Millennials and tech transforming digital payments – and your business

by Kylene Casanova

A white paper by ACI Worldwide - Fast-track merchant growth paths in eCommerce - highlights the shifting payments paradigm and discusses how payments are an increasingly crucial part of any business strategy.

The paper, developed in cooperation with First Annapolis, outlines the potential role of payments within business, how it can drive expansion and greater customer interaction, as well as the factors that are driving the adoption of mobile and ecommerce.

Millennials are now the largest segment of the US population and comprise 24 per cent of EU citizens. With the prevalence of smartphones and high-speed Internet connection, consumers are far more likely to research product info and reviews online, buy with a wide choice of mobile or Internet options, as well as then publish their own reviews and comments about products on social media and review websites. The white paper say these social changes are behind the 10 to 20 per cent consistent annual growth in digital commerce – and this is happening as in-store sales are stagnating or declining by as much as 5 per cent a year.

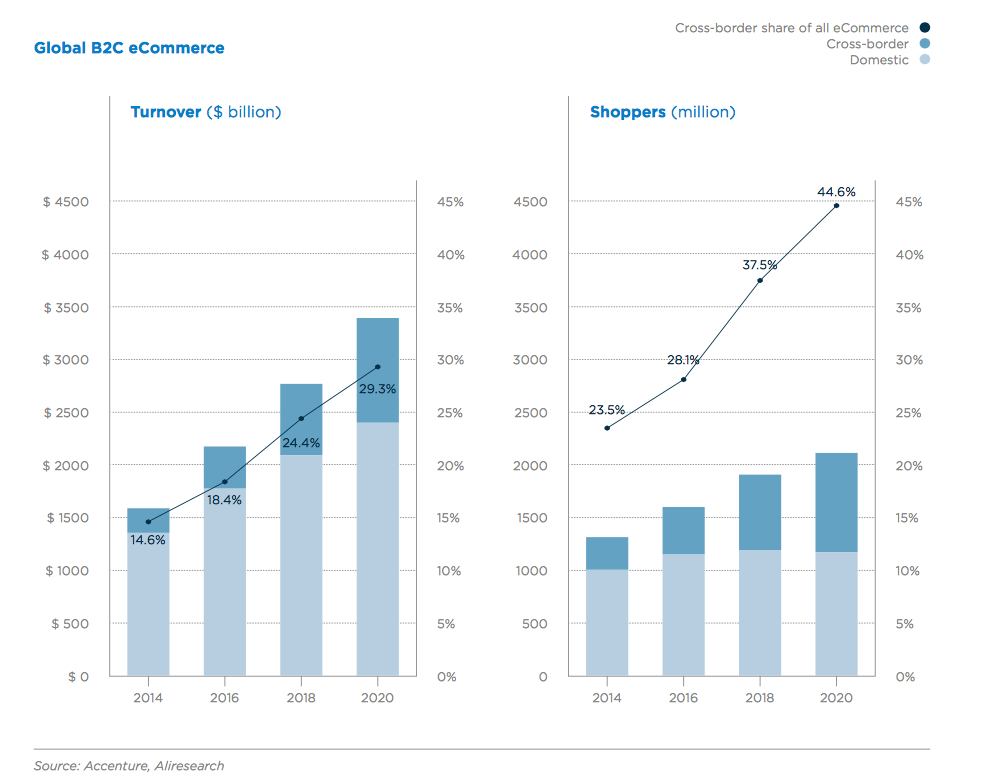

The graphs below show the growth of global B2C ecommerce since 2014, projected until 2020:

How ecommerce can boost your business

The paper outlines five ways in which businesses can use ecommerce to expand:

- brick-and-mortar retailers going online for the first time;

- successful domestic online merchants that optimize ecommerce by diversifying channels and distribution models;

- multi-channel retailers investing in mobile;

- domestic merchants expanding internationally; and

- digital merchants delivering omni-channel experiences and expanding into point of sale.

Acceptance at heart of digital payments

The paper also looks at the challenges involved in each of the above “growth paths” but one of the main challenges at the heart of digital payments is payment acceptance, underlining the need for a “a strategic payments plan”.

Other challenges noted in the paper include:

- operational complexities, which are magnified when merchants expand into non-direct distribution channels and business models in which enablers, intermediaries, and aggregators alter the operational requirements;

- adapting the customer experience and operating model to mobile payments;

- cross-border expansion, where competing for foreign consumers requires marketing and operational adaptation catered to local shoppers;

- the challenge of offering a consistent and seamless omni-channel experience to shoppers, when payment services are still too often divided between online and POS.

CTMfile take: This white paper, although it focuses on the B2C sector, makes some valid observations that can also apply to B2B payments and are certainly true for retailers. CTMfile has already written about the need for corporate treasury to think carefully about the omni-channel payments strategy.

Like this item? Get our Weekly Update newsletter. Subscribe today