Credit management best practice requires discipline and clear processes

by Kylene Casanova

Bryony Pettifor’s presentation - UK Credit Manager, Anixter Ltd - at the Association of Corporate Treasurers Cash Management conference in February 2014 showed that it is disciplines and clear processes, not necessarily the technology that make the difference in improving corporate credit management.

What is involved

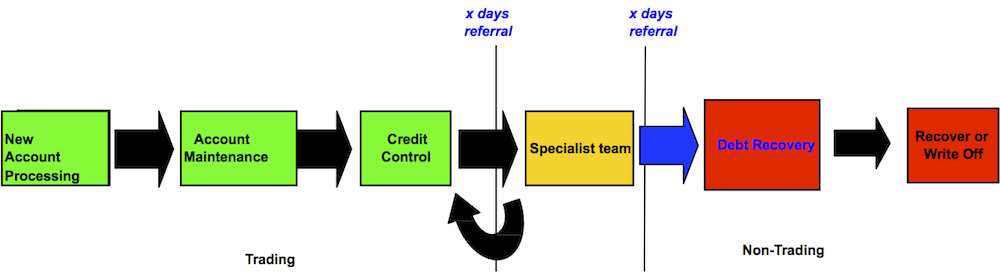

Credit management covers the Order2Cash process:

Source & Copyright©2014 - Anixter Ltd

In principle, the credit controller needs to focus on how the whole process can be improved by breaking down each step and working out where there are potential ‘blocks’ or processing issues, such as with a system driven Order checking process as shown:

Source & Copyright©2014 - Anixter Ltd

Credit Management tips

Bryony and team have found that to be successful they had to focus on one opportunity at a time to achieve improvements in their credit management, which allows them to measure the impacts and make any further changes.

Other tips included:

- it is essential to include sales, finance, operations, and customer services in communication to help understand the credit management (order to cash) process

- make sure you understand your customers and their customers, i.e. the supply chain

- communicate with your customers by phone, not impersonal e-mails, and make them your partners

- use on-line payment systems so that customers can pay at any time, whenever they want

- rank salesmen/women and sales offices as to their success in credit management, and publish the results to drive improvement

- group and report your disputes by age, e.g. Green - 1 month, Amber - 2months, Red - 3 months, with the aim of Credit Policy allowing the Credit team to take control in month 4 to credit the customer if still not resolved.

- ensure there is on-going validation and improvement of all processes including, getting feedback from everyone including customers, colleagues and management

- train and retain good credit management staff

- produce and communicate simple and regular metrics of the department’s performance, e.g.

Source & Copyright©2014 - Anixter Ltd

Source & Copyright©2014 - Anixter Ltd

The results

Using this approach to credit management Bryony and her team at Anixter Ltd in 18 months have:

- reduced Days Sales Outstanding by 5 days

- reduced dispute days by over 1 month

- introduced monthly Sales location meetings, which also included review of low risk customer opportunities

- delivered over £150k cost savings in key projects

- introduced a Working Capital Scorecard linked to Sales commission calculation.

- achieved QICM* Accreditation for the UK team (*Institute of Credit Management’s Quality in Credit Management Accreditation Process for Credit Management and related functions)

CTMfile take: Credit management is all about focus and fully understanding your process, with relentless attention to detail and acceptance of change, which is why Anixter are so successful.

Like this item? Get our Weekly Update newsletter. Subscribe today