Choosing the reporting standards that will achieve full visibility of your global cash balances

by Kylene Casanova

Having full visibility of global cash is vital. This requires balance and transaction reports from all banks and financial institutions where you hold an account. To do this today requires companies to accept bank balance and transaction data in many different formats, including, for example:

- SWIFT MT 940 and 942 messages

- in FileAct format when connected direct to SWIFT

- ISO XML based reporting

- local multi-bank reporting formats, e.g. EBIC - Germany & France, Anser - Japan, which also incorporates a set rules and signatures for exchanging the data

- BAI2 formatted files in North America

- local banks proprietary formats.

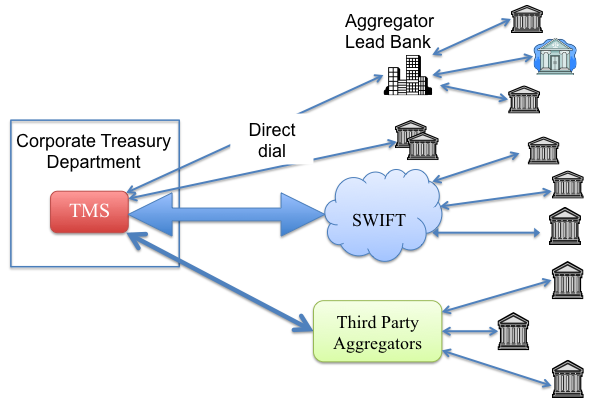

Mostly corporate treasury departments don’t encounter these different formats as they use a treasury management system or aggregation services from either a bank or third party, as shown below.

Cash visibility balance and transaction data collection systems and services

Source & Copyright©2014 - J&W Associates

Long-term goal

Most corporate treasurers want maximum strategic flexibility in choosing and using TMS, other systems and banks. To achieve this corporate treasury departments should avoid using supplier/bank proprietary standards and local standards wherever possible.

A long term programme should be to eliminate the use of these proprietary and local standards. Corporate treasury departments should aim to use the CGI ISO XML V3 reporting standards wherever possible, removing suppliers and banks which do not use these standards.

Like this item? Get our Weekly Update newsletter. Subscribe today