BPO adoption is growing (very) steadily, so what is holding it back?

by Kylene Casanova

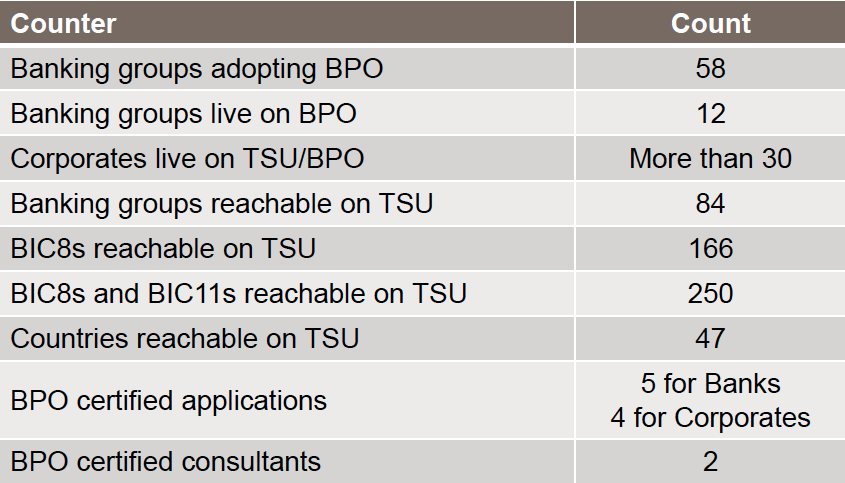

The new trade finance instrument Bank Payment Obligation (BPO) has been described as “A tortoise in the race?”, but it is making progress slowly. There are still now 12 banking groups live on BPO and TSU (Trade Services Unit), since its launch in early 2012. SWIFT describes progress as, ‘BPO adoption grows steadily’:

Source & Copyright©2014 - SWIFT

And the banks reachable on TSU are in every region:

Source & Copyright©2014 - SWIFT

And there are many approved partners working on BPO.

Slow adoption

The problem is that world trade is adopting the new instrument slowly. Nevertheless, the ever optimistic SWIFT conclude in their latest progress report that:

- leading Trade banks are partnering with the ICC and SWIFT to bring a modern trade instrument to the market: the BPO

- the BPO can be used on any channel (Internet, SWIFT) and with any software solution; the SWIFT Certified Application ensures inter-operability between competitive vendor solutions

- the BPO is based on proven best practices: technology neutral industry standards (ISO 20022)

- all leading trade vendors and trade banks in the world are adopting the BPO which confirms the growing acceptance and immediate relevance of the BPO to the trade finance market.

The progress report finishes with a plea: “Get ready now to offer future-proof trade services to your corporate clients”.

Yet, a new BPO transaction is still rates an exclusive write up in The Corporate Treasurer on 24 July: ‘Exclusive: COFCO completes BPO transaction through ANZ’.

What will speed up BPO adoption?

The case studies of the current usage of BPOs are impressive and clearly use of BPOs produces important benefits, e.g. BP’s Global Credit Manager: “We were able to share shipping documents with BNPP electronically and in a matter of hours we received confirmation that they were fine. In terms of ease of working, it’s very positive, and we plan to conduct BPOs with full cargoes in the future.”

So what is the problem? Is it that:

- international trade is inherently conservative and will take years to convince, e.g. Bolero?

- the lack of the electronic bills of lading?

- the time taken for the 58 banking groups to adopt BPO?

- trade is just too complicated to be fully automated?

- logistics is just too busy surviving to cope with any new trade instruments?

Reader suggestion on what problem is:

- it's such a wonderful product and easy to use, yet cost is disproportionate to what it replaces. Go figure.

Answers on a colourful postcard to André Casterman at SWIFT or to your trade banker.

Like this item? Get our Weekly Update newsletter. Subscribe today