Corporate hedge ratios surge as firms grapple with FX volatility - Weekly roundup: 2 September

by Ben Poole

Corporate hedge ratios surge as firms grapple with FX volatility

Corporate treasurers sharply increased their hedging activity in the second quarter of 2025, according to MillTech’s latest Quarterly Corporate Hedging Monitor. The report shows the average hedge ratio climbed to 57%, the highest level since tracking began over a year ago, as firms responded to steep currency swings and diverging monetary policies.

The US stood out with a marked jump in hedge ratios, rising from 39% in the first quarter to 61% in Q2. Hedge lengths, however, remained broadly unchanged, suggesting corporates are locking in higher levels of coverage rather than extending their maturities. The data reflects what MillTech CEO Eric Huttman described as a “heightened FX uncertainty and unpredictable policy shifts” that are prompting CFOs to act decisively.

The findings come against a backdrop of major currency moves. The US dollar suffered an almost 11% slide against a basket of peers in the first half of 2025, its worst performance since 1973, driven by trade tensions, fiscal worries, and expectations of rate cuts by the Federal Reserve. Sterling rose around 6% against the dollar in Q2, its strongest quarterly gain in three years, while the euro reached a four-year high against the greenback.

These shifts created both winners and losers: 51% of corporates reported a negative impact from dollar weakness, compared to 47% that benefited. UK firms were disproportionately affected, with 56% reporting losses, largely due to dollar-denominated costs and the pound’s appreciation eroding export competitiveness.

Overall, 62% of corporates faced financial losses from volatility in the first half of the year. Nearly half had some coverage in place but still suffered, revealing gaps in hedge timing and ratios. UK corporates were hit hardest, with nearly three-quarters reporting losses, compared to just over half of US firms. Only 38% of respondents said their hedging strategies fully anticipated the turbulence.

The data also highlights a shift in focus toward central bank policy. With the Bank of England cutting rates to 4%, the ECB signalling a dovish stance, and the Fed holding firm, companies are recalibrating strategies based on monetary divergence rather than short-term price moves.

As Q3 begins, MillTech expects FX risk to remain elevated, with trade disputes and policy uncertainty continuing to dominate currency markets. “Having a hedging strategy is not enough,” Huttman noted. “Success lies in the precision and adaptability of that strategy.”

