With a new regulatory alert issued every 7 minutes, how do I ensure compliance?

by Jack Large

Thomson Reuters Regulatory Intelligence has undertaken its third global survey to assess the impact of developments in regtech and fintech on the role, remit, and expectations of the compliance function in the financial services sector: Fintech, Regtech and the Role of Compliance in 2019, by Stacey English and Susannah Hammond. The research represents compliance and risk practitioners around the world from almost 400 financial services firms.

Regulations keeping on changing

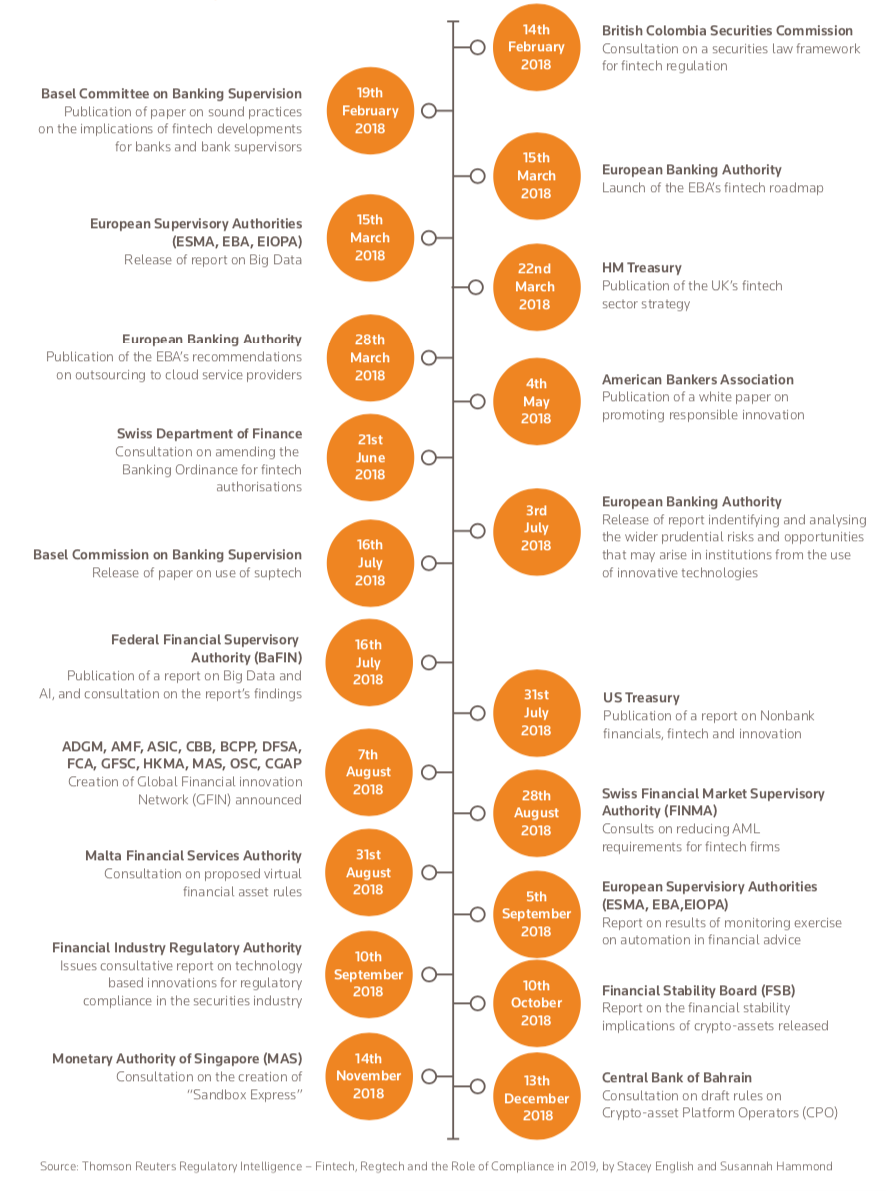

In 2018 there has been no let up in the pace of regulatory change as the figure below shows.

Fintech and the regulators - developments in 2018

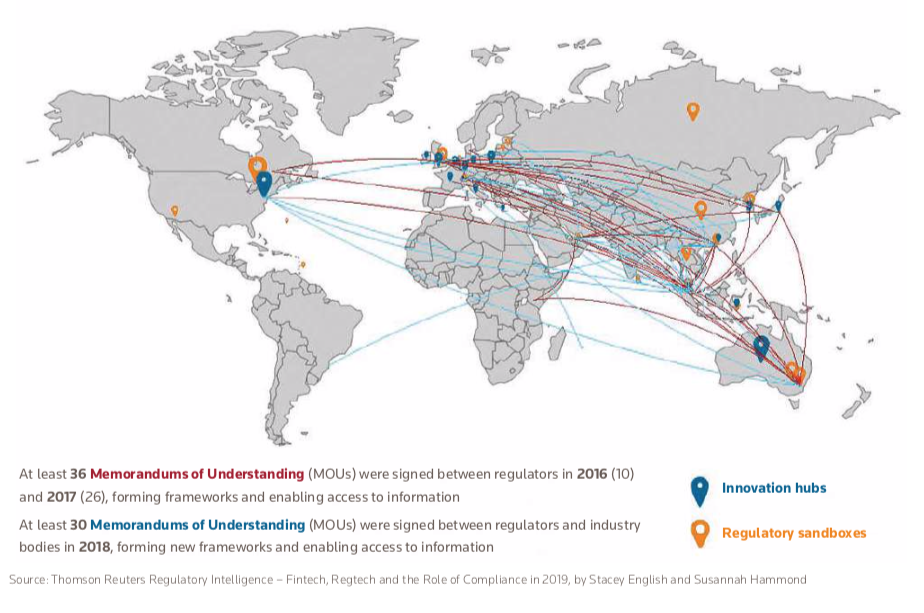

Not only have there been many changes locally, there have also been many memorandums of understanding and innovation hubs, as shown below:

Main findings

Main findings from the research were that:

- There has been a marked increase in the need for risk and compliance functions to have more involvement in assessing the implications of fintech innovation

- Board involvement in the firm’s approach to fintech, regtech and insurtech has fallen

- The biggest financial technology challenge for firms has remained consistently, year on year, as the need to upgrade legacy systems and processes

- There is a growing urgency to further invest in specialist skill sets to accommodate developments in fintech

- Implementation of regtech solutions in compliance management has slowed down

- In 2018, the top areas where compliance and regulatory risk management is most likely to be impacted by regtech were compliance monitoring, financial crime, AML/CTF, sanctions and then onboarding and KYC.

Solutions

This is a hugely complex area as the figures above and the findings show. When looking at solutions the survey presented an important chart showing that one of the most common solutions was a combination of in-house and external solutions:

CTMfile take: At a meeting of European corporate treasurers earlier this year, a member asked, “How do you keep up-to-date with regulatory changes worldwide and how do you manage your compliance worldwide?” Every one of the corporate treasurers agreed that it was basically impossible: they did what they could, but weren’t keeping up-to-date, and they were sure they weren't compliant somewhere in the world. Third-party automated solutions surely must be the way to go.

Like this item? Get our Weekly Update newsletter. Subscribe today