Will a new breed of fintech trade finance products take over from the tried and tested LC?

by Tim Nicolle, Founder & CEO, PrimaDollar

Traditional banking trade finance products are much loved and trusted the world over. Supported by a network of internationally-agreed protocols (UCP600, URR523 and others) and the Swift 700 series of message types, documentary credits have become a staple feature of international trade.

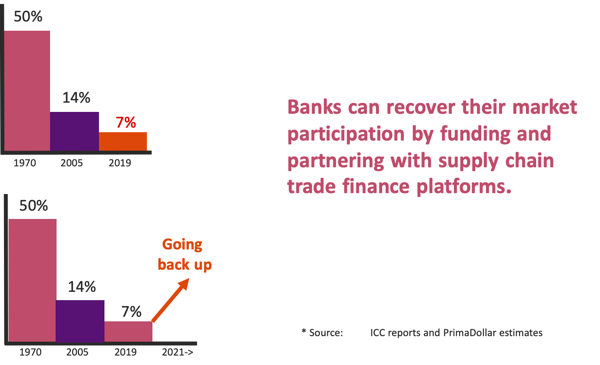

But, as the annual ICC report shows each year, the percentage of global trade using documentary credits is declining each year. On the other hand, whilst the role of the letter of credit may be coming to a natural end, banks will be able to re-engage with trade finance by funding the new breed of fintech platforms.

Market share of bank documentary credit in global trade

Source & Copyright©2020 - PrimaDollar

What do importers and exporters want from a trade finance product?

There are two tasks to be carried out, and they are quite simple:

- Get the exporter paid at shipment, the importer can pay later.

- A trade finance product should enable the exporter to get paid early and to shed the credit and payment risk of the importer.

- This is done by the provision of guarantees to pay in the future that can be discounted by the exporter, or simply by paying the exporter upfront.

- And the importer can take credit and pay the financier back later.

- Ensure that the exporter has done his job before he gets paid. Before the importer assumes an obligation to pay he should have the reassurance that the exporter has done his job and supplied what is required. In trade finance, this is done via the provision and examination of documents that evidence the supply and shipment of the goods involved.

These are the outcomes desired. Traditional bank trade finance products deliver these results. Crucially, trade finance gets cash to exporters at shipment, and before delivery. This is different to invoice finance or standard supply chain finance – which typically deliver funds only after delivery.

Bank trade finance works

Source & Copyright©2020 - PrimaDollar

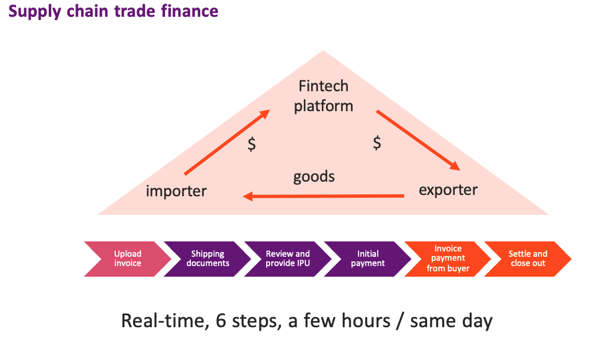

The emerging alternative of the platform solution delivers the same results and typically supported by similar funders

Fintech platforms are simple

Source & Copyright©2020 - PrimaDollar

It is all about trust

The trade finance process set out above is dealing with the fact that the importer and the exporter are not in the same country. This leads to a lack of potential trust and concerns about what to do if things go wrong – as legal action in foreign countries can be challenging.

There are export-side risks, principally will the exporter supply the right goods? And there are import-side risks, principally will the importer pay?

Both parties always have the choice to trust each other – for example, the exporter ships and hopes the buyer will pay later, or the buyer pays up front and hopes that the exporter has done his job faithfully – but this is not efficient. In fact, putting the import side risk (payment) onto the export side (supply) usually means it is mispriced and funded at an inefficiently high rate.

That is the main purpose of trade finance products. They allow the import side and export side risks to be cut between the two sides of the trade at shipment. This is the efficient point to switch funding responsibilities. The export side funds the making period and gets repaid at shipment, the import side then takes over and funds the payment period.