Eight forces to reshape corporate finance by 2030

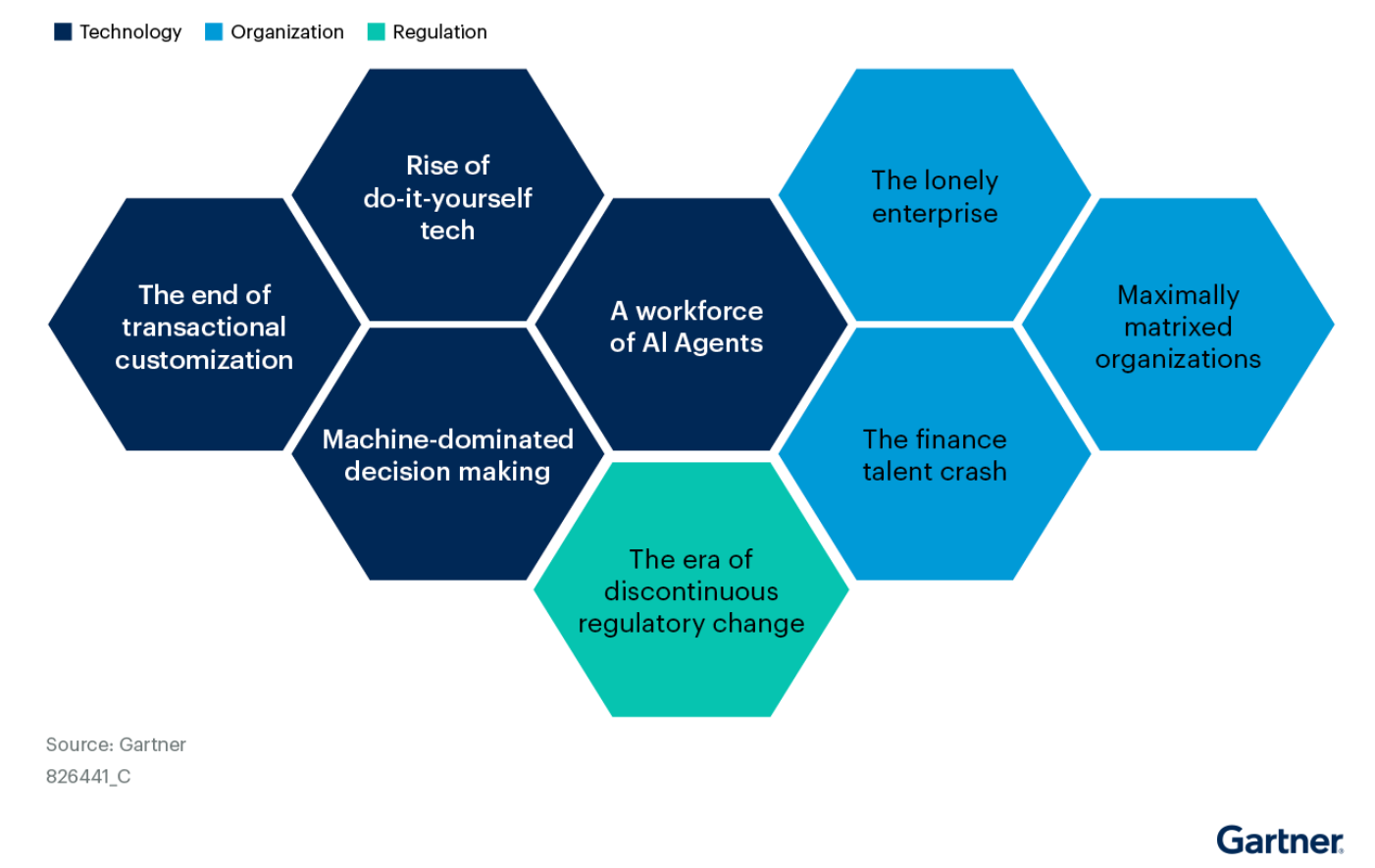

CFOs should prepare for sweeping changes in how finance teams operate over the next five years, according to new analysis from Gartner. The research firm has identified eight transformative forces spanning technology, talent, and regulatory change that it says will fundamentally alter finance structures, processes, and priorities by the end of the decade (Figure 1).

Source: Gartner (June 2025)

The report highlights the growing dominance of artificial intelligence, predicting that a third of enterprise applications will feature embedded AI agents by 2030, with around 15% of daily work decisions made autonomously. Gartner expects this to redefine finance roles, as professionals increasingly act as coordinators of AI-driven processes rather than sole decision-makers. The shift toward machine-led decisions will also accelerate, with 70% of finance teams forecast to use AI and connected device data for real-time cash flow and cost management decisions by 2028.

Another trend reshaping the sector is the rise of “do-it-yourself” technology, where non-specialists build solutions using low-code and AI tools. While this will boost finance’s digital agility, Gartner warns it will require stronger oversight to ensure quality and security.

Customisation is also on the decline. The research predicts finance functions will converge around standardised transactional processes, reducing costs but demanding new approaches to analytics and talent development.

On the workforce side, Gartner warns of a “talent crash” driven by widespread retirements among certified accountants and fewer entrants into the profession. This will push finance to recruit more technology specialists, balancing traditional expertise with new skill sets.

The firm also notes cultural and organisational shifts. Increasing reliance on technology risks isolating employees, eroding their understanding of broader business needs. At the same time, decision-making is becoming more “matrixed,” with authority spread across multiple stakeholders, often at senior levels, creating a need for local expertise to maintain decision quality.

Finally, Gartner highlights discontinuous regulatory change as a significant risk. Unpredictable policy shifts will demand decentralised teams and agile scenario planning, increasing the pressure on finance to remain compliant while providing strategic insight.

