Billing Systems & e-invoicing

Generating a bill or invoice - the request for payment (which is legally required in many countries and is subject to local laws) and presenting it to the customer for payment, and then collecting the payment is a core and costly part of any business transaction. There are seven types of billing / invoicing solutions as table below shows. Increasingly, the billing system is being integrated with one or more payment systems. The long-term solution will be the order-to-cash platforms integrating purchasing, billing and payment.

Types of Billing/Invoicing and Payment Solutions

These solutions are reviewed below.

Processing Costs

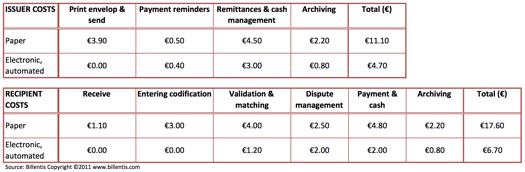

According to Billentis, the processing cost of a paper invoice based transaction is €11.10 for a supplier issuing an invoice and €17 for a buyer receiving the invoice. This cost can be dramatically reduced if e-invoicing is used: the cost of processing an electronic invoice is estimated to be €4.70 for suppliers and €6.70 for buyers - see table.

Costs of Invoice Processing

No wonder large companies, often with hundreds and thousands of suppliers, are the main drivers of e-invoicing because of the cost savings, and because it also opens up major opportunities for both suppliers and buyers. For suppliers, it provides the information and platform to be able to offer dynamic discounting and a reduction in the invoice to cash timescale. For buyers e-invoicing provides the platform for the extension of Days Payables Outstanding by providing Supply Chain Financing for their suppliers. It also enables buyers to take discounts for early payment when appropriate, and provides the platforms for improving the Procure-to-Pay and Order-to-Cash cycles.

There are currently massive efforts to persuade companies to adopt the new global standards for electronic billing and invoicing to replace the 100s of different national standards, particularly in Europe. However, it will take years for these be adopted by banks and companies world-wide. Nevertheless, companies don't have to wait for these standards to be adopted, e-invoicing services can be installed today that accept the 100s of different invoice standards and can produce massive savings and improvements within a few months. There are two main types of e-invoicing service: business-to-business (B2B) and business-to-consumer (B2C).

B2B e-Invoicing Platforms

In B2B e-invoicing, the large buyer signs up with an e-invoicing service. The buyer then requests that their suppliers submit their invoices via the e-invoicing supplier. The service ensures that the buyer receive accurate, error-free electronic invoices in their preferred format direct to their accounts payable systems, see figure. The service provider guarantees invoice delivery, service levels and compliancy with local VAT / sales tax and regulations.

Three Party E-invoicing Processes

Source: J&W Associates Copyright© 2011

The use of e-invoicing is growing rapidly worldwide, the major global e-invoicing network providers, as well as smaller regional suppliers, all report significant growth. A growing number of large multi-national corporations now insist their suppliers invoice them electronically.

Most buyers use a single e-invoicing service provider, a three party model, as shown in above. However, the three party model only works if both buyer and seller use the same service. There are now hundreds of thousands of e-invoicing enabled companies around the world and hundreds of e-invoicing service providers, so buyers and suppliers will not always use the same e-invoicing service. Demand is growing, particularly from large organisations, for inter-operability between the e-invoicing service provider networks. This requires a four party e-invoicing network exchange model, as shown below.

Four Party e-invoicing Network Exchange

Source: J&W Associates Copyright© 2011

But there is relatively little e-invoicing network exchange as yet.

B2B e-Invoicing Services

The simplest form of B2B e-invoicing service converts paper and images to electronic data files, which are then e-mailed. This is often call 'e-billing'. It requires no change to the supplier's systems and no new standards to be adopted. A file from buyer's payables ledger of the bills due is provided to the 'e-billing' service provider which produces and e-mails the bills.

The majority of B2B services provide an e-invoicing platform as shown in the three party model figure above. These services are similar with all suppliers providing invoice data capture and imaging, invoice delivery, multiple formats, and VAT and tax compliance. The biggest challenge in e-invoicing is enrolling suppliers onto the e-invoicing programme. This is a key factor in whether an e-invoicing programme is successful or not. It is also the biggest difference between e-invoicing suppliers. Another key difference between the suppliers is the provision of multiple language capability.

Another option in e-invoicing is to combine the invoice presentment with the payment, these are Electronic Invoice Presentment and Payment (EIPP) services are now available from a range of suppliers.

B2C e-Billing Platforms and Services

Sending bills to thousands and millions of consumers is a major cost for retailers, utility companies, local authorities and large companies. The main options for billing consumers are:

- sending paper bills by post - the least efficient

- e-mailing the bill, known as 'e-billing'

- posting the bill on company's web-site for downloading and informing customers by e-mail or mobile phone text message that their bill is available - the most efficient.

The problem with asking customers to access their bill on the company web-site is that if all companies set up their own portal consumers would have to go into many portals. An alternative is to use multi-biller systems like the consolidated bill and data presentment systems (known as EBPP systems) to which multiple banks and suppliers connect. The consumers then only have to visit one site to see all their bills. However, the problem is that in most EBPP systems not all local banks and suppliers are connected to the multi-biller system. Only a few countries have a multi-biller system that covers the majority of billers and banks.

Managing Multi-Billing Channels

Businesses and consumers are using a growing range of devices and payment systems; they also expect to be able to use them to pay their bills and invoices. As a result, companies are having to support multiple billing channels, each costing thousands of USD to set up and operate - some experts estimate it can cost $100k-300k per billing channel. All billing services now manage and collect payments from one or more billing channels.