Finance leaders must tackle weaknesses, adapt to digital age

by Bija Knowles

A survey on financial leadership has highlighted some of the weaknesses within financial and corporate treasury teams and some of the skills that need to be honed to make a success of digital transformation. Finance Redefined, a study conducted by business applications firm Workday, which surveyed 670 global finance leaders, a third of whom were chief financial officers (CFOs), found several key obstacles as the financial function adapts to the digital age, including:

- a lack of relevant skills;

- communication problems between the CFO and chief information officer (CIO);

- the integration of financial and non-financial data; and

- growing regulatory scrutiny.

The survey also highlighted a difference in attitude towards digital disruption, with the 'next-generation' of financial executives (generally those under the age of 39 with experience outside finance) viewing the risk of disruption differently to 'traditionalists' (generally the over-50s who have worked in finance for most of their careers). The 'next generation' finance leaders are more likely than the 'traditionalists' to identify the pace of technology change as a key risk, and believe it is important that their organizations keep pace with the latest digital innovations, seize growth opportunities, and drive further performance improvement. The report states: “This perhaps reflects the fact that younger generations are more aware of the impact of new technologies, and are more impatient for their organisations to keep pace with emerging developments.”

Time to act is now

Workday's Betsy Bland commented: “The world of business is only getting more complex, dynamic, and competitive. The time is now for finance leaders to focus on redefining their function across several key areas to continue driving business growth and lead in the increasingly digital economy. This requires finance to invest in cultivating the right skills, bridging better connections to other leaders, and pushing the boundaries of technology to break down data silos and outpace the competition.”

The survey also found that only 39 per cent of financial leaders are highly confident about their ability to manage their top risks – and also that the lack of meaningful data is the main barrier to improving risk management. The report said: “For many organisations, valuable data that could transform risk management is trapped in legacy systems and organisational silos. Few organisations can seamlessly access that data, combine it with external data sources, and build the data models and predictive capability to transform their approaches.”

Advanced analytics overlooked by many

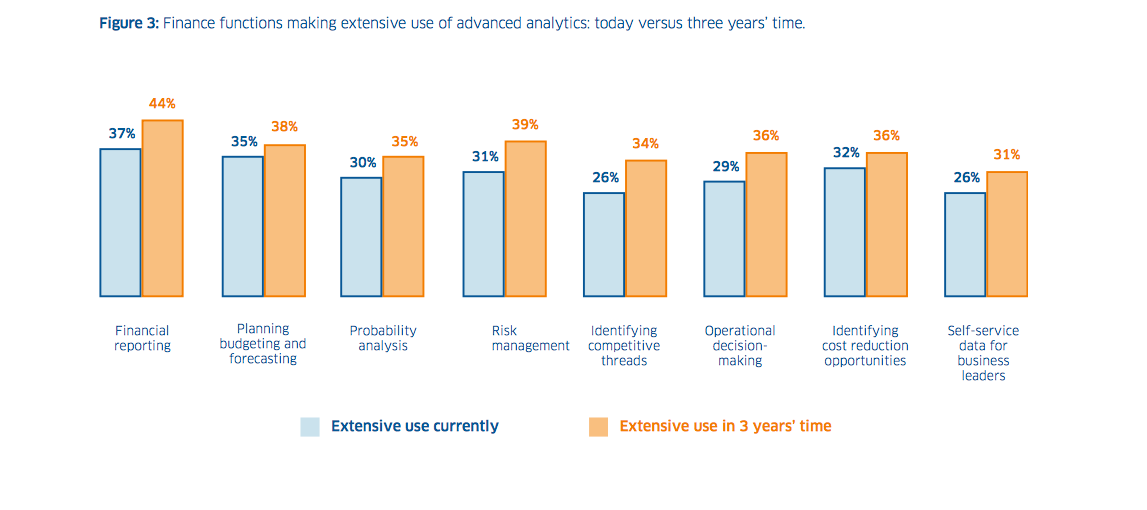

The report also shows that, in almost all types of financial processes, including planning, budgeting, and forecasting, fewer than a third of companies are making extensive use of advanced analytics. The results show that this is not expected to increase significantly in the next three years, with most financial leaders seeing themselves making moderate or limited use of advanced analytics. The main obstacles preventing finance functions from making more use of advanced analytics are:

- challenges in integrating finance and non-finance data;

- system inefficiency, requiring teams to spend significant time aggregating and reconciling data;

- an organisational culture that is focused on intuition rather than data-based decision-making; and

- concerns over data security and privacy.

Like this item? Get our Weekly Update newsletter. Subscribe today