Find the real FX and commodity exposures in your ERP systems and then manage them

by Kylene Casanova

A basic rule in all cash and treasury management processes and systems is that you first need to identify the exact position/exposures and then manage them. Over the last decade a whole range of solutions have been developed to help manage FX and commodity risk. The key is to find the real exposures which mostly are hidden in your ERP systems (there is rarely just one and often they are from more than one vendor) and bring all the data together, and then manage it. AtlasFX’s solution is a classic example of this. Others include FireApps and Hedge Trackers.

AtlasFX approach and solution

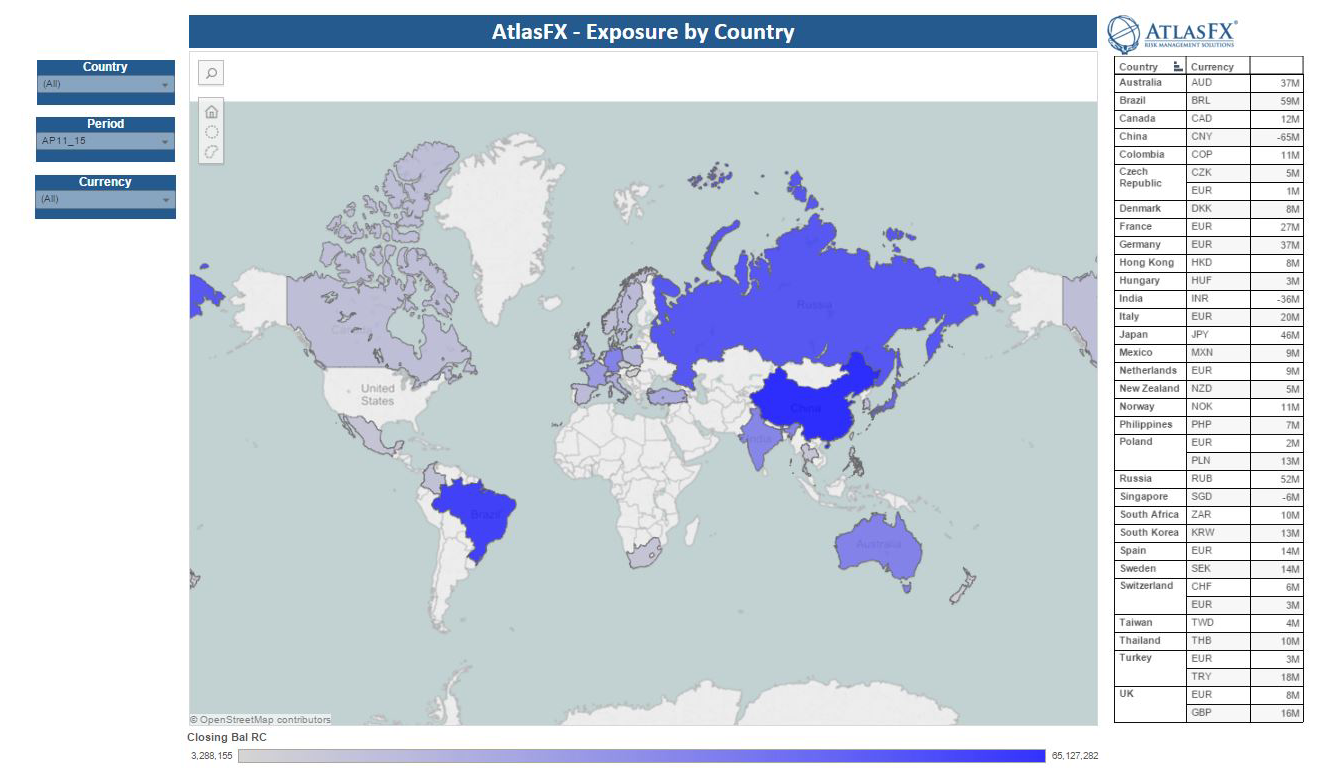

AtlasFX is a cloud-based solution which captures the transaction currency detail hidden within your ERP system regardless of vendor or version. They then are able to show your exposures, for example in interactive maps:

Source & Copyright©2016 - AtlasFX

Source & Copyright©2016 - AtlasFX

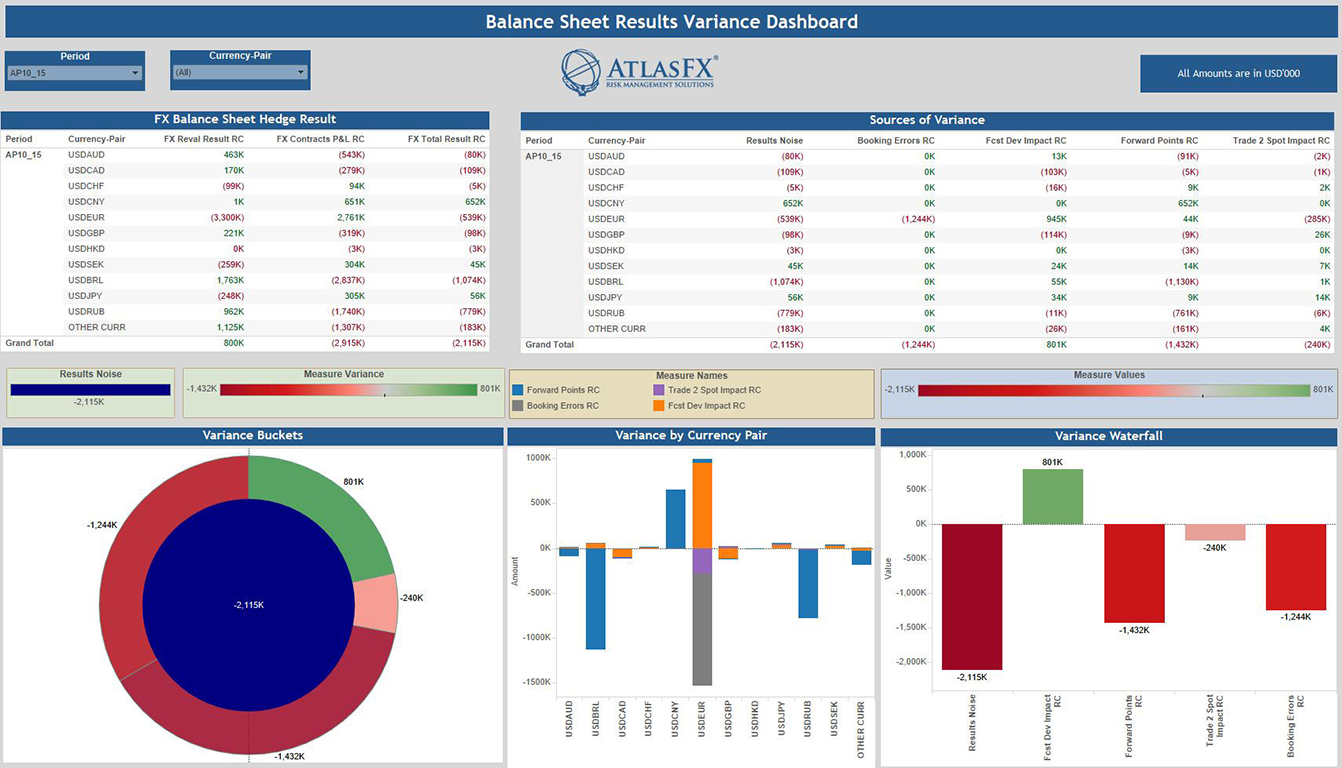

Or your FX exchange P&L variance in their interactive dashboard:

Source & Copyright©2016 - AtlasFX

These systems are being employed in corporate treasury departments around the world.

Installation of FX and commodity risk management solutions

Important examples of how the new FX and commodity management solutions are being used include:

- AtlasFX’s latest installation is at the Raleigh-based Red Hat, the world's leading provider of open source, enterprise IT solutions, who have implemented the AtlasFX solution from Atlas Risk Advisory. The firm is using AtlasFX to optimize and advance their FX hedging strategy and improve month-end closing times.

- Using AtlasFX’s Transaction Currency Detail and Cross-Currency Analytics modules, the Red Hat treasury and risk team have accessed and aggregated the ERP data and analyzed hedge performance. This has enabled the team to optimize their hedging forecast and strategy while also improving month-end close times with consolidated and automated reporting. The AtlasFX team provides a consultative implementation process which allowed the Red Hat treasury team to start using the cloud-solution in just one month.

- FiREapps was used in Ericsson’s award winning revamp of their currency risk management programme, see.

CTMfile take: Extracting and aggregating your full FX and commodity exposure is a complex and arduous task, yet it needs to be carried out regularly. The type of solutions reviewed here are vital.

Like this item? Get our Weekly Update newsletter. Subscribe today