Gartner says these eight forces are converging rapidly and urges CFOs to rethink finance operating models now rather than wait for disruption. The firm argues that the most successful finance leaders will anticipate these trends, invest early in scalable systems and AI integration, and rethink workforce strategies to balance automation with human expertise.

Ant, StanChart and Swift trial ISO 20022-backed bank-to-wallet payments

Ant International, Standard Chartered and Swift have launched live production trials of a bank-to-wallet payment solution powered by ISO 20022 financial messaging standards. The initiative successfully completed its first transactions between a Standard Chartered customer account and a partner e-wallet via Alipay+, the digital wallet gateway under Ant International.

The solution is designed to simplify global money transfers by combining Swift’s global network of over 11,500 financial institutions in more than 200 countries and territories with Alipay+’s ecosystem of 36 digital wallets serving 1.7 billion user accounts. The collaboration highlights the growing emphasis on interoperability between traditional banking systems and digital wallets, particularly in Asia’s fast-expanding payments market.

The initiative demonstrates the increasing role of ISO 20022 standards in cross-border payments, offering greater transparency and data-rich messaging. By enabling direct bank-to-wallet transfers, it aims to reduce friction in remittances and international transactions, offering users more choice and flexibility in how they move funds.

For Standard Chartered, the trials reflect its strategy to support seamless international payments and its focus on working with fintech partners to broaden access to digital financial services. The bank has positioned itself as a lead partner in exploring bank-to-wallet interoperability, while Swift continues to prioritise innovation to make cross-border payments faster and more efficient. Ant International’s involvement adds significant reach to the initiative, leveraging Alipay+’s growing presence across Asia and other emerging markets.

The launch of this trial coincides with Standard Chartered’s other major moves in trade finance. Last week, the bank announced a USD 300mn syndicated bank guarantee for Envision Group, supporting the supply of wind power equipment to international markets. Structured with a second-party opinion and aligned with the International Chamber of Commerce’s Principles for Sustainable Trade and Trade Finance, the facility is believed to be the first sustainable trade finance deal of its kind.

Together, these developments underline a broader shift in global finance, where interoperability, sustainability and innovation are increasingly intertwined. By advancing ISO 20022 adoption and testing scalable models for connecting banks with digital wallets, the collaboration between Ant International, Standard Chartered and Swift marks an important step toward a more connected and inclusive payments ecosystem.

Swedish growth revival predicted from 2026 amid policy support

Sweden’s economy is expected to gather momentum next year, supported by additional rate cuts from the Riksbank and an expansionary fiscal policy, according to Swedbank’s latest Economic Outlook. The bank warns that global uncertainty, higher US tariffs and weakening trade flows will weigh on exports, but improving household finances will set the stage for a domestic-led recovery.

Household consumption is forecast to be the primary growth driver. Swedish households have built strong balance sheets following a period of elevated savings, and rising incomes, easing borrowing costs and government support measures are expected to encourage spending. “Rising incomes, lower interest rates and supportive fiscal policy will further strengthen the financial situation for households, paving the way for increased consumption,” said Mattias Persson, Swedbank’s group chief economist.

The labour market remains subdued following the prolonged slowdown, with unemployment projected to stay elevated through 2025. However, job creation is forecast to accelerate as economic activity improves, with unemployment expected to decline to 7.7% by the end of 2027.

The housing market is also set for a delayed recovery. Activity has been muted, with long sales cycles and low bidding levels persisting through 2025. Swedbank expects easing mortgage regulations, rising purchasing power and labour market improvements to lift property prices from 2026 onwards.

Inflationary pressures, which temporarily rose over the summer, are projected to ease, aided by a stronger krona. Swedbank anticipates two further rate cuts from the Riksbank this year, bringing the policy rate down to 1.50%. Persson said the central bank’s focus is shifting to supporting growth: “The cuts will be important to get the economy going. If growth picks up speed, the Riksbank could hike the rate in 2027.”

