Payment systems - think different

by Jack Large

The problem with making and collecting payments is that most systems and processes have been around for ever and are engrained into the thinking, habits and processes of businesses and consumers world-wide. But it is possible to be different, to think differently and to tackle the problem/the issue from a different angle, a different starting point. For example………

Credit and debit cards

Two card issuers in the UK now have turned card design on its head. Starling Bank’s new card design uses portrait card design:

Source & Copyright©2018 - Starling Bank

CITY A.M. explain that, “All customer details, including their name, card number and expiry date, will be on the back of the card, which the bank says improves security by making it harder for spies to copy personal information.”

Starling Bank claim that, "Our lives are largely lived in portrait now, even down to how we use our phones. A bank card in portrait reflects how we actually use our cards today; it’s intuitive, instinctive, and in short: it’s just common sense."

Deep understanding of the transaction process is the key, then it becomes commonse to think differently.

Remove the payment process from buying

Consumers and businesses just want the good or service they are buying, they want the payment process to be ‘frictionless’, as minimal as possible. One of the main things that UBER understoood in their peer-to-peer ridesharing, taxi cab, food delivery, and transportation network company is how to make the payment process disappear. Customers order a ride, a food delivery and then car or food arrives. After which the customer is automatically debited and a receipt issued. All because all the payment details, etc. are set up at the beginning of the relationship.

In the large majority of well established companies at least 60% of the customers are long term customers who come back year after year, so setting up automated arrangements with procedures for payments and exceptions are vital.

Make most payments subscription payments

To take payments out of buying process for long term customers, how can your company:

- Break your service(s) into monthly payments

- Offer discounts for monthly payments

- Pay and collect via the local automated clearing house.

Real-time payroll

The first UK customer for the Mastercard Send service in the UK will be Income Group, a payroll-focused payment provider that enables businesses to significantly improve the efficiency and reduce the costs associated with running a payroll by reducing the time taken to pay employees down from days to real-time, as figure below shows:

Source & Copyright©2018 - IncomeGroup

The main benefits IG claim are:

- Benefits for payroll and finance managers:

- 50% or more cost savings of traditional & recalled payment options

- Enhance payment processing whilst maintaining authorisation workflows

- Benefits for payroll bureau

- Have more time & control for payroll changes and processing

- No more payment system upgrade charges.

Expand cash usage

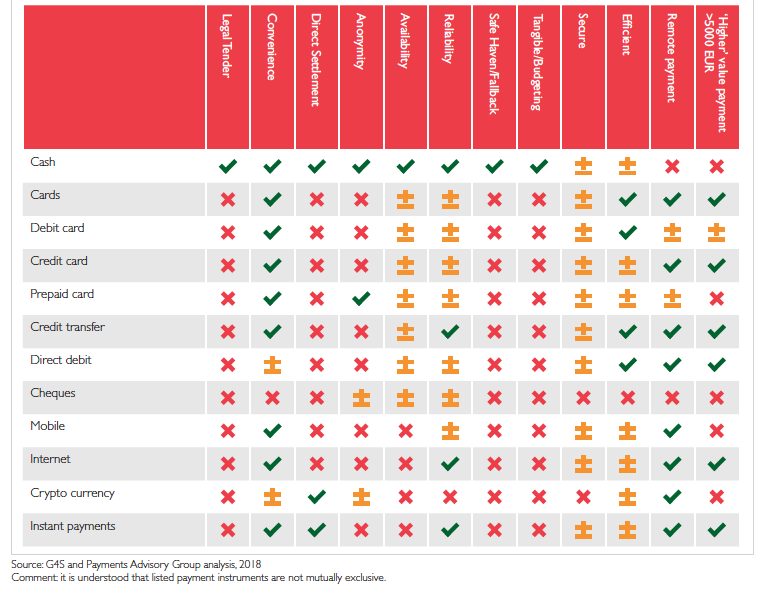

Technology mad-men insist cash is bad, and needs to be got rid of, but remember:

- It has a unique set of attributes:

- Cash can be the cheapest way to collect payments:

- The British Retail Consortium 2016 Payments Survey showed that the cost of point of sale payments were:

- The question with cash is when and where should it be used to gain/protect business and lower costs? NOT to think that accepting cash is always a bad idea.

CTMfile take: It pays to understand the dynamics of each type of transaction, and then Think Different.

Like this item? Get our Weekly Update newsletter. Subscribe today