Payment roundup: instant payments, virtual cards, mobile payments, biometrics

by Kylene Casanova

The global payment systems and services revolution continues with:

- the move to instant payments ramps up:

- New instant payment schemes in US - all major banks are members - and Eurozone with nearly 600 payment institutions from eight European countries participating in SCT Inst (SEPA Instant Credit Transfer)

- 25 instant payment schemes are already live worldwide

- Faster Payments in the UK growth continues at 20%/year even though is has been going for 10 years

- Virtual card and API technology expands, e.g Bank of America Merrill Lynch has launched:

- an enhanced virtual card capability that uses application programming interface (API) to enable commercial purchasing clients to connect directly to the bank’s virtual card system.

- the streamlined and dynamic virtual card solution, known as BofA Merrill Virtual Payables, also uses new capabilities to create single-use account numbers in real time

- Payment services for SMEs:

- DBS Bank and Xero have launched an industry-first online payments solution to help start-ups and SMEs manage their cashflow needs better. This API-driven banking service, enables payments to be initiated on Xero and approved through the bank’s corporate internet banking platform, DBS IDEAL, all in a few clicks.

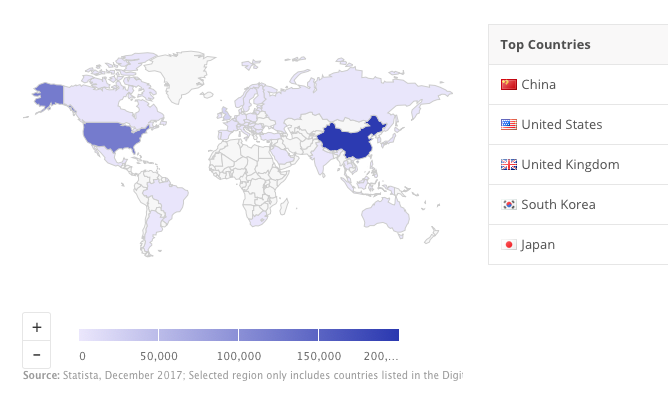

- Mobile payments are taking over globally with USA and China being heaviest users:

- Press Here! Visa begins pilots of new biometric payment card:

- Visa has announced it has initiated pilots with Mountain America Credit Union and Bank of Cyprus of a new EMV dual-interface (chip- and contactless-enabled) payment card, making these the first commercial pilots to test an on-card biometric for contactless payments.

- Signature no longer required for card transactions:

- From April 2018 Visa will no longer require signatures for purchases, joining Mastercard, AmEx, and Discover

- Connected payment card technology

- Dynamics Inc. and Sprint, a wholly owned subsidiary of SoftBank, yesterday unveiled at the 2018 Consumer Electronics Show in the USA, the first battery-powered, “connected” payment card,see below:

- Source & Copyright©2018 - Www.dynamics.com.

- Google merges payments platforms and launches Google Pay

- Google have revamped its mobile payment offerings bringing together Android Pay and Google Wallet in one product and creating a new brand called Google Pay.

Like this item? Get our Weekly Update newsletter. Subscribe today