The evolution of payments fraud: Broader reach, faster speed, and the AI Advantage

by Pushpendra Mehta, Executive Writer, CTMfile

Fraud in payments isn’t just growing—it’s evolving, becoming smarter, faster, and harder to detect.

To help corporate treasurers address this escalating challenge, this article highlights actionable insights from recent survey reports and research that shed light on the payments fraud landscape and guide effective risk management.

Payments fraud extends across corporate channels

New research from Datos Insights, commissioned by BNY and published in The New Treasury Frontier, reveals a troubling trend in payments fraud during 2025. Despite significant corporate investment in prevention and mitigation, 29% of organisations reported experiencing fraud across multiple payment channels, with digital payments bearing the highest rates of attack.

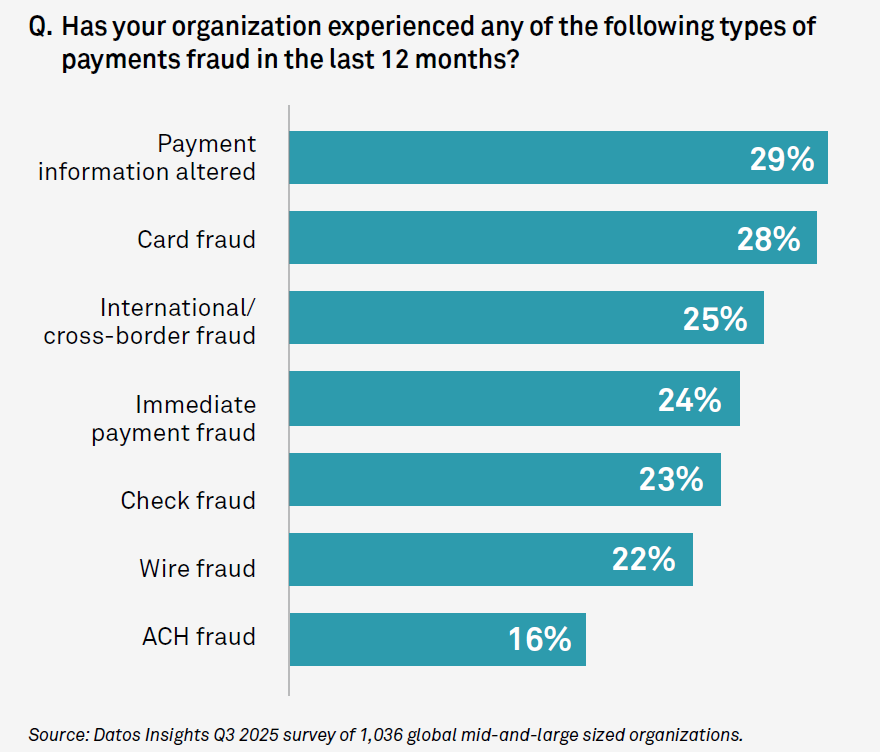

Payment fraud data highlights a broad landscape affecting organisations through various tactics. Altered payment information (29%) and card fraud (28%) were the most common types reported. The relatively narrow spread across fraud categories—ranging from 16% to 29%—indicates that bad actors are strategically diversifying their attacks rather than concentrating on a single payment method.

Most Common Types of Payments Fraud

While ACH fraud was reported at the lower end (16%), fraud linked to digital and international transactions was considerably higher, in the 22% to 25% range. This reinforces the growing vulnerabilities in modern technology-driven payment ecosystems, particularly as treasury teams expand their reliance on new digital channels and cross-border networks.

