Balance & Transaction Data Collection Services

Many years ago the variation in the banks' standards and procedures for both bank account balance and transaction reporting, and payment instructions created the need for general bank balance and transaction data collection and consolidation services, and for payment instruction delivery services. Specialist aggregation and delivery services are well established and have connections to over 1,000 banks and other financial institutions world-wide.

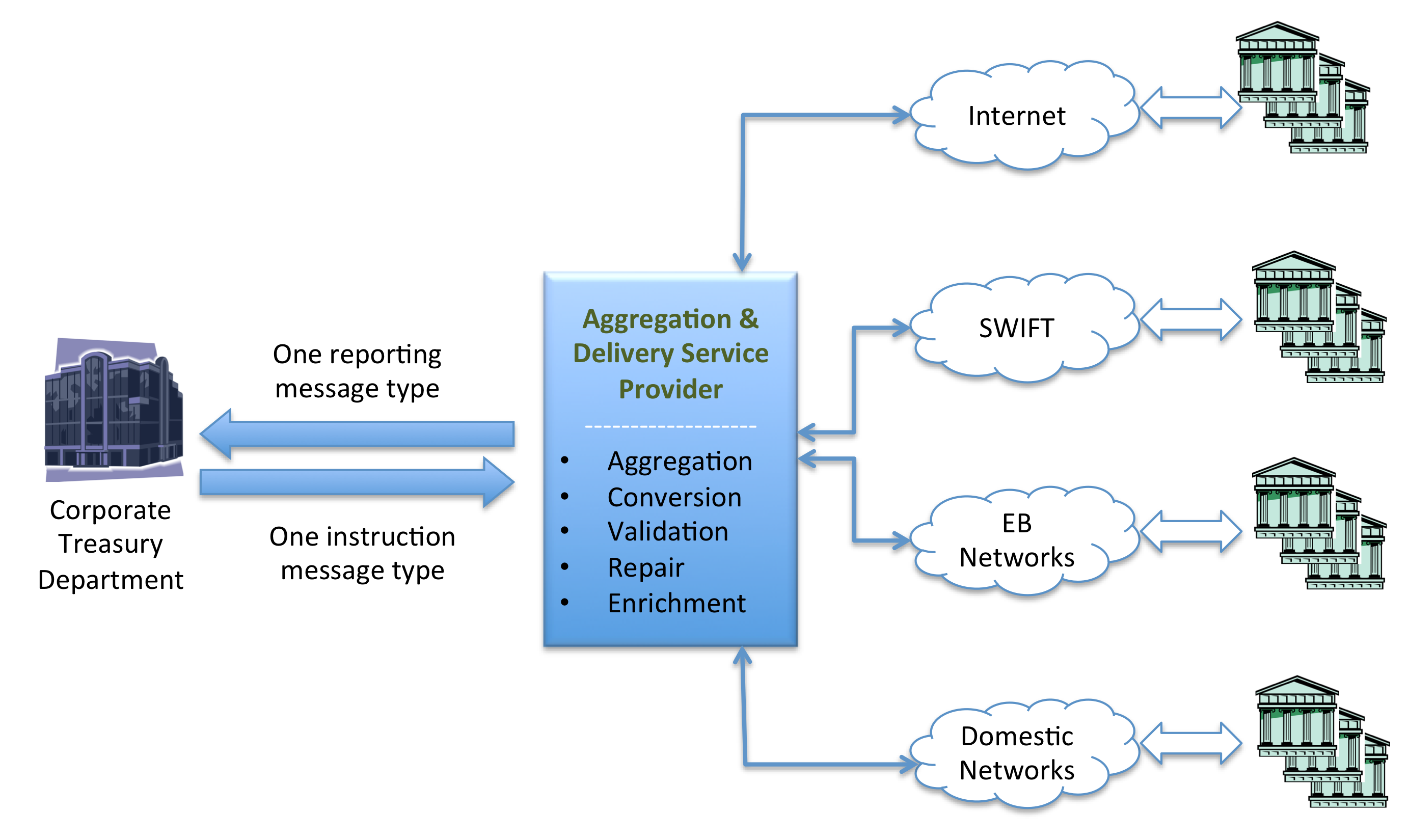

Aggregation & Delivery Services

Copyright© 2011 J&W Associates

The key advantage for the corporate treasury department is that there is only one bank balance and transaction standard and only one payment instruction standard. The department does not have worry about the different message standards, protocols and interfaces.

Demand and Cost-Effectiveness

Although the direct connection of companies to the SWIFT network has certainly cut the demand for the aggregator services, there is still a need for such services because of the many variations between the banks as to how they format and use SWIFT messages. Also many banks and individual bank branches, e.g. in North America and South America, and many other financial institutions are not members of SWIFT and not use SWIFT standards. These services enable the corporate treasury department to connect to all their banks and financial institutions world-wide with just one system, one format and one set of security procedures.

There are two main issues as to whether to use the aggregation and delivery services: 1) are the additional charges above the banks' normal EB and payment charges worth the savings in op |erational time and resources, and 2) is it simpler just to use a direct connection to SWIFT or not.