FiREapps Corporate Earnings Currency Impact Report - Europe greater than North America

by Kylene Casanova

The latest FiREapps Corporate Earnings Currency Impact Report, see, estimated a total negative currency impact in 2014 Q1 of $7.4 billion.

North America v. Europe

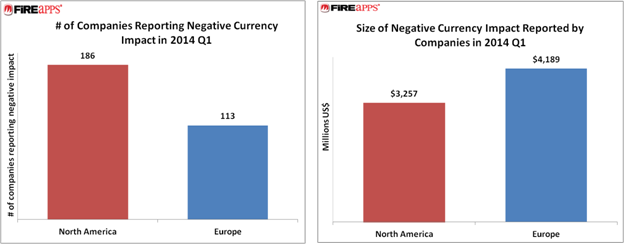

A greater number of North American corporates (186) than Europeans (113) reported negative currency impacts in the first quarter. However, the aggregate impact quantified by companies in Europe was larger (€3.08 billion, or $4.19 billion) than in North America ($3.26 billion).

Negative Currency Impact Reported by Companies in 2014 Q1

Source & Copyright©2014 - FiREapps

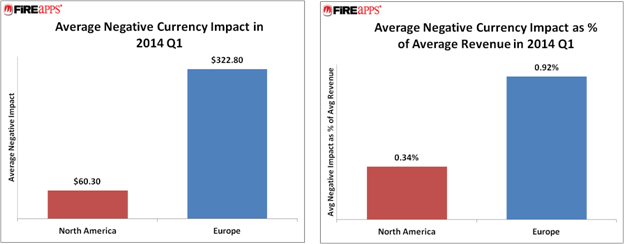

The currency impact reported by European corporates was larger than that reported by North American corporates in absolute and relative terms. The average per-company negative impact – both as a number and as a percentage of revenue – was much larger for European corporates ($323 million, 0.92% of average revenue) than North American corporates ($60.3 million, 0.34% of average revenue).

Average Per-Company Negative Currency Impact

Source & Copyright©2014 - FiREapps

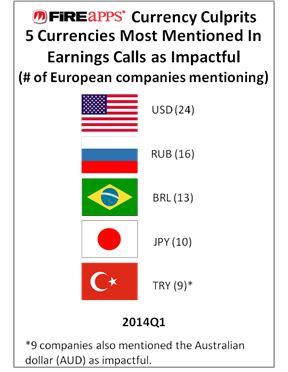

The Most Impactful Currencies on European Corporate Earnings

The five currencies mentioned most often as impactful by European corporates (the “Currency Culprits”) included three emerging market currencies that dealt currency surprises to companies in the first quarter: the Russian ruble, the Turkish lira, and the Brazilian real. The most mentioned currency of all, however, was the U.S. dollar.

Currency Culprits – The 5 Currencies Most Mentioned in Earnings Calls as Impactful (# Companies Mentioning)

Source & Copyright©2014 - FiREapps

FiREapps actionable items

If you are an investor:

For investors in North American and European corporations, it is critical to understand that some companies’ earnings per share are being diminished by currency-related losses. While expansion into emerging markets does indeed hold the potential for significant value returns, that is only the case if the corporation can mitigate the risk associated with doing business in those markets – including the very real risk of currency impact. To understand how a company is impacted by currencies investors should 1) read Item 3 in the quarterly report; 2) read Item 7A in the annual report; and 3) read the transcript of the quarterly earnings call, which can quickly be searched for key words like “currency” and “foreign”.

If you are an analyst:

Continue to press CEOs and CFOs to explain how they are managing currency risk, from emerging markets and elsewhere. Corporates have the ability to understand how currency volatility impacts earnings, and should be able to explain impacts and articulate what they are doing to manage currency risk more effectively in the future.

If you are a CEO or CFO:

There are a variety of reasons to expand operations into emerging markets, from lower production costs to enormous untapped consumer bases. Ultimately, your investors expect those expansions to generate value, and they are increasingly sensitive to the steps you are taking to ensure that the risks associated with emerging markets are well understood. It is your responsibility to communicate with your investors the steps you are taking to manage the currency risk associated with doing business in volatile markets.

Your investors know that if you have currency impacts greater than $.01 EPS, you are not managing currency risk to the market standard, and are therefore likely to have continuing surprises. That uncertainty and lack of predictability impacts your share price. Furthermore, analysts have a tendency to extrapolate the lack of risk management in one area to a lack of risk management in other areas, especially those that are tangential to finance.

Managing currency impacts to less than $.01 EPS is doable. For example, a recent article in FierceCFO profiled how Pfizer – a multinational pharma that is “heavily exposed to currency risk” – keeps its currency impact to less than $.01 EPS. “Pharmaceutical giant Pfizer makes most of its money abroad these days, so its operations are exposed to significant currency risk. Such exposure has taken some other multinationals by surprise, as evidenced in sizable hits to earnings. Yet Pfizer's results suggest that it is effective at actively hedging its currency risk.”

If you are a treasurer/FX manager:

Getting the kind of accurate, complete, and timely (ACT) visibility that many corporate treasurers now understand they need requires instituting an analytic framework that bridges the accounting and treasury organizations. The analytic framework allows the treasury organization to see every currency exposure in the business, and thereby understand the effect that operational decisions might have on those exposures and, by extension, on earnings. In that way, the analytic framework can mitigate currency impacts that are often preventable, and always explainable.

Like this item? Get our Weekly Update newsletter. Subscribe today