Non-performing loans in EU remain high - EBA report

by Kylene Casanova

A report by the European Banking Authority (EBA) has said that the level of non-performing loans (NPLs) in the EU banking sector remains high, at up to three times higher than other global jurisdictions.

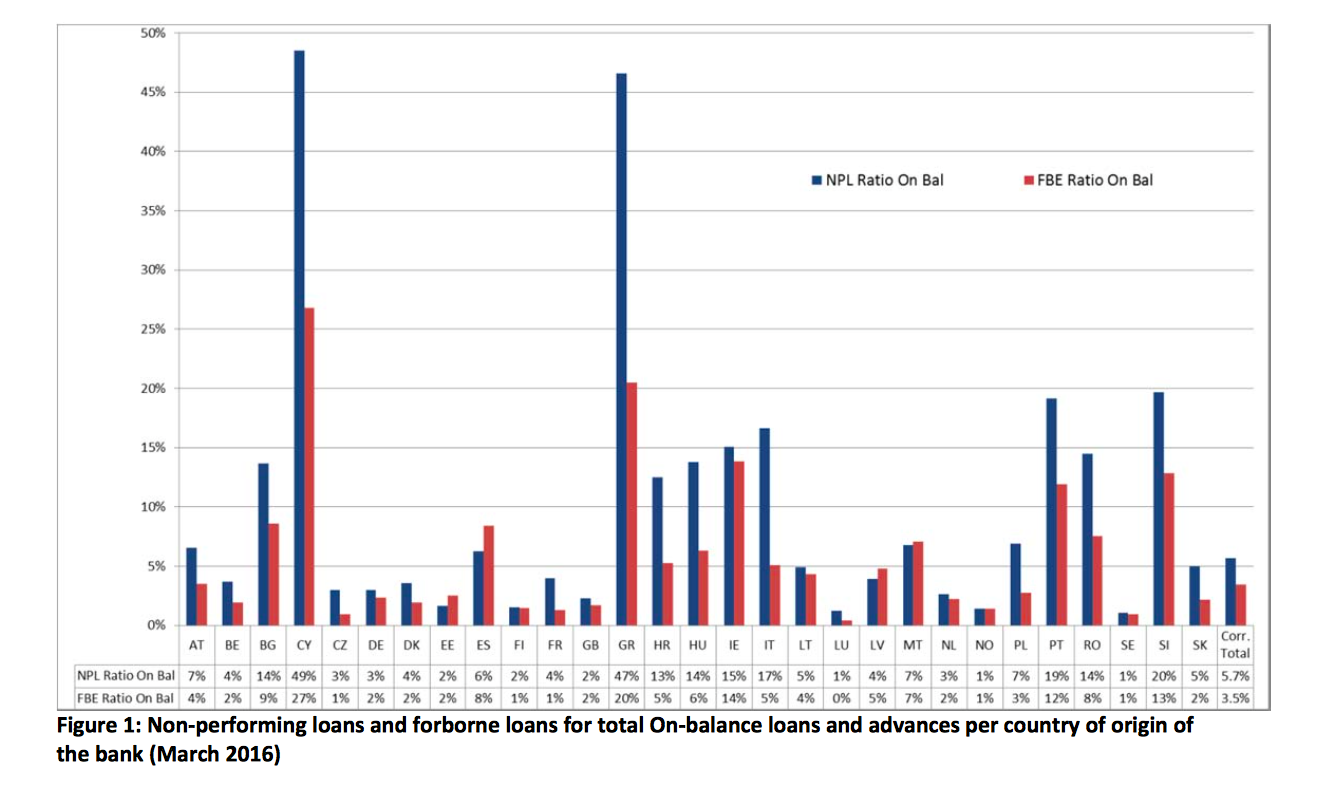

It found that, although the EU banking sector has significantly strengthened its capital position since 2011, NPLs have an average ratio at 5.7% in March 2016. But of note is that Cyprus and Greece have extremely high ratios, of 49 and 47 per cent respectively, while Italy is the only top-five EU economy with a NPL ratio far higher than Europe's other leading economies. Of the top five countries in terms of GDP (Germany, UK, France, Italy and Spain), Italy's NPL ratio, at 17 per cent, far outstrips the others (3, 2, 4 and 6 per cent respectively). No other top-10 EU economy has an NPL above 7 per cent.

The report – The dynamics and drivers of non‐performing exposures in the EU banking sector – covers a sample of 166 EU banks and the time‐period from September 2014 until March 2016. It provides detail on NPLs and forbearance loans (FBLs) across EU countries, as well as background to how the EU has addressed this issue.

The table below shows the levels of NPLs and FBLs as a percentage of total loans for each EU country.

The report notes that some of the key structural areas that affect banks' capacity to deal with NPLs include legal systems, the duration of court proceedings and tax regimes, as well as the absence of a deep and liquid secondary market in NPLs. The report states that “the major impediment to reliable and fast insolvency procedures is the slow process and significant work-overload of some judicial systems, especially those with high NPL ratios.” The length of insolvency proceedings and the speed and rates of the recovery process are important factors.

The EBA identified several policy options for removing or easing the impediments to NPLs resolution:

- supporting the ongoing supervisory work to push for improved provisioning and arrears management;

- addressing structural issues, such as backlogs in judicial systems and processes; and

- improved sliquidity, transparency and efficiency of secondary market in loans to facilitate the disposal of NPLs.

Like this item? Get our Weekly Update newsletter. Subscribe today