Omni-channel payment platforms add functionality & partners - dominating? Not yet

by Kylene Casanova

The enticing omni-channel payment dream is to collect and make all payments through one platform. We are not there yet, but you can see with three recent developments, what is happening.

Adyen rolls out Global Acquiring in Brazil, Hong Kong and Australia

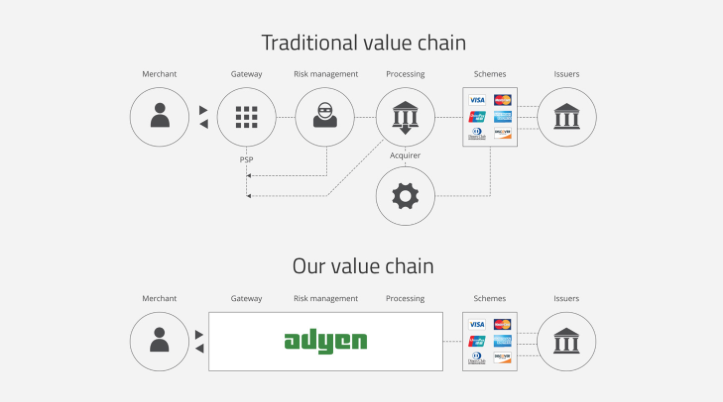

Adyen, one of the largest omni payment platforms, has just announced three new markets for their Global Acquiring service. Now, in addition to the US and Europe, they also connect via Visa and MasterCard directly to these three new markets. They now reach in five continents. Instead of having multiple contracts for requiring, corporate's are able to have one contract with Adyen, see the new value chain below:

Source & Copyright©2016 - Adyen

Adyen manages the entire payment flow, including gateway, risk management, and enquiry, on a single path.

Bank of America Merrill Lynch and Modo Announce Strategic Relationship

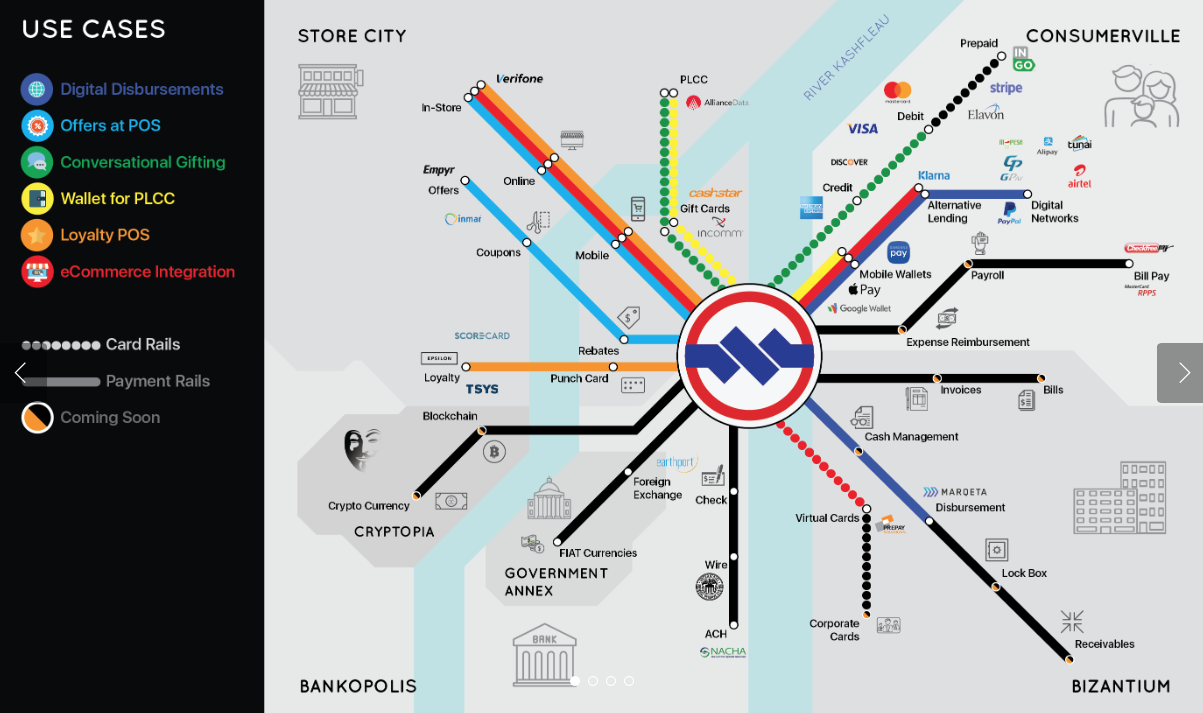

Bank of America Merrill Lynch and ModoPayments, LLC (Modo), an industry leader in digital payments innovation, have announced a strategic relationship that will give the bank access to Modo’s patented COIN® Operated Digital Payments Hub which Modo extravagently claim their “patented COIN® transaction takes monetary value from just about any source, and can deliver it to just about any destination, without requiring partners to modify their systems”:

Source & Copyright©2016 - Modo

Through the hub, Bank of America Merrill Lynch clients will have the ability to connect with multiple emerging payment networks.

Tipalti Unveils Cloud OCR to Invoice Processing Workflow

Tipalti, a leading supplier of payables automation, have added Optical Character Recognition (OCR) technology to its invoice processing module which cuts, Tipalti claim, cuts invoice processing times by up to 80% by delivering touchless invoice automation. The solution automatically scans inbound invoices from email and the Tipalti supplier portal, extracts the invoice details for processing into the invoice workflow, and triggers multiple organizational approvals.

The invoice module is seamlessly integrated into Tipalti’s end-to-end AP automation software, allowing finance departments to manage their entire global supplier payments operation with one holistic cloud platform.

The overall SaaS based Tipalti service:

- sets up new payees effortlessly with self-service supplier on-boarding

- collects and validates W-8 and W-9 tax forms automatically, including tax withholding calculations

- checks payees against OFAC and international "Do Not Pay" blacklists

- pays suppliers across any country in their choice of 6 different payment methods and from over 100 currencies

- instantly communicates supplier payment status and gives partners anytime, anywhere visibility in to payment history

- performs real-time payment reconciliation with your ERP system and prepare 1099 / 1042-s tax preparation reports.

CTMfile take: Omni-channel payment solutions are emerging in many different forms. Modo’s description describe the dream perfectly, takes monetary value from just about any source, and can deliver it to just about any destination, without requiring partners to modify their systems.” These three examples show that integrated multi-payment system solutions (covering not just the payment also many other features including tax et cetera) are what is coming. Corporates can only benefit, but choosing the effective and appropriate partners will not be easy.

Like this item? Get our Weekly Update newsletter. Subscribe today