Faster payments may enable faster fraud

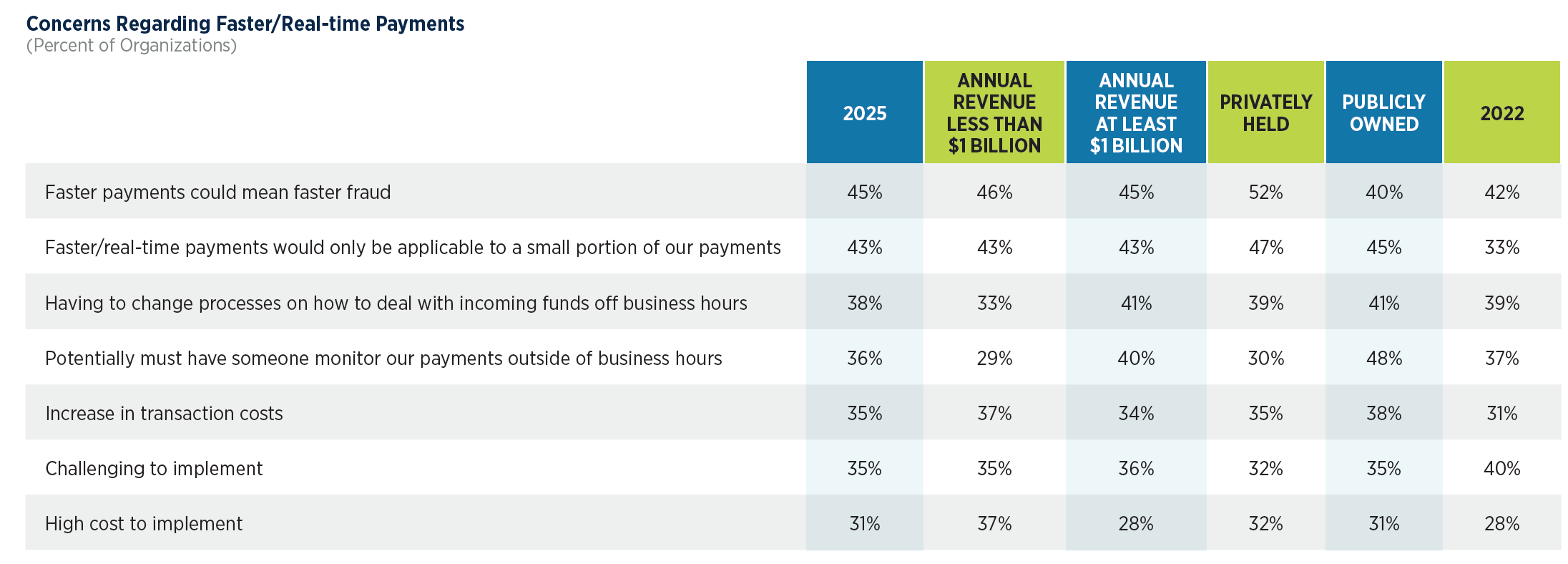

The concerns about faster/real-time payments potentially resulting in increased payments fraud remain significant among treasury practitioners. In 2025, 45% of surveyed treasury professionals in the Association for Financial Professionals® (AFP) 2025 Digital Payment Survey Report expressed apprehension that the speed of faster/real-time payments could lead to more instances of fraud. This is a modest increase compared to the 42% who reported similar concerns in 2022, indicating a persistent and slightly rising level of unease as real-time payment adoption grows.

Source: 2025 AFP® Digital Payment Survey Report: A Triennial Publication

When broken down by company size, the data shows consistency across revenue categories. Organizations with annual revenue less than US$1 billion (46%) and those with at least US$1 billion (45%) reported nearly identical levels of concern. This suggests that the risk of faster fraud is viewed as a universal challenge, not one confined to smaller or larger firms.

Ownership structure reveals more variation. Privately held firms expressed the highest level of concern, at 52%, compared with 40% among publicly owned companies. This disparity may reflect differences in resources, fraud monitoring tools, risk appetite, and the strategies deployed by private versus public entities.

The underlying worry, as highlighted in the AFP survey, is that the immediacy of faster/real-time payments leaves little or no time to detect and stop criminal activity before settlement, thereby increasing vulnerability to fraud. As organizations accelerate the adoption of faster payments, there is a clear need for a deeper understanding of the associated risks and regulatory requirements—particularly around the finality of settlements—to effectively prevent and address payments fraud that exploits the speed of these systems.

Organizations that adopt AI early combat fraud more successfully

According to the recent survey report, On the right side of AI: Shaping the future of payment fraud prevention, by Mastercard and Financial Times Longitude, “Organizations lost $60 million on average in the last year as a result of payment fraud.”

