The operational challenges of AR automation

by Pushpendra Mehta, Executive Writer, CTMfile

“In the competitive arena of enterprise finance, accounts receivable (AR) automation is a game-changer — an engine for efficiency, speed and accuracy”, according to the survey report titled How Automations Reduce Receivables Delays, a PYMNTS and Corcentric collaboration.

The survey polled 100 CFOs from US-based firms across 13 industry segments generating US$250 million or more in annual revenues to assess the current state of specialised AR automation adoption and examine its effects on days sales outstanding (DSO) and operational efficiency.

“Companies using specialized digital software to automate more than 50% of AR workflows are reaping outsized rewards. These firms report a 32% reduction in DSO, on average — equivalent to 19 days”, observed the survey report.

Some of the key findings of the survey include the following:

Firms in highest revenue bracket stand at the forefront of AR automation

Organizations in the highest revenue bracket lead the way in AR automation. “Specifically, 37% of companies annually generating at least $1.5 billion in revenue reported automating more than 50% of their AR processes in the past six months, while just 17% of those in the $250 to $750 million revenue range” have done so, the PYMNTs report noted.

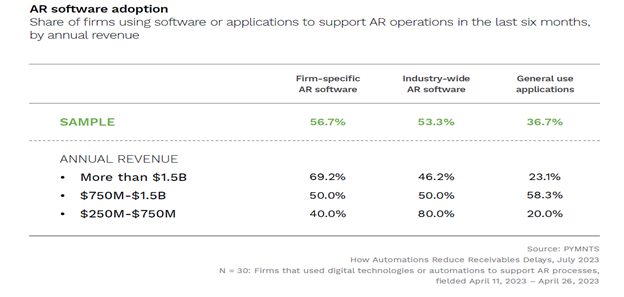

Larger firms are also more likely to employ customised AR software compared to their smaller counterparts. When considering companies that already use some form of specialised AR software, 69% of those generating over $1.5 billion in revenue opted for custom software, in contrast to 40% for smaller firms. Organizations with revenue between $750 million and $1.5 billion fall somewhere in the middle at 50%.

Furthermore, among companies that have used these applications to automate at least 50% of their AR workflows or processes, 93% indicate satisfaction with their outcomes.

Automated AR systems operating challenges: simple has become complex

The survey report highlights the benefits of embracing AR automation. This includes a reduction in the days of delay in payment and exceptions around payments, improved invoicing processing speeds and instant updates and tracking, reduced invoicing errors, and enhanced effectiveness and accuracy of AR operations. However, there are operational challenges associated with AR automation.

Although AR automation promises simplification, PYMNTS research findings indicate that complexity is the primary roadblock impeding progress in the realm of AR automation.

Given that a staggering 80% of CFOs state that automated AR workflows are overly complicated, greatly diminishing their effectiveness in reducing DSO, and an additional 78% of finance leaders highlight complexity as a prominent challenge when it comes to managing disputes and exceptions related to order quality and accuracy, these complexities at hand emphasise an essential demand for simplicity in AR automation. In essence, embracing the “keep it simple” approach is imperative to overcome the challenges posed by complexity.

Besides highlighting complexities, the survey report reveals that the lack of on-call advisory services in AR automation “fail to reduce payment friction.”

The study found that four out of five (80%) CFOs cited “The lack of on-call advisory as a significant drawback in the applications for AR systems they used, preventing them from reducing the firm’s DSO.”

The operational challenges continue beyond this point. “Forty percent said that not having an option for automated customer service is the top pain point standing in their way”, the survey explained.

Furthermore, “Many CFOs find that automated AR systems sometimes fail to function as expected. Two-thirds of CFOs attribute invoicing errors to AR tools not performing as intended, and 63% believe that difficulties in tracking invoices result from automation inconsistencies, all impacting efforts to improve AR.”

To conclude, AR automation offers real-time insights, speeds up cash flow, reduces operational costs, and improves accuracy in invoicing and payment processing, ultimately helping to streamline an organization’s financial operations and improve efficiency. However, AR automation also presents its fair share of challenges, primarily arising from the complexities of using this relatively new technology.

“To capitalize on the potential of AR automation while mitigating its challenges, CFOs must navigate the transition away from manual AR processes with a focus on ease of use and reliability, striking a balance that will enable firms to fully leverage the critical benefits of automating previously labor-intensive, error-prone human AR functions”, the PYMNTS survey recommends.

Like this item? Get our Weekly Update newsletter. Subscribe today