The US dollar’s dominance in global trade and finance is steadily declining

by Pushpendra Mehta, Executive Writer, CTMfile

The US dollar was officially crowned the world’s foremost reserve currency at the 1944 Bretton Woods conference. Since then, it has ruled the international monetary system and become the dominant currency for global trade and finance.

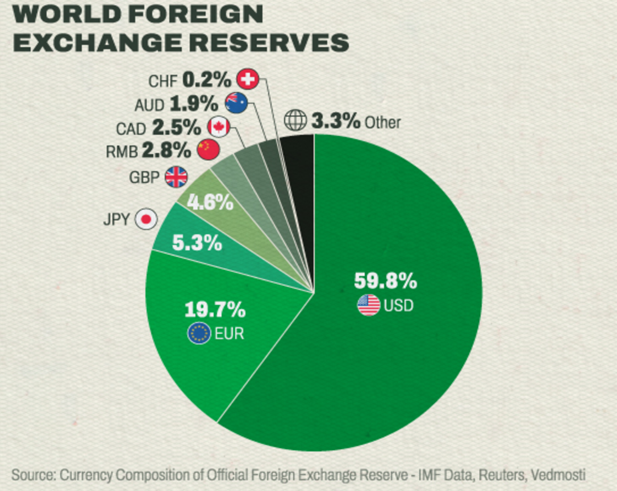

Currently, central banks hold about 60% of their foreign exchange reserves in dollars, while the euro – being the second most-used currency – accounts for roughly 20% of the global foreign exchange reserves.

However, the Russia-Ukraine war may be the turning point setting the stage for a number of countries to wean off US dollar dependence and look for alternatives to the greenback.

The US dollar losing ground as dominant currency in global trade

While the dollar has been the world’s preeminent currency in global markets, its share of global foreign exchange reserves has been falling gradually. According to the IMF’s Currency Composition of Official Foreign Exchange Reserves (COFER) data, “The share of reserves held in U.S. dollars by central banks dropped by 12 percentage points since the turn of the century, from 71 percent in 1999 to 59 percent in 2021.”

This decline in the dollar’s share is not a shift toward the euro, the British pound sterling and the Japanese yen, but “Has been matched by a rise in the share of what we refer to as nontraditional reserve currencies”, defined as currencies other than the US dollar, euro, Japanese yen and British pound sterling.

These nontraditional reserve currencies, as per the IMF data, are “The currencies of smaller economies that haven’t traditionally figured prominently in reserve portfolios, such as the Australian and Canadian dollars, Swedish krona and South Korean won, that account for three quarters of the shift from dollars.”

In addition, as per the IMF data, “There has been an increase in the share of reserves held in Chinese renminbi.” This accounts for a quarter of the shift away from dollars into the renminbi in recent years.

As Russia and China lead in ditching the dollar in bilateral trade, other nations and regions have also accelerated efforts in recent months to move away from the dollar for trade. Brazil, Argentina, India, South Africa, the Middle East and Southeast Asia are opting to trade in national or alternative currencies for international settlements, and this process is expected to gain further momentum.

This “dedollarization” (reducing reliance on the dollar) initiative has resulted in a decline in the global trade of the US dollar. “The share of dollars in global central bank reserves has dropped from roughly 70 percent 20 years ago to less than 60 percent today, and falling steadily”, observed Fareed Zakaria, foreign affairs columnist, in his recently published article in The Washington Post.

While the supremacy of the dollar and its sovereign status won’t end anytime soon, and it is expected to remain the premier currency for international trade and financial transactions, its stranglehold on the global financial system is likely to weaken as more countries start seeking or testing alternatives to diversify their reserves away from the dollar.

How are countries and regions intensifying dedollarization efforts

Among the BRICS grouping (Brazil, Russia, India, China, and South Africa), China and Russia are leading the dedollarization efforts due to their geopolitical rivalry with the US.

The use of local currency is on the rise to replace the dollar in Russia-China bilateral trade, with the Russian ruble and the Chinese yuan accounting for two-thirds of trade payments between the two nations.

