SWIFT service bureau can do more than you expect

by Kylene Casanova

Traditionally SWIFT service bureau have focused on SWIFT connectivity services and access to local clearing systems. The next generation of service bureaux do so much more.

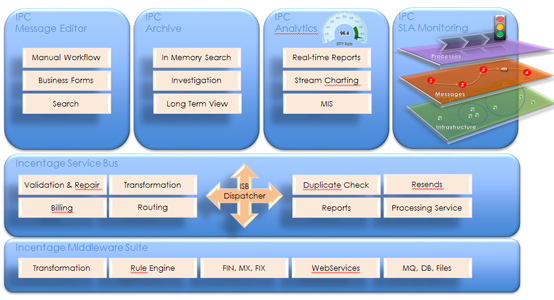

A good example is finexworks ServiceBureau which delivers a range of value added services via a layered architecture as well as the normal SWIFT and banking connectivity.

The foundation of the set of services is the SOA based messaging middleware layer and Service Bus from its strategic partner, the Swiss software house Incentage, see figure below:

Source & Copyright©2016 - finexworks.

Message transport and connectivity services

Finexwork provide a range of message transport and connectivity services based on the middleware platform see graphic above, including:

- Data transformation services based on a standard library, which supports various format such as SWIFT FIN / ISO 15022, XML / ISO 20022, UN/EDIFACT, SAP IDoc, UK Bacs, NACH, CH SIC, FIX, CSV

- Message tracking & real-time end-to-end monitoring of the whole payment process

- Operational dashboard and SLA monitoring

- Payment and message flow analytics, stream charting and real-time reporting

- Search and manual repair facilities

- Message Repository which enables users to search for specific payments and messages

- Analytics, reporting, data mining and extraction, transformation and visualization of payments, counter parties and message flows.

Range of value added services

finexworks provides a range of value added payment processing services, including:

- Compliance Suite - a comprehensive range of modules which include:

- Compliance Risk System - hazard analysis and assessment of the customer risk

- Monitoring & Detection System - money laundering and fraud combating.

- Transaction Controlling & Monitoring - payment systems monitoring for terrorist financing and embargo violations as well as customer base checking.

- Politically Exposed Person - checking the customer base for Politically Exposed Persons.

- Third Party Check - workflow-based evaluation of the compliance risk for third parties.

- Gifts & Entertainment Log - IT-supported application for a compliance with corporate-internal guidelines regarding gifts and events.

- Customer Due Diligence – compliance testing during the customer acceptance process

- Enterprise Case Management – support of the compliance business processes

- Correspondence Bank Monitoring – detection of suspicious transaction activities of correspondent banks connected to money laundering and terrorism financing

- Automated Customer Review – solution for on-going checking processes of customer relationships.

- Forex / MM confirmation matching module

- Cash reconciliation module

- Banking Services Billing module and reporting.

Customers and users

finexworks provides services to banks and to corporates both in Europe and worldwide. Corporate users include many major multi-national corporations in Europe and the USA.

CTMfile take: finexworks really is the next generation of SWIFT service bureau. They have given a whole new meaning as to what a SWIFT service bureau can support.

Like this item? Get our Weekly Update newsletter. Subscribe today