Nordea’s Global Cash Pool: the real-time cross-border, cross-currency cash pooling service .....

by Kylene Casanova

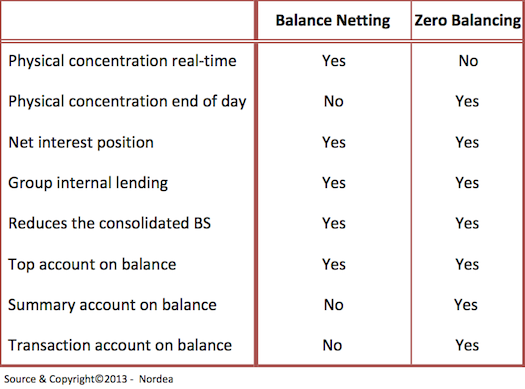

Nordea’s Global Cash Pool (GCP) provides access to client’s overall liquidity using balance netting to provide real-time cross-border, cross-currency cash pooling. Balance netting is much more than zero balancing, as the table below shows:

Balance Netting v. Zero Balancing

In the GCP, the cash pool is topped by an off balance multi-currency master account holding the cash pool‘s net balance in the user’s chosen currency.

Each transaction on a local transaction account is updated in real time to the master currency account, allowing continuous group-level access to the netted balance in master account regardless of location and currency. This gives users real time access to the funds. Each time funds are received or withdrawn, the master account balance is instantly updated. And also gives users immediate access to group liquidity whilst minimizing external short-term financing with on-line visibility and reduced balance sheet requirements.

Currently the GCP covers the Nordic countries - Denmark, Finland, Norway and Sweden and also UK. Country coverage will be extended as the service matures.

Balance Netting provides much more than zero balancing and is probably the ultimate solution to cash concentration.

Like this item? Get our Weekly Update newsletter. Subscribe today