Surviving and managing the new corporate banking

by Kylene Casanova

Celent - a research, advisory, and consulting firm focused on financial services technology - believe that, “The mantra of corporate banks is easier and faster: easier and faster to do business with them (e.g., customer onboarding, self-service, digitization of manual processes) and easier and faster to innovate and harness emerging technology.” Their latest report by Alenka Grealish, a Senior Analyst with Celent’s Banking practice explains why they have come to this conclusion.

Top Trends in Corporate Banking: From Disruption to Transformation

Grealish’s report, see, explains they see that transformation is occurring in three overarching areas: integration of corporate banking tech infrastructure, digitization of customer journeys, and open banking and partnerships.

The questions

The report answers the following questions:

- What are the digital and omni-channel trends impacting corporate banking?

- What are the emerging technologies that bankers should pay attention to?

- How can bankers modernize and develop new ecosystems?

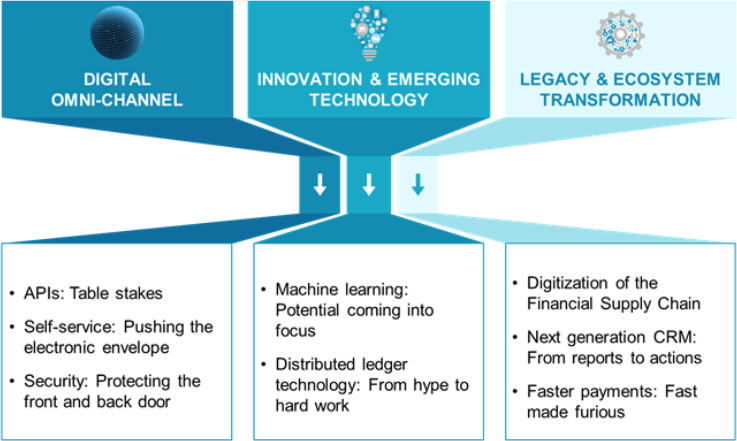

Top trends 2017-18:

Source & Copyright©2017 - Celent

Celent believe that banks are opening their minds to selective coopetition and cannibalization. They see five critical trends (CTMfile’s questions for corporates in brackets):

- APIs are becoming table stakes (How can corporate treasury departments manage these?)

- self-service improvements are paramount to differentiation (Corporate treasury departments need to tell their banks what self service processes make a difference and save time because many don’t they just save the bank time)

- security fortifications include biometrics and advisory services (Which should corporate treasury departments accept and what they won’t?)

- machine learning applications are becoming viable, and distributed ledger technology is entering the “hard work” period. (Do you have a clear idea of what you want here?)

Future development

Grealish couldn’t resist giving banks advice (that is what Celenet do and why they want the banks to purchase this report). She believes that bankers should:

- "embrace select aspects of a ‘Day 1’ culture: be data-driven, challenge the status quo by continually revisiting strategy and tactics, and avoid sacred cows.”

- "break from the traditional view of products/services as a walled garden and develop an open banking strategy in which the bank partners with third parties to manufacture and/or distribute better products and services and embed themselves into customer workflows.”

CTMfile take: Banks are going to survive, but corporate banking is going to be very different. What do corporate treasury departments want and what don’t you want?

Like this item? Get our Weekly Update newsletter. Subscribe today