The good news is that AI-driven solutions are helping corporations proactively identify and prevent payment fraud, allowing them to bolster their defences in the process.

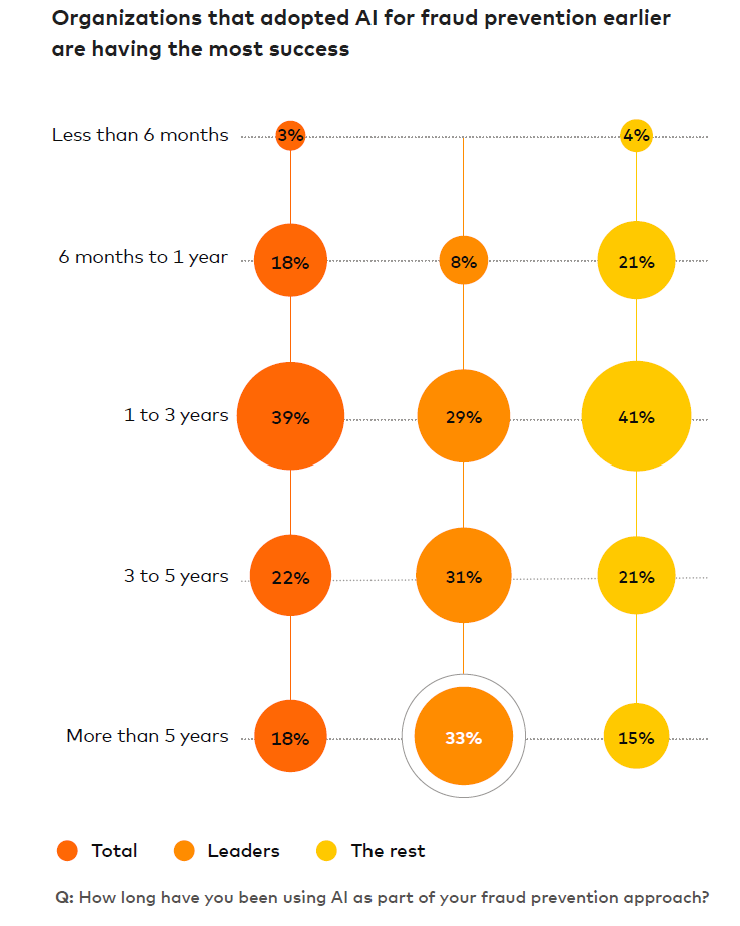

This finding is further supported by the Mastercard and Financial Times Longitude survey: “Our research indicates that there is a positive correlation between the length of time leveraging AI and success rates. For instance, those who have used AI for more than five years say that they have saved $4.3 million in lost revenue, nearly double the average savings ($2.2 million).”

Source: On the Right Side of AI Survey Report

Overall, the survey demonstrates that most surveyed enterprises (79%) have been using AI to combat fraud for at least one year, while 18% have leveraged AI for five years or more. The leaders group represent organizations ahead of the curve, with 33% using AI for over five years—18 percentage points higher than non-leaders—underscoring that longer-term adoption of AI correlates with stronger outcomes in fraud prevention.

To conclude, the fight against payments fraud has entered a new era—one defined by speed, sophistication, and scale. As cybercriminals evolve their tactics across digital, cross-border, and real-time payment channels, corporate treasuries can no longer rely on traditional defenses. The convergence of faster payments and smarter threats demands equally intelligent countermeasures.

To stay ahead, corporate treasury must embrace AI-powered fraud detection methods, strengthen fraud risk governance, and cultivate a culture of vigilance across all payment operations. The evidence is clear: organizations that integrate AI early and invest in continuous payments security training are not only mitigating losses but also reinforcing trust in their payment ecosystems.

In this climate of accelerating digital risk, payments security has become a defining measure of a treasury’s foresight and resilience. The corporate treasuries that act decisively—combining technology, insight, and preparedness—will be the ones that outpace fraud’s evolution and secure the future of payments.

Like this item? Get our Weekly Update newsletter. Subscribe today