Sustainability programmes make commercial sense even for major emitters

by Jack Large

Global 250 Greenhouse Gas Emitters: A New Business Logic report from Thomson Reuters presents the latest greenhouse gas (GHG) emissions data from the world’s 250 largest publicly traded emitters. This report looks at best practices across the economy and aims to demonstrate the relationships between decarbonization and long-term financial performance. This information is critical to investors and policymakers, alongside the demands for increased transparency and accurate and comparable performance metrics.

Global 250 will determine the fate of efforts to address climate change

The Global 250 is a group of businesses in the oil, gas, utility, automotive, aircraft, manufacturing, steel, mining and cement sectors. Key finding from the new report are that:

- This small group of companies are responsible for 1/3 of global annual emissions (including their value chains) and will help determine the fate of efforts to address climate change

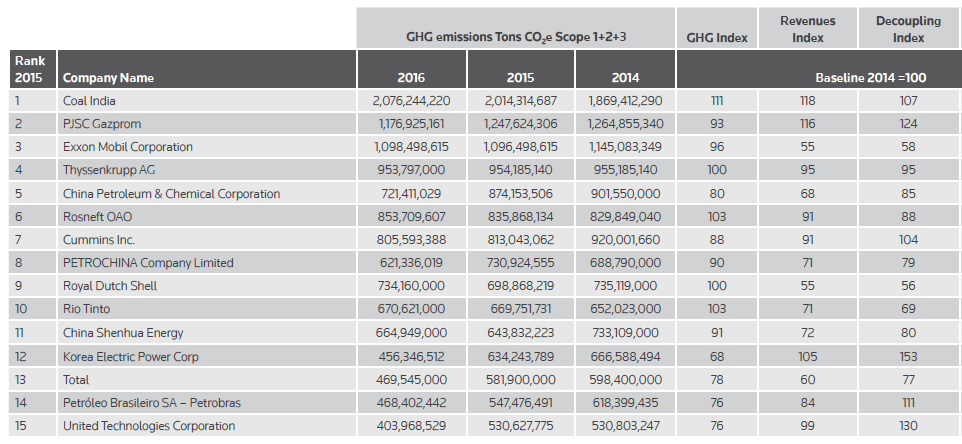

- Of concern is that in the 15 largest companies, some have got worst or made not progress since 2014

- Source & Copyright©2017 - Thomson Reuters

- Comparing the relationship between multiyear decarbonization trajectories and a broad set of financial performance metrics, there is no evidence of a trade-off between financial and environmental performance among the G250

- Only 20% of the G250 have strategies in place to drive business transformations necessary to reduce their climate impacts

- A meaningful number of that 20% are demonstrating that their transformation strategies create real business value through cost structure improvements and new revenue growth opportunities, as well as risk mitigation.

David Craig, President Financial and Risk, at Thomson Reuters, commented, “Firms that are transitioning to lower carbon business models are building competitive advantage and reputational equity for the long-term. Sustainability considerations in corporate strategic planning will be increasingly important to global economic prosperity and increasingly important to investors who are looking for this leadership.”

Investers

The report found that, “Increasingly, investors see the value creation potential from companies that are transparent on their emissions and offer product portfolios designed to compete in the emerging low-carbon economy. Investors themselves are also coming under increasing regulatory pressure to disclose the carbon footprint of their own portfolios.” Indeed, State Street Global Exchange’s Mark McDivitt, Managing Director, Head of ESG Solutions is quoted in the report. “For global financial players of all stripes, it’s time to answer the question “Are you in the game integrating climate impacts into investment strategies or are you still on the bench?”

AND Goldman Sachs’ recent report on the emerging lowcarbon economy, concluded that, “One-fourth of equities could be affected by (carbon impact reporting) 2025.”

Sustainability premium

The report contains a rigourous analysis of whether companies that introduce a sustainability programme have any benefit commercially in the market. Total - who have reduced their emmisions considerably since 2014 - have had programme to differentiate itself from other majors which is built on three strategic pillars:

- Reducing the carbon intensity of its fossil fuel product mix

- Investing judiciously in carbon capture, utilization and storage technologies

- Expanding their business base in “renewables,“ which includes production, storage and the distribution of clean energy and biofuels.

The report found that:

- Total has a peer-leading credit rating

- As it continues to extend its climate impact leadership with more renewable and low-carbon solutions, the increasing value of its transformed green product portfolio is likely to significantly outpace the potential declining value of its traditional high-carbon products.

This is the Sustainability Premium at work.

CTMfile take: This report has some good news, e.g. There is a real return from sustainability programmes, but the bad news is that only 20% of the G250 have strategies in place to drive business transformations necessary to reduce their climate impacts, and three of the top 15’s emmissions are getting worse. Much to be done.

Like this item? Get our Weekly Update newsletter. Subscribe today