Virtual Cash Management - the new future or the same old?

by Kylene Casanova

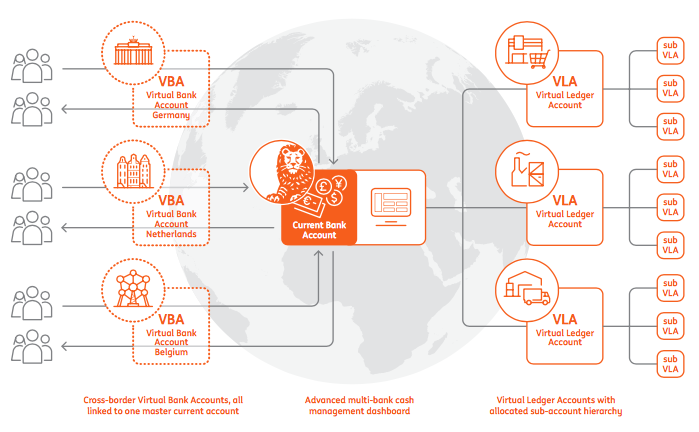

Virtual bank accounts are where physical ledger accounts are replaced by virtual bank accounts held in a virtual banking system. ING’s vision for their Virtual Cash Management (VCM) solution is that, “corporates of all sizes should be able to manage group-wide cash in a digital arena through a single, flexible, multi-bank, self-service portal that can seamlessly integrate into any treasury department’s existing IT infrastructure.”

ING Virtual Cash Management

Source & Copyright©2016 - ING Bank

Key differentiators

Most virtual account based cash management solution providers claim improved cash visibility, access and reconciliation, and ability to rationalise bank accounts. ING claim that the key differentiators in their VCM solution are:

- how VCM combines cross-border Virtual Bank Accounts (VBA) and a multi-bank cash management dashboard, called the Virtual Ledger Account (VLA), offering complete cross-border cash visibility and control - anywhere, anytime

- facilitates cash centralisation and helps rationalise bank account structures

- full, group-wide cash visibility, access and control

- creates an in-house bank and lowers barriers to entry around POBO/COBO

- increases straight through processing and reconciliation

- self-service, multi-bank cash management dashboard with enhanced reporting

- works regardless of financial IT set-up.

ICM VCM users

ING’s VCM is designed for large and mid-sized corporates who are looking for:

- their treasury department becoming a value added cost centre

- new ways to centralise, optimise and automate, in a world where risk mitigation and liquidity are key priorities

- enhanced payment reconciliation processes

- improved ability to make better informed strategic decisions.

Client pilot programmes begin in December 2016.

Like this item? Get our Weekly Update newsletter. Subscribe today