Fiscal policy will add further stimulus, with SEK 75bn of unfunded measures expected in 2026. More than half of the package is forecast to go to household transfers and tax reductions, while increased defence spending will also contribute to growth. Persson said Sweden’s strong public finances leave room for additional support if global conditions deteriorate.

Overall, Swedbank forecasts GDP growth of 1% in 2025, rising to 2.3% in 2026 and 2.2% in 2027. While household demand is set to strengthen, exports and corporate investment will remain constrained by a challenging international environment, keeping the recovery dependent on domestic drivers.

Mastercard and Infosys collaborate to expand cross-border payments access

Infosys has announced a collaboration with Mastercard aimed at improving financial institutions’ access to Mastercard Move, a portfolio of money movement solutions spanning domestic and international transfers. The partnership centres on integrating Mastercard Move with Infosys Finacle, the banking platform developed by Infosys’ subsidiary EdgeVerve Systems. This integration is intended to provide banks and non-bank financial institutions with a faster, more resource-efficient way to access Mastercard’s cross-border payment capabilities, which cover more than 200 countries, over 150 currencies, and an estimated 95% of the global banked population.

Cross-border payments remain a key growth area for financial services, driven by rising remittance flows, migration and digitalisation, particularly across Asia, which accounted for nearly half of global remittance inflows in 2024. By combining Mastercard’s global infrastructure with Infosys’ platform, the collaboration aims to streamline onboarding processes, lower operational barriers, and improve the reach of digital payment services.

The initiative is also designed to address increasing expectations from both consumers and businesses for faster, more seamless international payment experiences. With banks under pressure to modernise core systems and expand their digital offerings, the collaboration seeks to help financial institutions reduce implementation timelines and operational complexity while scaling cross-border payment solutions.

Infosys Finacle’s composable banking platform will serve as a foundation for connecting Mastercard Move’s capabilities to financial institutions globally, enabling a broader range of services, from remittances to commercial payments. The companies said the partnership reflects a shared focus on improving liquidity management, risk control and operational efficiency across the payments ecosystem.

OCBC launches blockchain-based US commercial paper programme

OCBC has introduced a US$1bn digital US commercial paper (USCP) programme, becoming the first issuer to use blockchain across the entire lifecycle of USCP issuance. The move provides the bank with near-instant settlement capabilities for short-term US dollar funding, as both securities and funds are tokenised and transacted on-chain.

The programme adds an alternative channel for OCBC to access the US$1.4tn USCP market, complementing its conventional US$25bn programme established in 2011. By moving issuance, settlement, record-keeping, and servicing on-chain, OCBC aims to reduce reliance on traditional infrastructure and intermediaries. The system allows all parties to view and verify transactions in real time, creating a single auditable record and improving operational transparency.

The first tokenised issuance under the programme took place on 20 August, involving six-month maturity notes placed with an accredited institutional investor. The bank received funds within minutes of completing the transaction. J.P. Morgan acted as sole dealer and provided its Digital Debt Service platform, part of its Kinexys Digital Assets infrastructure, to facilitate the issuance.

OCBC’s digital USCP programme has been assigned top short-term credit ratings of P-1 by Moody’s and F1+ by Fitch. Proceeds raised through the programme will be used for general funding purposes.

The launch marks the bank’s latest step in integrating blockchain into capital markets activity. OCBC previously adopted J.P. Morgan’s Digital Financing platform for repo and reverse repo transactions in 2024 as part of its wider liquidity optimisation strategy. By leveraging tokenisation, OCBC is looking to increase speed and flexibility in funding operations at a time of heightened macroeconomic and geopolitical uncertainty. The development highlights growing institutional interest in applying blockchain technology to established markets such as commercial paper issuance, where demand for faster settlement and enhanced transparency continues to rise.

Linklogis partners with XRPL to scale blockchain supply chain finance

Linklogis has announced a strategic partnership with XRPL to deploy its global digital supply chain finance platform on the XRP Ledger mainnet. The move aims to support large-scale commercialisation of blockchain-based trade finance and cross-border settlement solutions.

