We are all Amazonians now with ‘instant’ C2B and B2B models

by Jack Large

“I want it (a banking system) to work just like an Apple product. You get it out of the box and it just works. I don’t expect any complications or delays.” said a Global corporate treasurer at an ACT conference last year. Consumers’ experience with their day-to-day technology, such as mobile phones and paying their friends ‘immediately’, has created demand and expectations from corporates for their business services deliver the same level of immediacy and efficiency. They now expect much more.

This will change B2B e-commerce systems and processes dramatically. B2B business models will become ‘instant’. One of the biggest changes is the expectation for next day delivery and that the supplier will not ship the goods until they have been paid, this has been and is one of the drivers for the use of immediate payments.

Instant payment growth and expectations in Europe

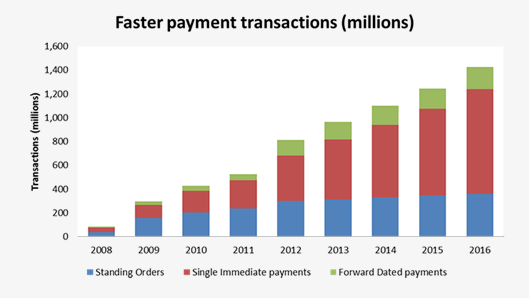

In the UK, even after eight years, the growth, particularly of single immediate payments, is astounding:

Source & Copyright©2017 - Vocalink

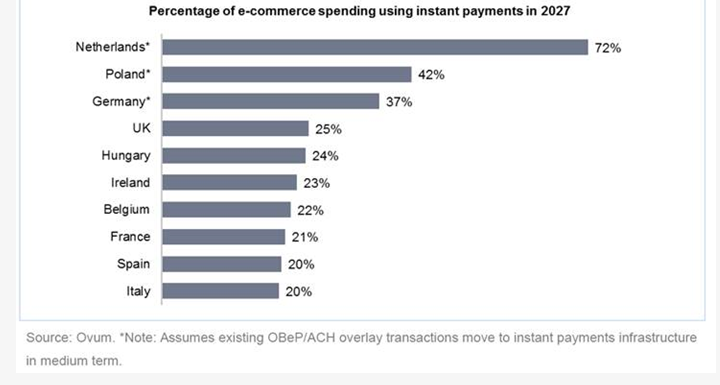

Also astounding is the finding in a recent study by Ovum of the likely demand for instant payments in e-commerce in the next decade that in the Netherlands 72% of e-commerce spending will use instant payments, see below:

It also found that there would be significant usage of instant payments in all other countries.

New B2B business model

Consumer experience with the new technologies and payment systems available to them today is driving the development of new B2B ‘Amazonian’ business models, in which:

- customers expect overnight delivery of the goods

- payments are made direct from the end distributor to the primary manufacturer, cutting out the distributor and speeding up the whole process

- Instant payments and/or direct debiting are now preferrred in some industries because they are both faster than card payments and cheaper (cheques are a non-starter),

- debit card payments are increasingly encouraged (over credit cards) to reduce payment charges

- cashflow is OK because suppliers will have already received the funds before they ship the goods

- financial and credit risks in the value chain are reduced or eliminated

- the working capital required in the value chain is reduced significantly.

These new value chain business models will transform B2B commerce, particularly in industries heavily dominated by dealer-distributor networks.

However, to achieve this new ‘instant business model’ huge changes will be needed, e.g. Moving from batch to real-time operations, etc. and liquidity management will need to be immediate.

CTMfile take: Instant e-commerce is here in C2B and is coming to B2B e-commerce. A/P and A/R departments and corporate treasury departments are you ready?

Like this item? Get our Weekly Update newsletter. Subscribe today