Crossflow Payments: First integrated EDI and Supply Chain Finance platform

by Kylene Casanova

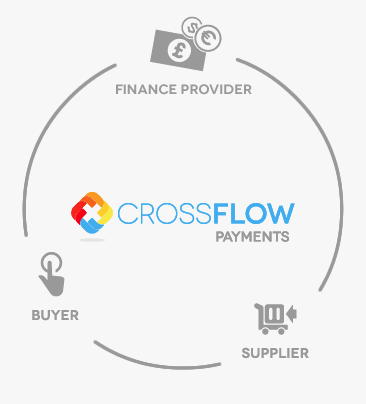

Crossflow Payments offers a unique solution which eliminates EDI costs from the supply chain, and provides ‘just-in-time’™ finance to suppliers:

Source & Copyright©2014 - Crossflow Payments

Set up in 2010, Crossflow Payments had a vision of developing a fully integrated and scalable platform providing electronic data interchange (EDI) and supply chain finance. The peer-to-peer funding platform was launched in September 2013 and provides a broad funding network.

The company typically signs three-year agreements for free EDI transaction processing (integrated to a commitment to offer the Crossflow finance solution to suppliers). Crossflow’s revenue is driven by its free connectivity, a competitive transactional connectivity offering – and the uptake by suppliers of finance.

Crossflow Payments believe that their platform is mutually beneficial for all three parties, viz:

- Buyers:

- eliminating transaction processing costs

- maintaining payment terms and existing debtor days

- supporting financial resilience of most critical suppliers

- Suppliers:

- immediate payment of invoices

- funding available at competitive rates

- pressure eased from cashflow

- no requirement of security

- Finance providers:

- finance granted using an algorithm that takes into account the credit ratings of the buyers and suppliers and other data in the supply chain

- investment facilities agree to support one or more corporate buyer programmes

- support all sizes and types of suppliers

- provides short-term financing which is aligned to attract surplus cash flows at hedge funds, pension funds and other institutions

- portal provides full reporting on amounts outstanding, repayment profiles and returns achieved as well as offering transparency and ease of use.

Progress to date

So far 20 UK companies are using the free EDI replacement for supplier connectivity.

20 million transactions / £904 million processed so far.

Crossflow Payments have put together the ability to support finance for over $8.4 billion invoice settlements in 2014. The funds are provided by a range of major institutional investors.

CTMfile take: Making the EDI / e-invoicing platform free in Supply Chain Finance programmes is unique. Crossflow Payments is definitely a new paradigm. The level of funding they have put together to support their invoice settlements is impressive outstrips most competitors and shows how investors understand the opportunity to finance approved invoices. The market for financing the supply chain is becoming very competitive, corporates can only benefit.

Like this item? Get our Weekly Update newsletter. Subscribe today