Traditional bank trade finance is based around two banks acting as correspondents, each taking the risks that are local to themselves: the importer’s bank takes the importer risk, and the exporter’s bank takes the exporter risk. The banks, as regulated institutions, trust each other – and so this means that the importer and exporter are no longer directly exposed to each other’s risks.

Why are traditional products becoming unpopular?

Around 90% of documentary credit business is carried out over SWIFT, so analysis of the volumes and values of SWIFT messages (700 series and 400 series message types) reveals the trends. Extrapolation from the SWIFT data suggests the market share of traditional bank trade finance products has fallen well below 10% - perhaps from a high of 50% a few decades ago.

The alternative to using traditional trade finance product has been to trade on “open account” and often with the buyer deferring payment. This means that the exporter-side of the trade is funding and managing the buyer payment risk. As already mentioned, this adds costs to the supply chain because the risks are crossing over and being managed by the wrong side of the supply chain.

But this is changing. Supply chain trade finance platforms are now offering an alternative approach: all the simplicity and efficiency of a supply chain finance platform, but all the reach and scope of traditional bank trade finance products.

Triangle is better than a rectangle

Source & Copyright©2020 - PrimaDollar

There are three main factors driving this trend, amongst others:

First, and perhaps most importantly, the world is becoming a much smaller place in terms of trust and information. With the internet, email and social media, it has become much easier to keep an eye on the performance of distant counterparties and even to assess their risks. This means that one financing party can coordinate both sides of the supply chain. There is no longer any need to have two.

Second, many supply chains have become well established. This has led to increasing trust between importer and exporter. This means that there is no longer any need to use banks to police the trades.

Third, we have the increasing popularity of supply chain finance programs. Many buyers have now taken control over how their supply chains are funded. The supply chain trade finance platform is a simple evolutionary step – adding a trade finance dimension to an accepted invoice finance product. Significant cost savings can follow through standardisation and efficient financing of the supply chains over a platform.

The customer journey matters

Whilst traditional banking trading finance products are declining in popularity, the banking industry is fighting back. There are many platforms receiving large amounts of investment that seek to make the documentary credits work better (Komgo, Marco Polo, Contour to name a few), generally involving the use of blockchain technology to make connections between banks work more efficiently.

So, on the one hand, we have the banking industry focussed on its established products, and on other hand, we have the fintech upstarts whose platforms can replicate the functionality of the traditional products but in a simple and lower-cost way.

Who is the client?

There is one very important difference between the new breed of bank blockchain trade finance platform and supply chain trade finance. Who is the client? The clients of the bank blockchain trade finance initiative are typically the banks; the clients in a supply chain trade finance platform are the importers and exporters.

Which is the right strategy?

This is not a race, and every approach will have its devotees. But, in our view, it is likely very clear which route is going to succeed. It takes 30+ steps for an exporter to monetise a typical documentary credit for an exporter. Each of those steps is an interaction between two or more of the four parties involved (importer, importer bank, exporter, exporter bank).

Complexity and cost arise from UCP600

Source & Copyright©2020 - PrimaDollar

The many steps are a result of the rule books that the banks use to determine what they will and will not do – UCP600 and its various brethren. The issue fundamentally lies in the correspondent model and the complexity of the relationship between the two banks. And of course, it is good to hear that rule books for some of the new blockchain bank platforms have now been developed – but surely trade finance without these rule books will be significantly easier for the customer?

On the new fintech platforms, the same result can be delivered in 6 steps.

Simple - clients just talk to each other

Source & Copyright©2020 - PrimaDollar

So, at the risk of being controversial, perhaps the future of trade finance should move away from the correspondent banking model to a system where importers and exporters simply deal directly with each other? They are connected by a technology platform that enables real-time and direct communication between the principals with the integration of shipping documents and payments.

Supply chain trade finance – this is the version of trade finance that customers want. Moreover, once the customer journey has been simplified, trade finance will re-emerge as a major working capital product with wide adoption. And the banks, who fund these platforms, will recover their market share.

Like this item? Get our Weekly Update newsletter. Subscribe today