The ruble-yuan trade volume surged after Russia’s invasion of Ukraine, which led to unprecedented Western sanctions against Russia. With China’s increased purchases of Russian exports and China’s exports to Russia soaring, the “Ruble-yuan trade increased eighty-fold from February to October 2022”, as has been reported by Reuters.

Brazil, the largest country in South America and an important member of the economic bloc BRICS, is partnering with Argentina to launch a joint currency named the "sur" (south), that may eventually become South America’s euro and be adopted by all of the continent’s countries. The common currency is expected to strengthen regional trade and lessen dependency on the dollar.

Meanwhile, India, the world’s fifth-largest economy and another key member of BRICS, is in talks with the UAE to trade non-oil commodities in Indian rupees. The UAE's trade deal with India aims to increase bilateral non-oil trade to US$100 billion over a five-year period. Furthermore, according to an Indian Ministry of Commerce official, “Russia, Sri Lanka, Mauritius and Bangladesh are some of the other countries that are keen on rupee trade with India.”

India’s rupee trade settlement mechanism, which was set up by its central bank, the Reserve Bank of India (RBI), in July 2022, is attracting interest from more countries, as the trade settlement mechanism is a means of using rupees instead of dollars and other big currencies for international transactions. While this will help reduce India’s dependency on US dollars, the move to encourage international trade settlement in rupees is primarily being done to promote the rupee as a global currency and to settle trades in rupees to save dollar outflows, given that India runs a trade deficit (imports are greater than exports).

In January 2023, South African Foreign Minister Naledi Pandor said, “BRICS is exploring ideas to create a fairer payment system that reduces dependence on dollars.” Last year, the BRICS countries kickstarted talks to develop a new reserve currency that would be based on a basket of the currencies of its five members. This is being done to reduce its reliance on the greenback and present an alternative to the US dollar.

Southeast Asia, too, has taken an important step in dollarization. Southeast Asia’s largest economies – Indonesia, Thailand, Singapore, Malaysia and the Philippines – have developed a digital payments system to trade between these countries in their local currencies, bypassing the need for relying on the dollar as an intermediary.

Meanwhile, after being pegged to the dollar for nearly five decades, Saudi Arabia’s Finance Minister Mohammed Al-Jadaan announced in Davos in January that the world’s biggest oil producer will consider trading in currencies other than the US dollar. This is being interpreted as a sign that the oil-rich nation may be ready to diversify away from the greenback.

In the light of the advance in digital assets, Russia and Iran are reportedly exploring the development of a joint gold-backed stablecoin to enable cross-border transactions instead of using fiat currencies like the dollar, ruble or Iranian rial. This is being considered as a step up in their push to dedollarize.

Central bank digital currencies (CBDCs) can reduce the dollar’s dominance in trade

Some experts believe that the dollar’s dominance will also erode because of central bank digital currencies, or CBDCs, as in this digital world of a government-issued currency, any digital form of central bank money or digital version of an existing national currency will be as easy to use in cross-border payments as any other. This is expected to reduce transaction costs without involving the dollar or correspondent banks.

According to the Atlantic Council GeoEconomic Center’s Central Bank Digital Currency (CBDC) Tracker, “114 countries, representing over 95 percent of global GDP, are exploring a CBDC”. The US is trailing the most influential global trade and commerce countries in the CBDC development race, and the slow US adoption may enable other nations to shape the standards for CBDCs, resulting in diminished popularity of the dollar in inter-regional and intra-regional trade.

Conclusion

The talk of dedollarization isn’t new in recent times. The launch of the euro in 1999 created expectations that it would enjoy equal standing with the dollar or dethrone it. Again, during the financial crisis of 2008, the dollar’s demise was predicted.

But the dollar’s resilience and ability to rally in times of crisis has helped it retain its buoyancy and pre-eminence, and it is seen as a safe haven asset for investors. While we will continue to live in a multipolar currency order world where the dollar will compete with several strong currencies that maintain local and regional hegemony, which may cause it to lose some of its lustre, the US dollar is likely to remain the dominant global reserve currency for the foreseeable future.

Like this item? Get our Weekly Update newsletter. Subscribe today