from using commercial cards last year due to cost considerations, these companies are looking to triple their utilisation of this working capital financing solution for both strategic and tactical purposes. In particular, growth corporates consider virtual cards suitable for funding growth-driven initiatives and bridging cash flow gaps as they arise.

More importantly, those who made use of them as a working capital solution in the prior year demonstrate the highest potential for improving operational efficiency in 2024. In fact, the report suggests that “CFOs who use virtual cards as a working capital option are strongly correlated to higher buyer–supplier payment integration.”

“This is especially true for fleet and fuel cards, which are essential for managing fleet operations, offering centralized payment systems that streamline fuel and maintenance expenses, transaction tracking and driver spending monitoring”, the report further added.

Conclusion

Middle market companies are expected to drive the digital economy forward, and understanding their unique needs and capabilities will help finance and treasury professionals leverage the right working capital solutions to enhance operational efficiency, boost liquidity, and grow their business.

Specifically, the 2023-2024 edition of the Growth Corporates Working Capital Index, provides valuable insights into the attributes of top performing fast-scaling companies around the globe that are more likely to have used external working capital solutions for strategic purposes, have lower DPOs, superior buyer-supplier payment integration, and shorter cash conversion cycles that increase investor confidence and fuel steady growth.

Like this item? Get our Weekly Update newsletter. Subscribe today