Working Capital Benchmarks

by Brian Shanahan, Founder & CEO, Informita

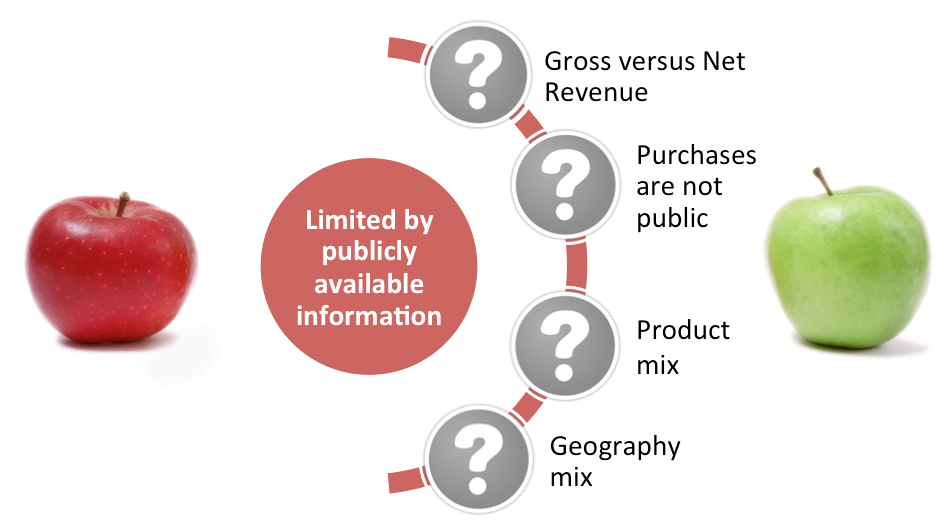

There are a number of working capital benchmarks published by many organisations across the world and all of them lead with headlines such as “$1 trillion lost in working capital”. While these headlines might please the marketing people, increasingly the finance community is more and more sceptical of these surveys and there are a number of very good statistical reasons why they are absolutely right to be doubtful.

Source & Copyright©2016 - Informita

Receivables

The first problem are the revenue numbers used to calculate Day Sales Outstanding (DSO). The standard calculation used is Trade Receivables over Net Revenue times 365 days. In countries with no VAT or GST and where there are no significant rebates paid to customers then the calculation will be accurate. If there is VAT or GST in play, then the Trade Receivables number will include the sales tax and the revenue number will not. If there are large rebates being paid, then Gross Revenue will give a more accurate DSO number. So very often the DSO numbers quoted in such surveys are wrong.

Payables

The next problem is with the Days Payable Outstanding (DPO) number. The standard calculation used is Trade Payables over Net Revenue or Cost of Goods Sold (COGS) times 365 days. The fundamental problem with these calculation methods is that the proper numerator should have been purchases of third party goods and services, but this number is not available in published accounts. The resulting DPO numbers will then be much higher than the real number and cannot be compared with any internally driven measurement.

Inventory

Then there is Days Inventory Outstanding (DIO). The standard calculation used is Inventory over Cost of Goods Sold (COGS) times 365 days. While the calculation itself should be pretty accurate the resulting DIOs require careful interpretation. Most large corporations will have a mix of manufacturing activities and each of those manufacturing cycles will take different lengths of time to complete. For example, a bottle of whisky will take years to complete whereas beer can be completed in a number of weeks. So if we compare Diageo and ABInbev DIOs it only has proper context if we understand the exact product mix that is being manufactured.

Geography

Finally, there is the geography mix issue. Payment terms practices vary in different countries around the world. So I would expect my receivables to be lower in Germany than in Mexico and I would expect my payables to be higher in Japan than in Sweden. But large corporations have very different geographic footprints around the world in terms of where sales are made and goods and services procured. So without knowing what these mixes there is a danger that apples are being compared with oranges.

Conclusion

But working capital benchmarks still have their uses. If you understand the potential drawbacks of the calculations involved, then you can use the results to recognise if you are in line with your peers or not. This can then be used to build a high level business case for action before any detailed analysis is conducted. It is always worth remembering that the best benchmarks can only tell you the gap between you and your peers and cannot tell you the best that you can be.

Like this item? Get our Weekly Update newsletter. Subscribe today