Bottomline adds SWIFT to the 4 party e-invoicing exchange network options. This might be the key to

by Kylene Casanova

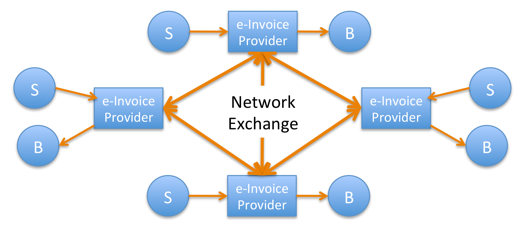

Most buyers use a single e-invoicing service provider, a three-party model, as shown in above. However, the three-party model only works if both buyer and seller use the same service. There are now hundreds of thousands of e-invoicing enabled companies around the world and hundreds of e-invoicing service providers, so buyers and suppliers will not always use the identicalle e-invoicing service. In some scenarios, bilateral agreements have already been put in place between e-invoicing service providers, but these are not standardized and tend to be fragmented and are negotiated on a case by case basis. Demand is growing, particularly from large organisations, for resilient and secure inter-operability between the e-invoicing service provider networks using common standards. This requires a four-party e-invoicing network exchange model with global reach, as shown below.

Four Party e-invoicing Network Exchange

Source & Copyright©2012: Bottomline

Bottomline, one of only two SWIFT service bureaux that have been granted are Category 2 status by SWIFT, in September 2011 launched a SWIFT e-invoicing service, based on the work from the SWIFT e-invoicing Working Group and their existing Transform e-invoicing services.

A key feature of the new service is that Bottomline carry out the conversion of the invoices into the ISO 20022 financial invoice format and deliver them via SWIFT to the other parties in the 4-party exchange. The e-invoicing service provider supplier partners, in this example with Nordea Bank and Tieto, who then deliver the e-invoices to multiple customers in the Nordic region received as part of their normal service, e.g. Nordea delivers the e-invoices as part of their normal electronic banking payment and reporting service.

Since the launch of this inbound and outbound SWIFT e-invoicing service, Bottomline has signed up other corporate customers and is in discussions and proof of concept work with a number of international banks and other e-invoicing service providers.

Adding SWIFT to the 4-party e-invoicing exchange options is clearly a vital development in the global adoption of e-invoicing and could be a stepping stone to the integration of the physical and financial supply chains, as well as the convergence of cash and trade. But it will not be the only route, direct exchange between the e-invoicing providers will also continue.

Like this item? Get our Weekly Update newsletter. Subscribe today