Reports of the death of payment cards have been greatly exaggerated

by Jack Large

EDC’s Annual Payments Report has grown over the last 12 years from a small survey and a brief commentary on the state of payments - thanks to colleagues, clients, and payment professionals across the globe - to being an eagerly awaited annual event on the payments industry calendar.

The 2018 report is full of important views as to the future of payments. Over the next few days CTMfile will be reporting on key parts of their analysis. Our first review is on the future of payment cards.

Reports of the death of payment cards have been greatly exaggerated

‘Experts’ have been predicting the death of payment cards for many years. But this could not be further from the truth.

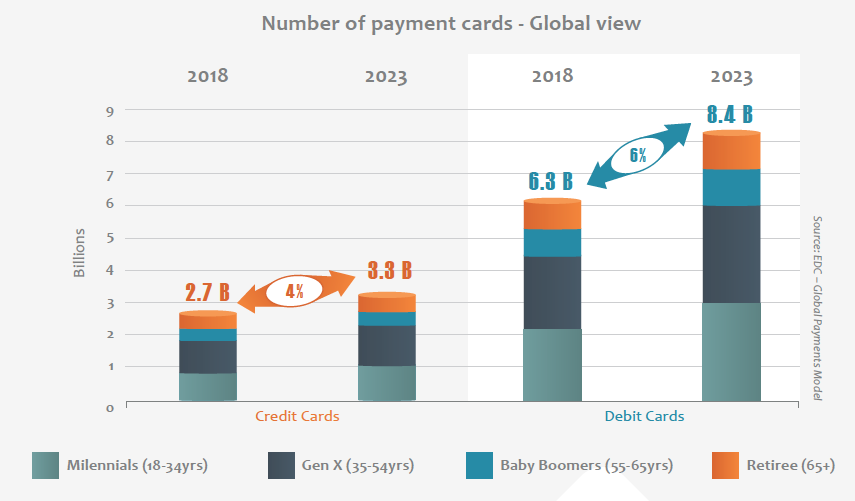

EDC report that, “Global Payments Model (GPM) indicates that payment cards – credit, debit, prepaid, and other types – will continue to grow over the next 5 years. Payment cards in circulation on a global basis are expected to be around 11.7 billion by 2023, out of which 8.4 billion are estimated to be debit cards. While slow growth is expected in the more mature markets, payment cards in the emerging markets such as China and India are expected to grow significantly.” As figure below shows.

Source & Copyright©2018 - Edgar, Dunn & Co.

Although some market research has indicated that millenials might be slowing their takeup of credit cards, overall EDC are predicting that, “on a global basis, millennials will continue to support both credit and debit cards for their payment needs.”

Another reason for the continuation of payment cards is that new payment methods often rely on digitally stored payment cards to fund and process payments.

CTMfile take: In standard business and in e-commerce don’t give up payment cards.

Like this item? Get our Weekly Update newsletter. Subscribe today