Big-picture risk report shows environmental disruption more likely

by Bija Knowles

2017 was the warmest year without El Niño on the historical record, which gave us several high-impact natural disasters, extreme temperatures and the first rise in CO2 emissions for four years. It's no surprise then that a recent report on business risks found that environmental risks are more prominent than in the past. The Global Risks Report 2018, published by the World Economic Forum (WEF), in partnership with Marsh & McLennan Companies, highlights the systemic threats to businesses and economies. It highlights the interconnected nature of the global economy and categorises risks – also referred to in the report as “potential sources of value destruction” - according to their likelihood and their impact.

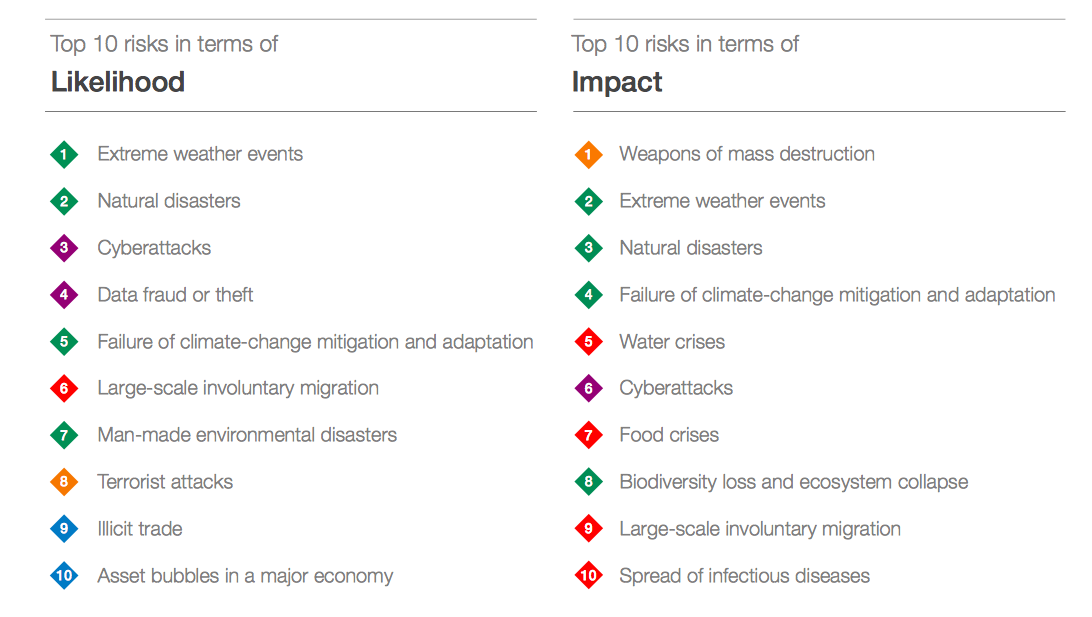

Likelihood vs. impact of global risks

The report shows that the most impactful risks aren't necessarily the same as the most likely risks. The WEF's graphic shows that some of the top 10 most likely risks for 2018 don't make it into the list of 10 most impactful risks. Data fraud or theft is fourth on the list of risks ranked by likelihood, but it doesn't appear in the top 10 risks by impact. Likewise for man-made environmental disasters; terrorist attacks; illicit trade; and asset bubbles in a major economy.

Looking at the risks with most impact, it's also clear that some of the most impactful risks are not among the 10 most likely to occur in 2018, according to the WEF's analysis. Weapons of mass destruction; water crises; food crises; biodiversity loss and ecosystem collapse; and spread of infectious diseases would all have a huge impact – but they aren't among the top 10 risks by likelihood. This raises the issue of how our perception of risk can differ to reality and we often think that risks with greater impact are more likely to occur than in reality. (For example, fear of flying is common even though statistics suggest you are more likely to die in a road traffic accident).

Only connect

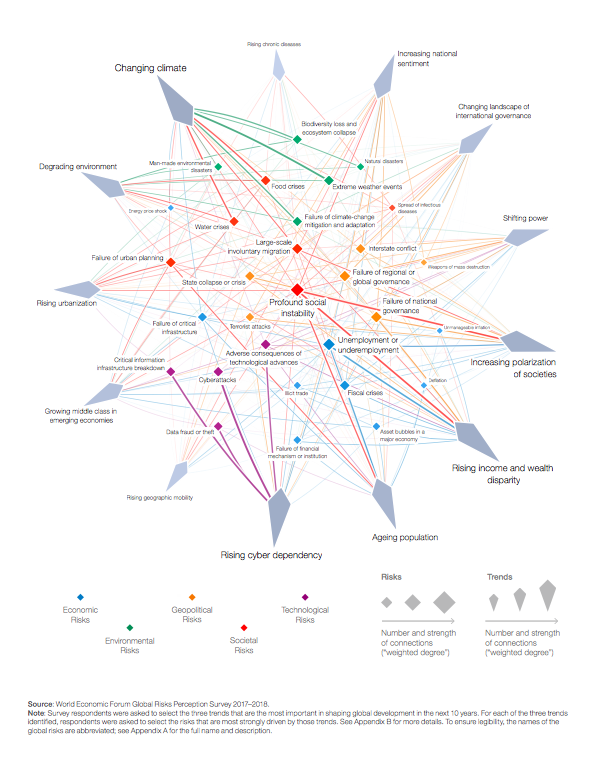

The WEF report states that, while humans have “become remarkably adept at understanding how to mitigate conventional risks that can be relatively easily isolated and managed with standard risk- management approaches”, we are far less able to deal with the “complex risks in the interconnected systems that underpin our world, such as organizations, economies, societies and the environment”.

The report illustrates clearly how interconnected the global economy is and how a huge range of factors – from demographics, wealth inequality, societal trends, cyber dependency, as well as politics and the environment – are very closely interwoven to create a web of linked risks – as shown in the risk-trends interconnection map for 2018, below.

The report also highlights:

- Cybersecurity risks are also growing, both in their prevalence and in their disruptive potential. Attacks against businesses have almost doubled in five years, and incidents that would once have been considered extraordinary are becoming more and more commonplace.

- Headline economic indicators suggest the world is finally getting back on track after the global crisis that erupted 10 years ago. But there are long-standing vulnerabilities such as potentially unsustainable asset prices; elevated indebtedness, particularly in China; and continuing strains in the global financial system.

- A new and unsettling geopolitical phase shows many countries reverting to unilateral positions as “multilateral rules-based approaches” begin to fray. Some of the risks this gives rise to include rising military tensions, as well as economic and commercial disruptions.

Like this item? Get our Weekly Update newsletter. Subscribe today