Treasury Benchmarking: Supporting Sprint’s Working Capital Strategy programme

by Kylene Casanova

The first step in driving a group wide working capital management programme requires the development of an agreed set of benchmarks/objectives as Jennifer Dale, Assistant Treasurer & Director at Sprint Nextel explained in her fascinating talk at the AFP Annual Conference last week which was full of important, practical tips.

Sustainable improvement

Dale believes that it is vital that company need to ‘eat, drink, sleep working capital management’, “Getting serious about Working Capital means making it an integral part of operational processes and the corporate mindset….and not treating it as a one-time exercise.” Companies need to focus on the Working Capital - cash conversion cycle which should be used to benchmark and track your organization over time to measure the effectiveness and management of an organization, and, “decreasing or flat CCC are positive signs; while an increase warrants further analysis.”

To achieve sustainable working capital improvement, companies need to:

- have strong governance policy and procedures from executive management

- scale appropriately comprehensive end-to-end review of operations

- set performance measures at company, department, team and individual levels

- adjust incentive programmes on bonuses, incentives and commissions should be aligned to working capital

- implement and roll across the group defining the segments & identifying rollout process

- have a continuous process management which continually enhances and monitors processes, and retools the workforce so that they have the ability to continue to improve on metrics.

Working Capital Committee and setting objectives

Sprint set up a Working Capital Committee to “foster discussion of ideas and identify opportunities” across the group. The first step was to determine how they compared to other companies and those in their industry. They obtained benchmark data from: their banking partners, AFP surveys, other industry group surveys and on the web, data from Hackett, Aberdeen Group, Phoenix-Hecht, Blueflame Consulting, CFO.com and Bloomberg. Out of these different benchmarks, they constructed their own set of key comparison metrics in each area:

Source & Copyright©2014 - Sprint Communications

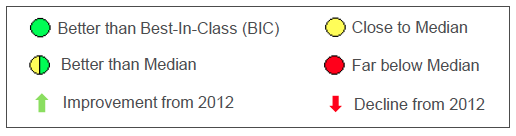

to compare themselves with their peers. The median and BIC were based on the following peers: AT&T, DirecTV, Time Warner Cable, Verizon, Comcast, CenturyLink and Dish Network.

Optimising Days Sales Outstanding

In optimising DSO found that the key drivers were:

- processing: straight through processing and real time credit posting

- organization: centralized reconciliation, credit and collection teams and shared information across the company

- knowledge/data: system access for research across organizations, and do lockbox sites have payment application/identification capability?

- technology: automated matching of payments to customer accounts, and electronic invoicing or recurring payment strategy

- performance evaluation: dashboards summarizing outstanding reconciliation issues, and collection reporting: Bad Debt forecast, Aging balances.

Sprint’s DSO performance over the last three years has been:

Source & Copyright©2014 – Sprint Communications

Each quarter Sprint also rated their performance to their peers as the following example shows:

Source & Copyright©2014 - Sprint Communications

Optimising Days Payables Outstanding

Sprint found that the key drivers in optimising their DPO were:

- processing: centralizing Information Reporting and Workflow (IR&W) processes in a single location and standardizing IR&W processes across locations/units

- organization: having an executive sponsor or champion for AP improvement initiatives, and dedicated resource for handling outsourcing relationships

- knowledge/data: invoices archived in a central, searchable location and training resources available for staff-members

- technology: automated matching of invoices to purchase orders and ability to compare invoices to contracts for payment terms and prices

- performance evaluation: dashboards summarizing current AP status and performance.

Sprint’s DPO performance over the last three years is shown below:

Source & Copyright©2014 – Sprint Communications

Each quarter Sprint also compare their performance to their peers, as below:

Source & Copyright©2014 - Sprint Communications

Optimising Days Inventory Outstanding

In optimising DIO Sprint focussed on:

- purchase order reviews

- timing of purchases/reorders

- coordinating monthly on spend forecast/initiative

- credit line management

- payment term management including supplier/trade financing.

Overall working capital analysis and performance

Sprint regularly carry out a peer analysis of their overall working capital performance v.

Through their programme Sprint have improved their cash conversion cycle over the last three years due to DPO improvement from electronic payments while maintaining active discount strategy, and active credit line management, as shown below:

Source & Copyright©2014 - Sprint Communications

Benchmarking has helped Sprint to impact over $1.5bn in cash and save over $27m in WACC.

CTMfile take: Sprint Communications have given corporate treasurers an impressive example of how a Working Capital Committee can use benchmarking and peer metrics to drive practical and sustainable improvements in working capital management across the group.

Like this item? Get our Weekly Update newsletter. Subscribe today