Under the collaboration, Linklogis will integrate its platform with XRPL to enable the circulation of digital assets backed by real-world trade flows. The initiative is intended to create a more efficient framework for processing cross-border supply chain transactions, using blockchain infrastructure to increase transparency and settlement speed.

Both parties also plan to explore broader applications of XRPL’s capabilities in areas such as stablecoins, tokenisation of real-world trade assets, and AI-driven supply chain finance solutions. Future developments could include smart contract–based trading of asset-backed products, supporting more advanced and automated trade finance ecosystems.

XRPL, launched in 2012, is an enterprise-grade blockchain designed to facilitate high-speed, low-cost value transfers and tokenised asset management. The collaboration extends its footprint in trade finance, where blockchain is increasingly being used to digitise and streamline financing processes.

Linklogis, headquartered in China, has been expanding its cross-border operations in recent years, with supply chain finance services now reaching 27 markets. By leveraging XRPL’s infrastructure, the company aims to enhance its international platform while addressing the rising demand for digital finance solutions in global trade.

The partnership reflects a growing trend of blockchain adoption in supply chain finance, as financial institutions and technology providers seek to modernise trade settlement systems and improve liquidity management.

Finastra and Circle to integrate USDC settlement into cross-border payments

Finastra has announced a collaboration with Circle to bring USDC stablecoin settlement to its Global PAYplus (GPP) platform, offering banks an additional way to process international payments. USDC is a regulated, fully reserved stablecoin pegged to the US dollar, designed to provide transparency and near-instant settlement. Through the integration, banks using Finastra’s GPP platform, which processes more than $5 trillion in cross-border transactions daily, will be able to settle transactions in USDC while maintaining fiat payment instructions on both sides of a transfer.

The initiative is intended to reduce reliance on traditional correspondent banking chains, speeding up settlement times while preserving foreign exchange capabilities and regulatory compliance. The companies said this approach gives financial institutions an opportunity to test new settlement methods and explore blockchain-based payment models without needing to overhaul existing infrastructure.

The collaboration forms part of a wider push by technology providers to modernise cross-border payments, an area often characterised by high costs and slow processing times. Stablecoins such as USDC have been gaining traction as a complement to existing systems, offering real-time settlement options backed by reserves.

By connecting GPP to Circle’s payment infrastructure, Finastra aims to provide banks with greater flexibility in how they handle international money movement.

KredX partners with MonetaGo to bolster fraud prevention in supply chain finance

KredX has partnered with MonetaGo to integrate its Secure Financing system into the Domestic Trade Exchange (DTX), its RBI-licensed Trade Receivables Discounting System (TReDS) platform. The collaboration aims to enhance fraud detection in domestic and cross-border factoring and lending by providing real-time validation to prevent duplicate invoice financing.

KredX, India’s largest supply chain platform, entered the TReDS ecosystem in January 2025 after receiving regulatory approval from the Reserve Bank of India to commercially launch DTX. By incorporating MonetaGo’s technology, KredX plans to strengthen the integrity of its trade finance workflows and improve security across its growing network of users.

India’s TReDS market continues to expand rapidly, with total transaction value reaching US$23.6bn in the most recent financial year. The platform has seen a compound annual growth rate of 134% since its inception in 2018, underscoring the increasing demand for efficient invoice discounting and financing solutions for small and medium-sized enterprises.

Traydstream raises US$11m to accelerate trade finance digitalisation

Traydstream has secured US$11m in interim funding to accelerate its expansion plans and drive adoption of its trade finance automation platform. The raise follows the company’s Series B round in September 2023 and comes as demand grows among banks and corporates for tools to streamline manual, paper-heavy processes, improve efficiency, and strengthen risk management.

The round was led by Pivot Investment Partners with participation from e& capital, underlining investor confidence in Traydstream’s strategy to digitise and modernise trade finance. The company said the fresh capital will support global growth opportunities and its wider mission to future-proof trade workflows.

Like this item? Get our Weekly Update newsletter. Subscribe today